Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 20x2, James Industries entered into an agreement to lease equipment to Espinoza Moving & Storage. The lease qualifies as a sales-type lease.

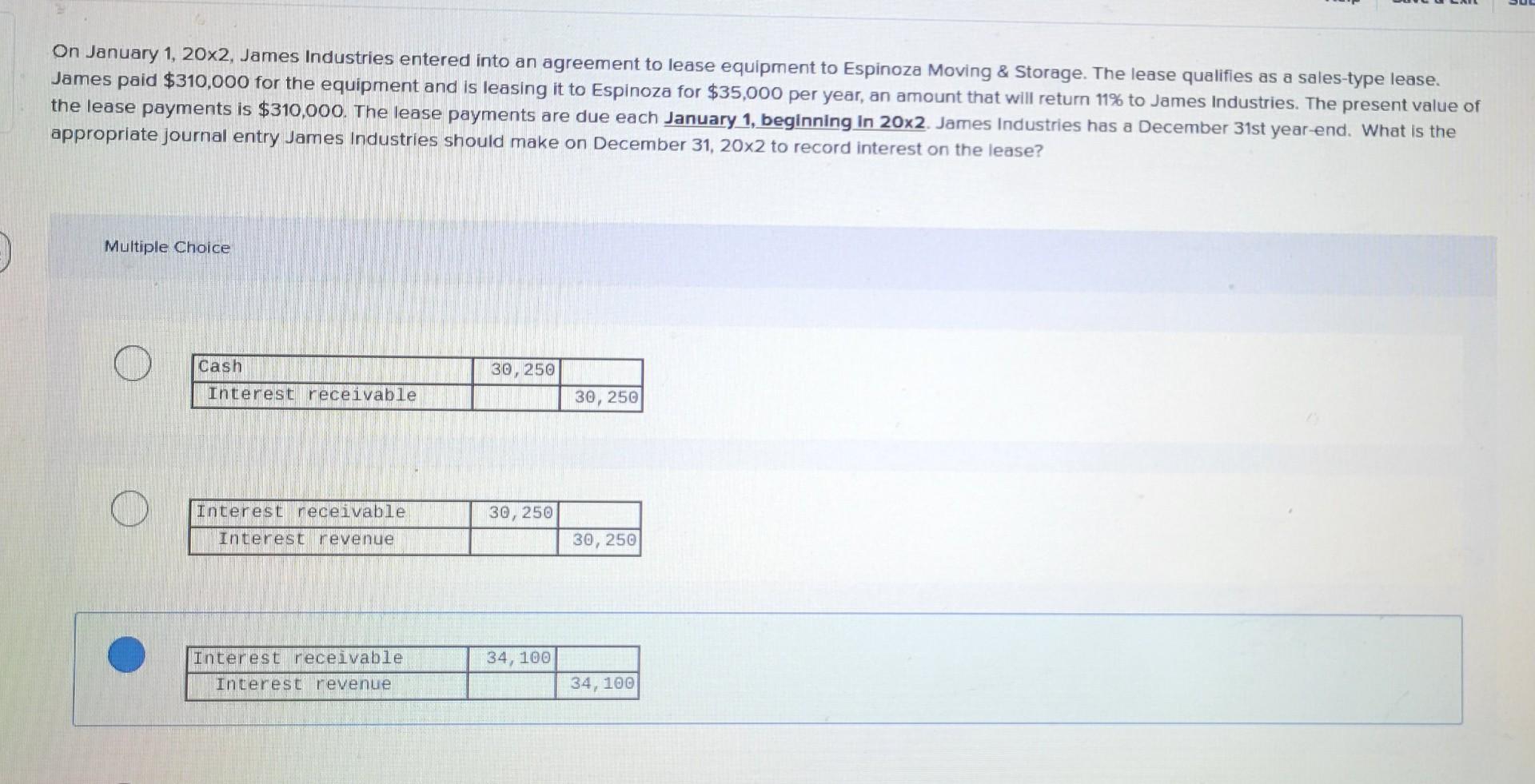

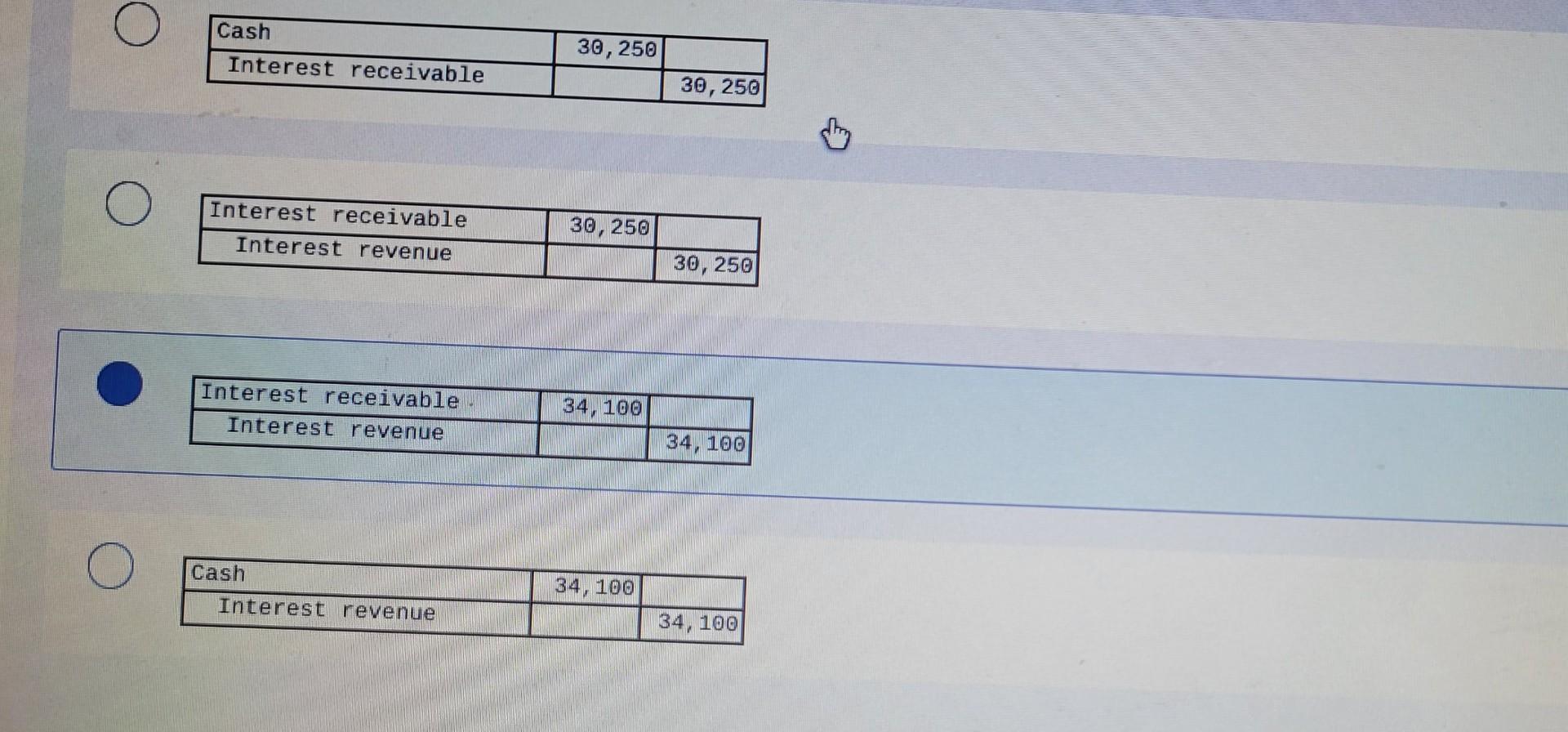

On January 1, 20x2, James Industries entered into an agreement to lease equipment to Espinoza Moving \& Storage. The lease qualifies as a sales-type lease. James paid $310,000 for the equipment and is leasing it to Espinoza for $35,000 per year, an amount that will return 11% to James Industries. The present value of the lease payments is $310,000. The lease payments are due each January 1 , beginning in 202. James Industries has a December 31 st year-end. What is the appropriate journal entry James Industries should make on December 31,202 to record interest on the lease? Multiple Choice \begin{tabular}{|l|l|l|} \hline Cash & 30,250 & \\ \hline Interest receivable & & 30,250 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Interest receivable & 30,250 & \\ \hline Interest revenue & & 30,250 \\ \hline \end{tabular} \begin{tabular}{|c|r|c|} \hline Interest receivable & 34,100 & \\ \hline Interest revenue & & 34,100 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline Cash & 34,100 & \\ \hline Interest revenue & & 34,100 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started