On January 1, 20X5, Pan Corp. purchased 85% of the outstanding voting common shares of Spoon Inc. for $850,000 cash. On this date, Spoon reported common shares of $400,000 and retained earnings of $500,000. Spoons identifiable assets and liabilities had fair values equal to their carrying values.

Additional information:

The investment in the subsidiary was found to be impaired by $10,000 in 20X7. The entire impairment loss was allocated to goodwill.

On January 1, 20X6, Spoon sold a trademark to Pan for $80,000. On this date, the trademark had a carrying value of $70,000 on the books of Spoon and a remaining useful life of five years. On September 1, 20X8, Pan sold land to Spoon at a $30,000 loss. Spoon still owns this land as of December 31, 20X8. The land asset was not impaired at time of sale.

During 20X8, Pans inventory sales to Spoon were $70,000. Spoon still had $20,000 of this inventory on hand at December 31, 20X8. Inventory purchased from Pan and still on hand at December 31, 20X7, was $7,000. Pan prices intercompany sales to yield a 25% gross margin.

During 20X8, Spoons inventory sales to Pan were $40,000. Pan still had $8,000 of this inventory on hand at December 31, 20X8. Inventory purchased from Spoon and still on hand at December 31, 20X7, was $4,000. Spoons gross margin on sales is 30% for all intercompany transactions.

Pan paid dividends of $15,000 and Spoon paid dividends of $20,000 in 20X8.

Pan uses the cost method to record its investment in Spoon. Pan applies the fair value entity method (FVE) for goodwill calculations.

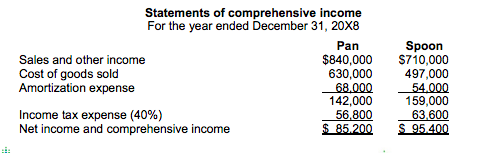

Spoon has not had any changes to its common share account since acquisition. The following are the statements of comprehensive income for the year ended December 31, 20X8, for Pan and Spoon:

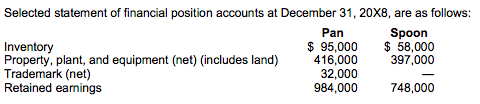

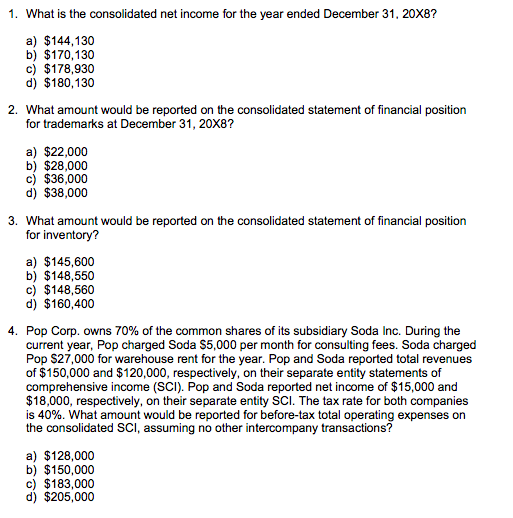

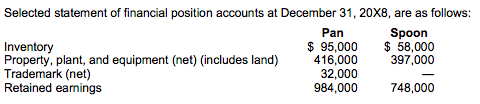

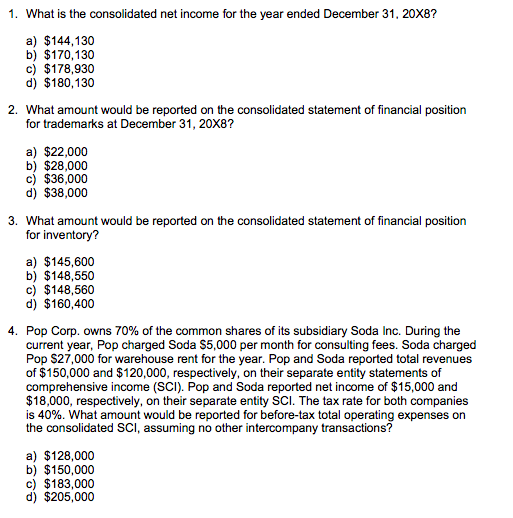

Statements of comprehensive income For the year ended December 31, 20X8 Pan Sales and other income $840,000 Cost of goods sold 630,000 Amortization expense 68.000 142,000 Income tax expense (40%) 56.800 Net income and comprehensive income $ 85.200 Spoon $710,000 497,000 54.000 159,000 63.600 S 95.400 Selected statement of financial position accounts at December 31, 20x8, are as follows: Pan Spoon Inventory $ 95,000 $ 58,000 Property, plant, and equipment (net) (includes land) 416,000 397,000 Trademark (net) 32,000 Retained earnings 984,000 748,000 1. What is the consolidated net income for the year ended December 31, 20X8? a) $144,130 b) $170,130 c) $178,930 d) $180,130 2. What amount would be reported on the consolidated statement of financial position for trademarks at December 31, 20X8? a) $22,000 b) $28,000 c) $36,000 d) $38,000 3. What amount would be reported on the consolidated statement of financial position for inventory? a) $145,600 b) $148,550 c) $148,560 d) $160,400 4. Pop Corp. owns 70% of the common shares of its subsidiary Soda Inc. During the current year, Pop charged Soda $5,000 per month for consulting fees. Soda charged Pop $27,000 for warehouse rent for the year. Pop and Soda reported total revenues of $150,000 and $120,000, respectively, on their separate entity statements of comprehensive income (SCI). Pop and Soda reported net income of $15,000 and $18,000, respectively, on their separate entity SCI. The tax rate for both companies is 40%. What amount would be reported for before-tax total operating expenses on the consolidated SCI, assuming no other intercompany transactions? a) $128,000 b) $150,000 c) $183,000 d) $205,000 Statements of comprehensive income For the year ended December 31, 20X8 Pan Sales and other income $840,000 Cost of goods sold 630,000 Amortization expense 68.000 142,000 Income tax expense (40%) 56.800 Net income and comprehensive income $ 85.200 Spoon $710,000 497,000 54.000 159,000 63.600 S 95.400 Selected statement of financial position accounts at December 31, 20x8, are as follows: Pan Spoon Inventory $ 95,000 $ 58,000 Property, plant, and equipment (net) (includes land) 416,000 397,000 Trademark (net) 32,000 Retained earnings 984,000 748,000 1. What is the consolidated net income for the year ended December 31, 20X8? a) $144,130 b) $170,130 c) $178,930 d) $180,130 2. What amount would be reported on the consolidated statement of financial position for trademarks at December 31, 20X8? a) $22,000 b) $28,000 c) $36,000 d) $38,000 3. What amount would be reported on the consolidated statement of financial position for inventory? a) $145,600 b) $148,550 c) $148,560 d) $160,400 4. Pop Corp. owns 70% of the common shares of its subsidiary Soda Inc. During the current year, Pop charged Soda $5,000 per month for consulting fees. Soda charged Pop $27,000 for warehouse rent for the year. Pop and Soda reported total revenues of $150,000 and $120,000, respectively, on their separate entity statements of comprehensive income (SCI). Pop and Soda reported net income of $15,000 and $18,000, respectively, on their separate entity SCI. The tax rate for both companies is 40%. What amount would be reported for before-tax total operating expenses on the consolidated SCI, assuming no other intercompany transactions? a) $128,000 b) $150,000 c) $183,000 d) $205,000