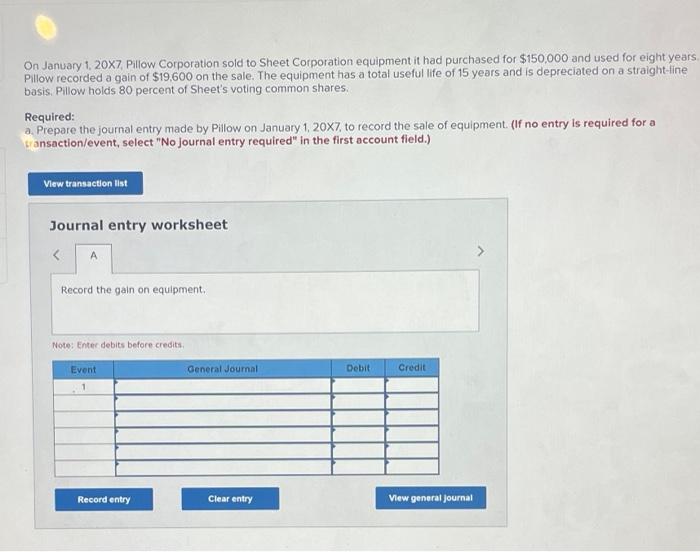

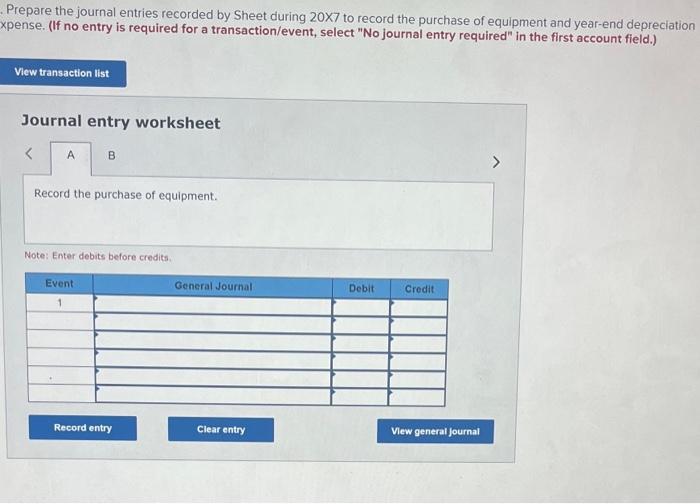

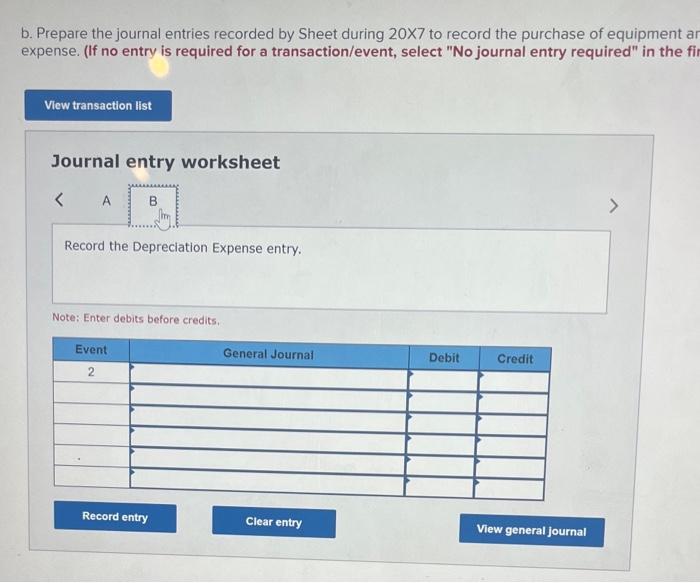

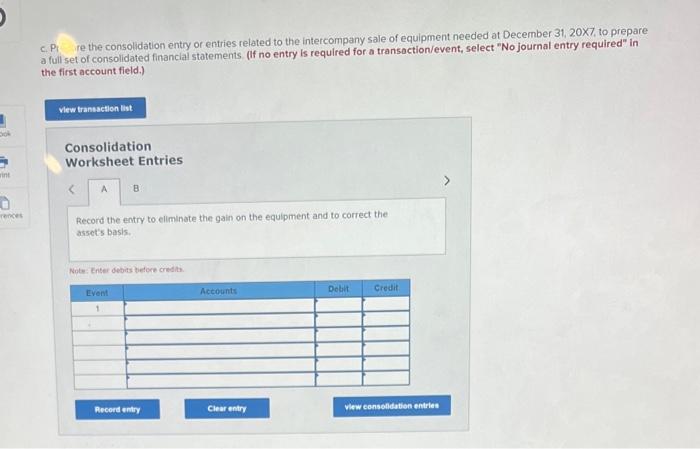

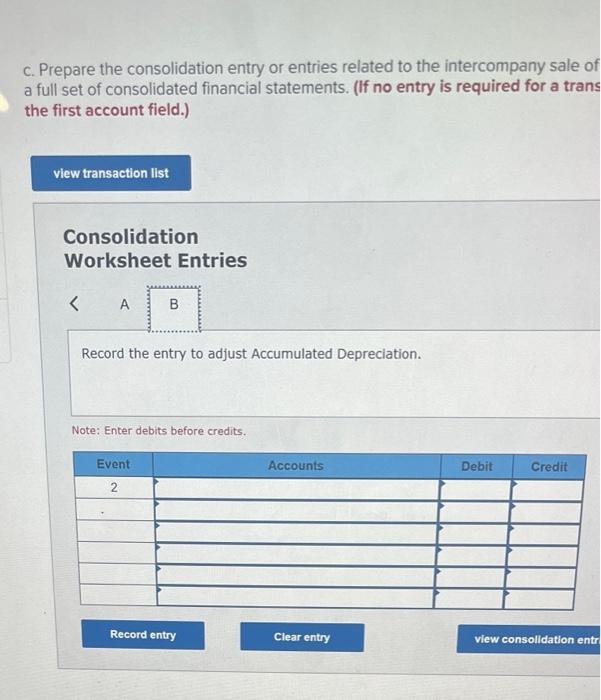

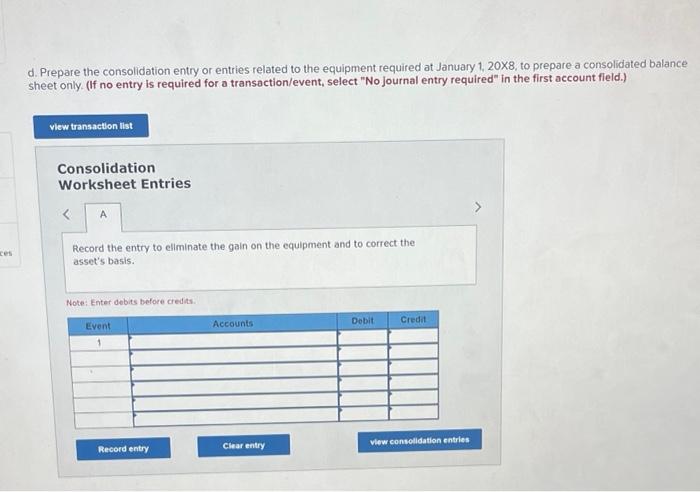

On January 1, 20X7, Pillow Corporation sold to Sheet Corporation equipment it had purchased for $150,000 and used for eight years Pillow recorded a gain of $19,600 on the sale. The equipment has a total useful life of 15 years and is depreciated on a straight-fine basis. Pillow holds 80 percent of Sheet's voting common shares. Required: a. Prepare the journal entry made by Pillow on January 1, 20X7, to record the sale of equipment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Prepare the journal entries recorded by Sheet during 207 to record the purchase of equipment and year-end depreciation xpense. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet b. Prepare the journal entries recorded by Sheet during 207 to record the purchase of equipment a expense. (If no entry is required for a transaction/event, select "No journal entry required" in the fi Journal entry worksheet c. Pi re the consolidation entry or entries related to the intercompany sale of equipment needed at December 31,207, to prepare a full set of consolidated financial statements. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Consolidation Worksheet Entries Record the entry to eliminate the gain on the equipment and to correct the asset's basis. Note: Enter debits thefore cresits. c. Prepare the consolidation entry or entries related to the intercompany sale of a full set of consolidated financial statements. (If no entry is required for a tran: the first account field.) Consolidation Worksheet Entries Record the entry to adjust Accumulated Depreciation. Note: Enter debits before credits. d. Prepare the consolidation entry or entries related to the equipment required at January 1, 20x8, to prepare a consolidated balance sheet only. (If no entry is required for a transaction/event, select "No journal entry required" in the first account fleld.) Consolidation Worksheet Entries Record the entry to eliminate the gain on the equipment and to correct the asset's basis. Note: Enter debits before credits