Question

On January 1, 20X8, P Company acquired 90 percent of Q Company's voting stock, at underlying book value. The fair value of the noncontrolling interest

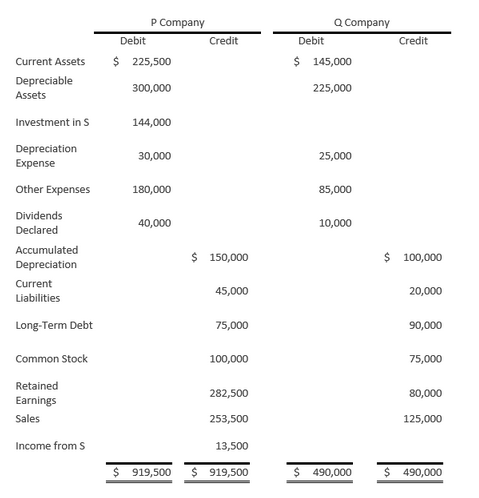

On January 1, 20X8, P Company acquired 90 percent of Q Company's voting stock, at underlying book value. The fair value of the noncontrolling interest was equal to 10 percent of the book value of Q Company at that date. The amount of accumulated depreciation to eliminate is $50,000. P uses the equity method in accounting for its ownership of Q. On December 31, 20X8, the trial balances of the two companies are as follows:

Give all consolidating entries required on December 31, 20X8, to prepare consolidated financial statements & Prepare a three-part consolidation worksheet as of December 31, 20X8.

Give all consolidating entries required on December 31, 20X8, to prepare consolidated financial statements & Prepare a three-part consolidation worksheet as of December 31, 20X8.

please educate on how you got the answer.

P Company Debit Credit $ 225,500 Q Company Debit $ 145,000 Credit Current Assets Depreciable Assets 300,000 225,000 Investment in s 144,000 Depreciation Expense 30,000 25,000 Other Expenses 180,000 85,000 40,000 10,000 Dividends Declared Accumulated Depreciation $ 150,000 $ 100,000 Current Liabilities 45,000 20,000 Long-Term Debt 75,000 90,000 Common Stock 100,000 75,000 80,000 Retained Earnings Sales 282,500 253,500 125,000 Income from S 13,500 $919,500 $ 919,500 5 490.00 190,00 P Company Debit Credit $ 225,500 Q Company Debit $ 145,000 Credit Current Assets Depreciable Assets 300,000 225,000 Investment in s 144,000 Depreciation Expense 30,000 25,000 Other Expenses 180,000 85,000 40,000 10,000 Dividends Declared Accumulated Depreciation $ 150,000 $ 100,000 Current Liabilities 45,000 20,000 Long-Term Debt 75,000 90,000 Common Stock 100,000 75,000 80,000 Retained Earnings Sales 282,500 253,500 125,000 Income from S 13,500 $919,500 $ 919,500 5 490.00 190,00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started