Answered step by step

Verified Expert Solution

Question

1 Approved Answer

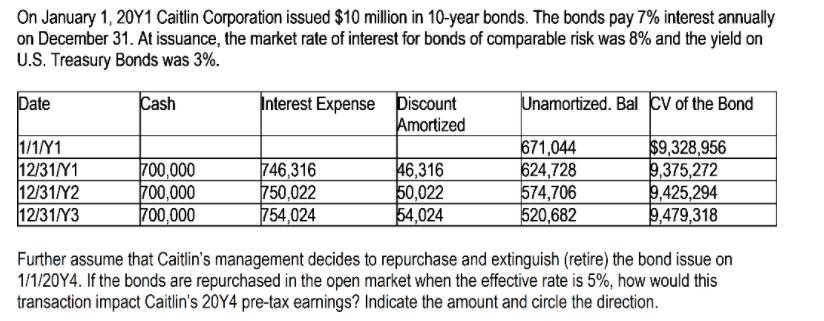

On January 1, 20Y1 Caitlin Corporation issued $10 million in 10-year bonds. The bonds pay 7% interest annually on December 31. At issuance, the

On January 1, 20Y1 Caitlin Corporation issued $10 million in 10-year bonds. The bonds pay 7% interest annually on December 31. At issuance, the market rate of interest for bonds of comparable risk was 8% and the yield on U.S. Treasury Bonds was 3%. Date Interest Expense Discount Amortized Unamortized. Bal cV of the Bond Cash 1/1/Y1 12/31/Y1 12/31/Y2 12/31/Y3 700,000 700,000 700,000 746,316 750,022 754,024 46,316 50,022 54,024 671,044 624,728 574,706 520,682 $9,328,956 9,375,272 9,425,294 9,479,318 Further assume that Caitlin's management decides to repurchase and extinguish (retire) the bond issue on 1/1/20Y4. If the bonds are repurchased in the open market when the effective rate is 5%, how would this transaction impact Caitlin's 20Y4 pre-tax earnings? Indicate the amount and circle the direction.

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

On 1120Y4 the carrying value of bonds payable would be 9479318 and the unortised value of b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started