Answered step by step

Verified Expert Solution

Question

1 Approved Answer

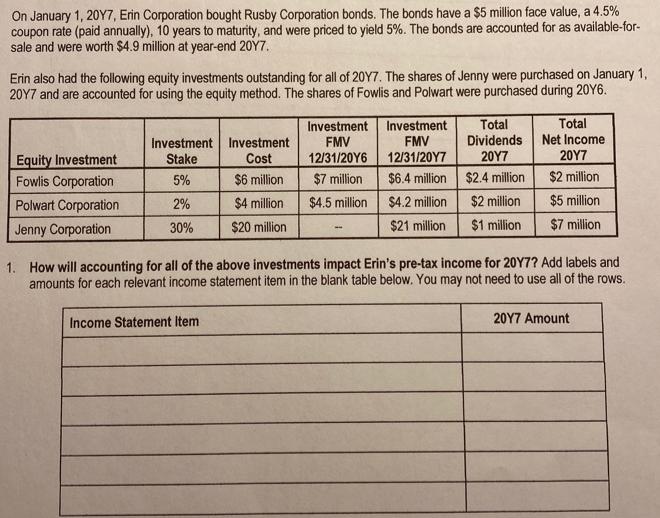

On January 1, 20Y7, Erin Corporation bought Rusby Corporation bonds. The bonds have a $5 million face value, a 4.5% coupon rate (paid annually),

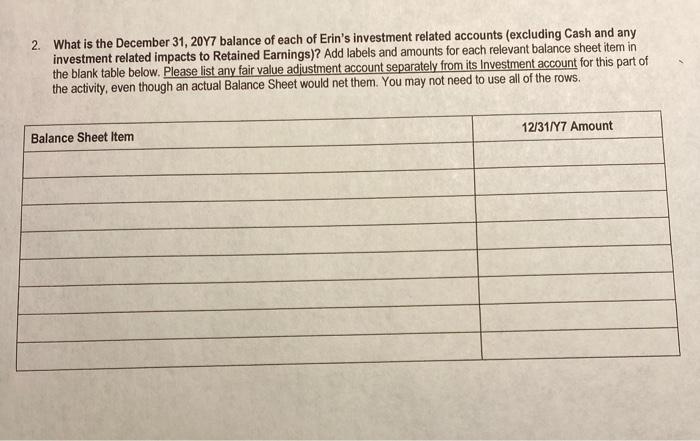

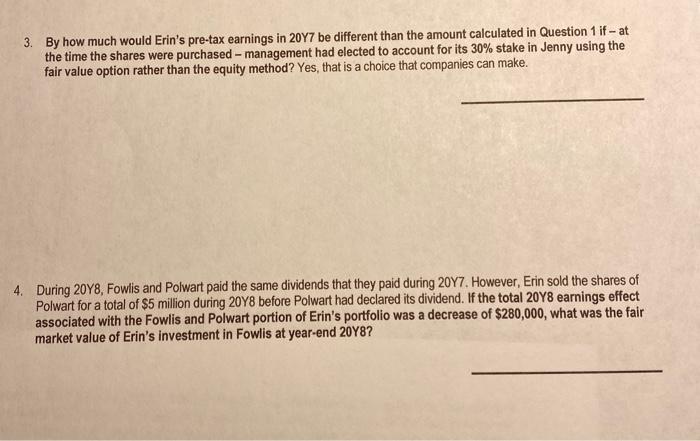

On January 1, 20Y7, Erin Corporation bought Rusby Corporation bonds. The bonds have a $5 million face value, a 4.5% coupon rate (paid annually), 10 years to maturity, and were priced to yield 5%. The bonds are accounted for as available-for- sale and were worth $4.9 million at year-end 20Y7. Erin also had the following equity investments outstanding for all of 20Y7. The shares of Jenny were purchased on January 1, 20Y7 and are accounted for using the equity method. The shares of Fowlis and Polwart were purchased during 20Y6. Equity Investment Fowlis Corporation Polwart Corporation Jenny Corporation Investment Stake 5% 2% 30% Investment Cost $6 million $4 million $20 million Income Statement Item Investment FMV 12/31/20Y6 $7 million $4.5 million ww Investment FMV 12/31/20Y7 $6.4 million $4.2 million $21 million Total Dividends 20Y7 $2.4 million $2 million $1 million Total Net Income 20Y7 $2 million $5 million $7 million 1. How will accounting for all of the above investments impact Erin's pre-tax income for 20Y7? Add labels and amounts for each relevant income statement item in the blank table below. You may not need to use all of the rows. 20Y7 Amount 2. What is the December 31, 20Y7 balance of each of Erin's investment related accounts (excluding Cash and any investment related impacts to Retained Earnings)? Add labels and amounts for each relevant balance sheet item in the blank table below. Please list any fair value adjustment account separately from its Investment account for this part of the activity, even though an actual Balance Sheet would net them. You may not need to use all of the rows. Balance Sheet Item 12/31/Y7 Amount 3. By how much would Erin's pre-tax earnings in 20Y7 be different than the amount calculated in Question 1 if- at the time the shares were purchased - management had elected to account for its 30% stake in Jenny using the fair value option rather than the equity method? Yes, that is a choice that companies can make. 4. During 2018, Fowlis and Polwart paid the same dividends that they paid during 20Y7. However, Erin sold the shares of Polwart for a total of $5 million during 20Y8 before Polwart had declared its dividend. If the total 20Y8 earnings effect associated with the Fowlis and Polwart portion of Erin's portfolio was a decrease of $280,000, what was the fair market value of Erin's investment in Fowlis at year-end 20Y8?

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Pretax income will be impacted by the accounting for all of the above investments as follows Inves...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started