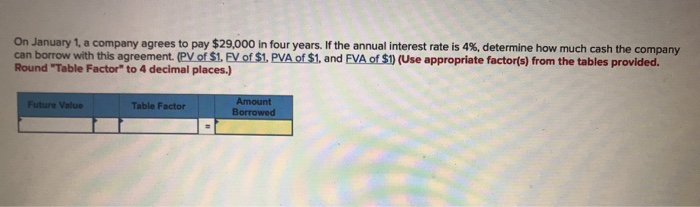

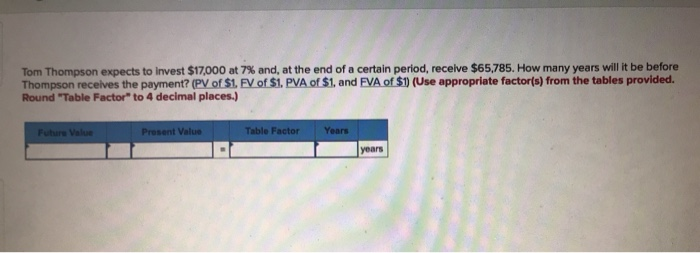

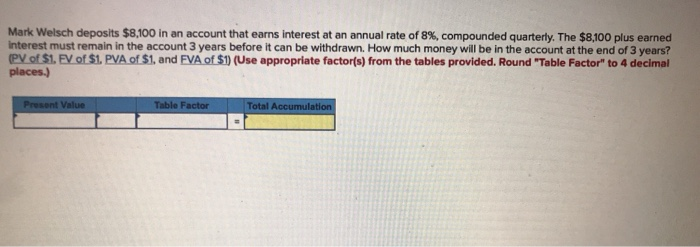

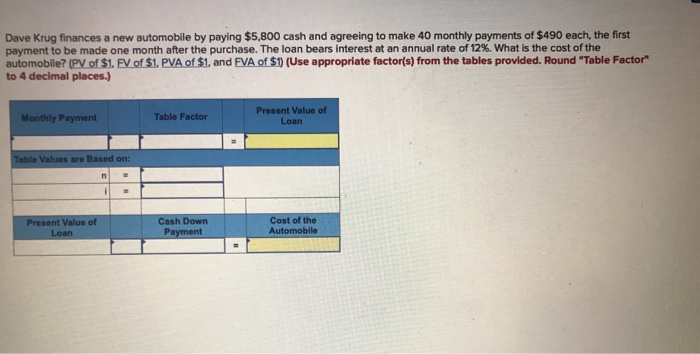

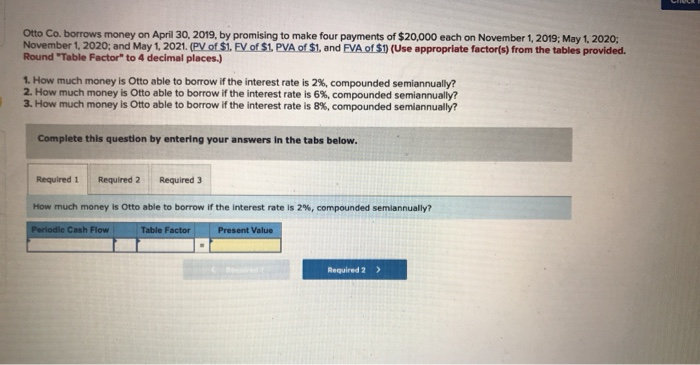

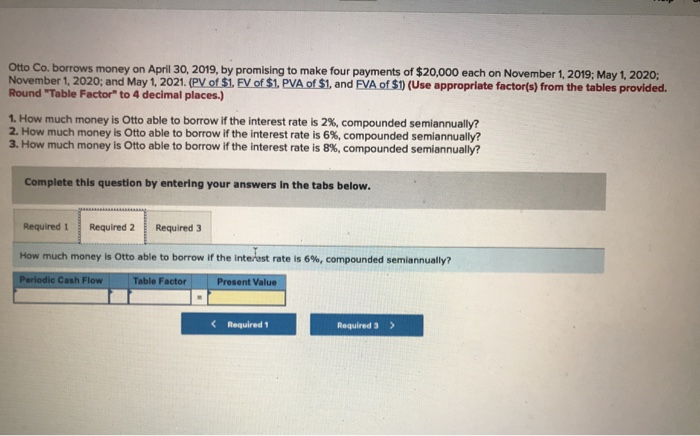

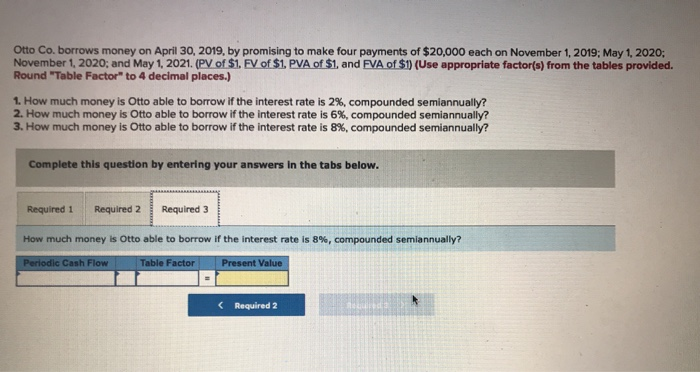

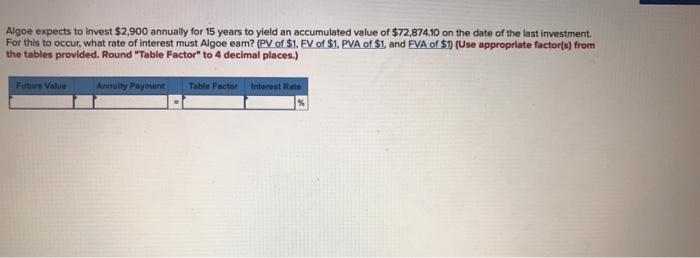

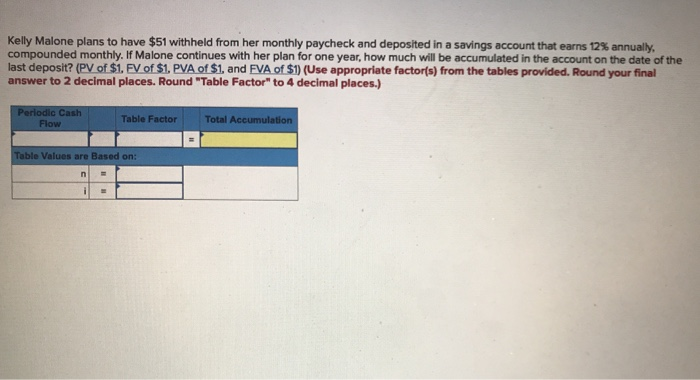

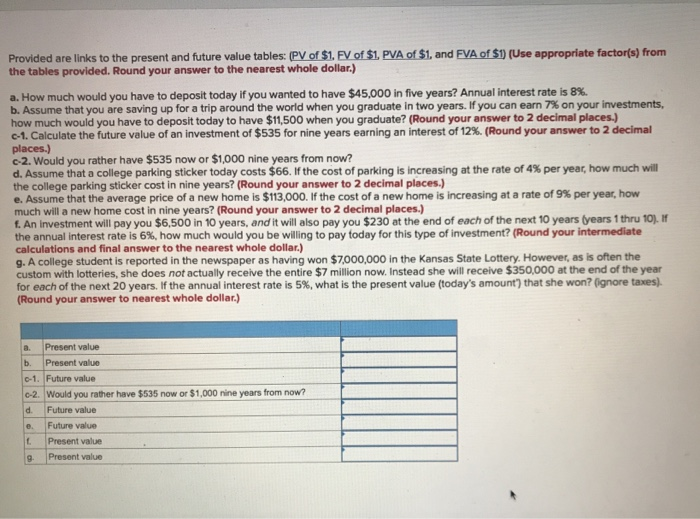

On January 1, a company agrees to pay $29,000 in four years. If the annual interest rate is 4%, determine how much cash the company can borrow with this agreement. PV of $1. EV of $1. PVA of S1, and FVA of $1 (Use appropriate factor(s) from the tables provided. Round Table Factor" to 4 decimal places.) Future Value Table Factor Amount Borrowed Tom Thompson expects to invest $17,000 at 7% and, at the end of a certain period, receive $65,785. How many years will it be before Thompson receives the payment? (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Future Value Present Value Table Factor Years years Mark Welsch deposits $8,100 in an account that earns interest at an annual rate of 8%, compounded quarterly. The $8,100 plus earned Interest must remain in the account 3 years before it can be withdrawn. How much money will be in the account at the end of 3 years?! PV of $1. FV of $1. PVA of S1, and EVA of S1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Present Value Table Factor Total Accumulation Dave Krug finances a new automobile by paying $5,800 cash and agreeing to make 40 monthly payments of $490 each, the first payment to be made one month after the purchase. The loan bears interest at an annual rate of 12%. What is the cost of the automobile? (PV of $1. FV of $1. PVA of $1, and EVA of SD) (Use appropriate factor(s) from the tables provided. Round "Table Factor to 4 decimal places.) Monthly Payment Table Factor Present Value of Loan Table Values are Based on: Present Value of Cash Down Payment Cost of the Automobile LOOR Otto Co. borrows money on April 30, 2019, by promising to make four payments of $20,000 each on November 1, 2019: May 1, 2020: November 1, 2020; and May 1, 2021. (PV of $1. FV of $1. PVA of $1. and FVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) 1. How much money is Otto able to borrow if the interest rate is 2%, compounded semiannually? 2. How much money is Otto able to borrow if the interest rate is 6%, compounded semiannually? 3. How much money is Otto able to borrow if the interest rate is 8%, compounded semiannually? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much money is Otto able to borrow if the interest rate is 2%, compounded semiannually? Periodle Cash Flow Table Factor Present Value Required 2 > Otto Co. borrows money on April 30, 2019, by promising to make four payments of $20,000 each on November 1, 2019: May 1, 2020: November 1, 2020; and May 1, 2021. (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) 1. How much money is Otto able to borrow if the interest rate is 2%, compounded semiannually? 2. How much money is Otto able to borrow if the interest rate is 6%, compounded semiannually? 3. How much money is Otto able to borrow if the interest rate is 8%, compounded semiannually? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much money is Otto able to borrow if the interest rate is 6%, compounded semiannually? Periodic Cash Flow Table Factor Present Value Required 1 Required 3 > Otto Co. borrows money on April 30, 2019, by promising to make four payments of $20,000 each on November 1, 2019: May 1, 2020: November 1, 2020; and May 1, 2021. (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) 1. How much money is Otto able to borrow if the interest rate is 2%, compounded semiannually? 2. How much money is Otto able to borrow if the interest rate is 6%, compounded semiannually? 3. How much money is Otto able to borrow if the interest rate is 8%, compounded semiannually? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much money is Otto able to borrow if the interest rate is 8%, compounded semiannually? Periodic Cash Flow Table Factor Present Value Required 2 Algoe expects to invest $2,900 annually for 15 years to yield an accumulated value of $72,874.10 on the date of the last investment For this to occur, what rate of interest must Algoe eam? (PV of $1. FV of $1. PVA of $1. and FVA of Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Future Value Annuity Payment Table Factor Interest Rate Kelly Malone plans to have $51 withheld from her monthly paycheck and deposited in a savings account that earns 12% annually, compounded monthly. If Malone continues with her plan for one year, how much will be accumulated in the account on the date of the last deposit? (PV of $1. FV of $1. PVA of $1. and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to 2 decimal places. Round "Table Factor" to 4 decimal places.) Periodic Cash Flow Table Factor Total Ace i te Table Values are Based on: Provided are links to the present and future value tables: (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your answer to the nearest whole dollar.) a. How much would you have to deposit today if you wanted to have $45,000 in five years? Annual interest rate is 8%. b. Assume that you are saving up for a trip around the world when you graduate in two years. If you can earn 7% on your investments, how much would you have to deposit today to have $11,500 when you graduate? (Round your answer to 2 decimal places.) -1. Calculate the future value of an investment of $535 for nine years earning an interest of 12%. (Round your answer to 2 decimal places.) c-2. Would you rather have $535 now or $1,000 nine years from now? d. Assume that a college parking sticker today costs $66. If the cost of parking is increasing at the rate of 4% per year, how much will the college parking sticker cost in nine years? (Round your answer to 2 decimal places.) e. Assume that the average price of a new home is $113,000. If the cost of a new home is increasing at a rate of 9% per year, how much will a new home cost in nine years? (Round your answer to 2 decimal places.) 1. An investment will pay you $6,500 in 10 years, and it will also pay you $230 at the end of each of the next 10 years years 1 thru 10]. If the annual interest rate is 6%, how much would you be willing to pay today for this type of investment? (Round your intermediate calculations and final answer to the nearest whole dollar.) g. A college student is reported in the newspaper as having won $7,000,000 in the Kansas State Lottery. However, as is often the custom with lotteries, she does not actually receive the entire $7 million now. Instead she will receive $350,000 at the end of the year for each of the next 20 years. If the annual interest rate is 5%, what is the present value (today's amount) that she won? ignore taxes). (Round your answer to nearest whole dollar.) a. Present value b. Present value 0-1. Future value 0-2 Would you rather have $535 now or $1,000 nine years from now? d. Future value Future value Present value 9. Present value