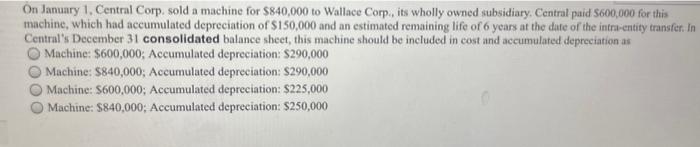

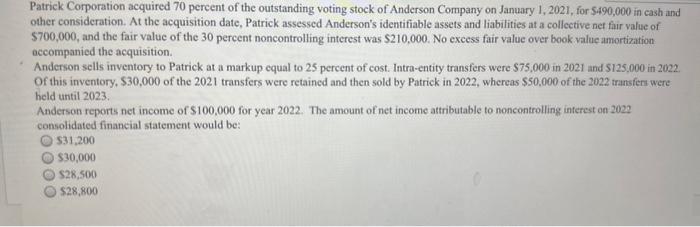

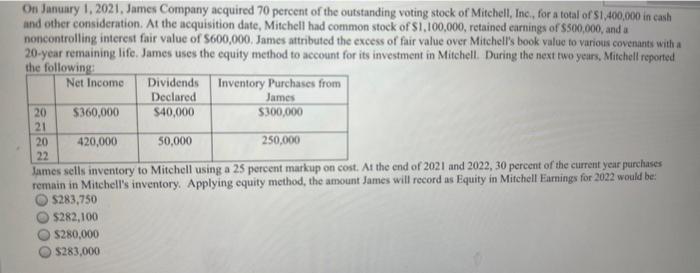

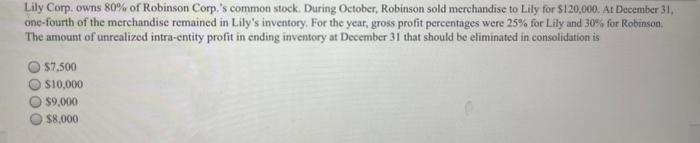

On January 1, Central Corp. sold a machine for $840,000 to Wallace Corp, its wholly owned subsidiary. Central paid $600,000 for this machine, which had accumulated depreciation of $150,000 and an estimated remaining life of 6 years at the date of the intra-entity transfer. In Central's December 31 consolidated balance sheet, this machine should be included in cost and accumulated depreciation as Machine: $600,000; Accumulated depreciation: $290,000 Machine: $840,000; Accumulated depreciation: $290,000 Machine: $600,000; Accumulated depreciation: $225,000 Machine: $840,000; Accumulated depreciation: $250,000 Patrick Corporation acquired 70 percent of the outstanding voting stock of Anderson Company on January 1, 2021, for $490,000 in cash and other consideration. At the acquisition date, Patrick assessed Anderson's identifiable assets and liabilities at a collective net fair value of $700,000, and the fair value of the 30 percent noncontrolling interest was $210,000. No excess fair value over book value amortization accompanied the acquisition. Anderson sells inventory to Patrick at a markup equal to 25 percent of cost. Intra-entity transfers were $75,000 in 2021 and $125,000 in 2022. Of this inventory, $30,000 of the 2021 transfers were retained and then sold by Patrick in 2022, whereas $50,000 of the 2022 transfers were held until 2023. Anderson reports net income of $100,000 for year 2022. The amount of net income attributable to noncontrolling interest on 2022 consolidated financial statement would be: $31,200$30,000$28,500$28,800 On January 1, 2021, James Company acquired 70 percent of the outstanding voting stock of Mitehell, Inc, for a total of 51,400,000 in cash and other consideration. At the acquisition date, Mitchell had common stock of $1,100,000, retained carnings of $500,000, and a noncontrolling interest fair value of $600,000. James attributed the excess of fair value over Mitchell's book value to various covenants with a 20-year remaining life. James uses the equity method to account for its investment in Mitchell. During the next two years. Mitchell reported the followine: James sells inventory to Mitchell using a 25 percent markup on cost. At the end of 2021 and 2022,30 percent of the current year purchases remain in Mitchell's inventory. Applying equity method, the amount James will record as Equity in Mitchell Earnings for 2022 would be: $283,750 5282,100 $280,000 $283,000 Lily Corp. owns 80% of Robinson Corp.'s common stock. During Oetober, Robinson sold merehandise to Lily for $120,000. At Deeember 31 . one-fourth of the merchandise remained in Lily's inventory. For the year, gross profit percentages were 25\% for Lily and 30% for Robinson. The amount of unrealized intra-entity profit in ending inventory at December 31 that should be eliminated in consolidation is $7,500 $10,000 $9,000 $8,000 On January 1, Central Corp. sold a machine for $840,000 to Wallace Corp, its wholly owned subsidiary. Central paid $600,000 for this machine, which had accumulated depreciation of $150,000 and an estimated remaining life of 6 years at the date of the intra-entity transfer. In Central's December 31 consolidated balance sheet, this machine should be included in cost and accumulated depreciation as Machine: $600,000; Accumulated depreciation: $290,000 Machine: $840,000; Accumulated depreciation: $290,000 Machine: $600,000; Accumulated depreciation: $225,000 Machine: $840,000; Accumulated depreciation: $250,000 Patrick Corporation acquired 70 percent of the outstanding voting stock of Anderson Company on January 1, 2021, for $490,000 in cash and other consideration. At the acquisition date, Patrick assessed Anderson's identifiable assets and liabilities at a collective net fair value of $700,000, and the fair value of the 30 percent noncontrolling interest was $210,000. No excess fair value over book value amortization accompanied the acquisition. Anderson sells inventory to Patrick at a markup equal to 25 percent of cost. Intra-entity transfers were $75,000 in 2021 and $125,000 in 2022. Of this inventory, $30,000 of the 2021 transfers were retained and then sold by Patrick in 2022, whereas $50,000 of the 2022 transfers were held until 2023. Anderson reports net income of $100,000 for year 2022. The amount of net income attributable to noncontrolling interest on 2022 consolidated financial statement would be: $31,200$30,000$28,500$28,800 On January 1, 2021, James Company acquired 70 percent of the outstanding voting stock of Mitehell, Inc, for a total of 51,400,000 in cash and other consideration. At the acquisition date, Mitchell had common stock of $1,100,000, retained carnings of $500,000, and a noncontrolling interest fair value of $600,000. James attributed the excess of fair value over Mitchell's book value to various covenants with a 20-year remaining life. James uses the equity method to account for its investment in Mitchell. During the next two years. Mitchell reported the followine: James sells inventory to Mitchell using a 25 percent markup on cost. At the end of 2021 and 2022,30 percent of the current year purchases remain in Mitchell's inventory. Applying equity method, the amount James will record as Equity in Mitchell Earnings for 2022 would be: $283,750 5282,100 $280,000 $283,000 Lily Corp. owns 80% of Robinson Corp.'s common stock. During Oetober, Robinson sold merehandise to Lily for $120,000. At Deeember 31 . one-fourth of the merchandise remained in Lily's inventory. For the year, gross profit percentages were 25\% for Lily and 30% for Robinson. The amount of unrealized intra-entity profit in ending inventory at December 31 that should be eliminated in consolidation is $7,500 $10,000 $9,000 $8,000