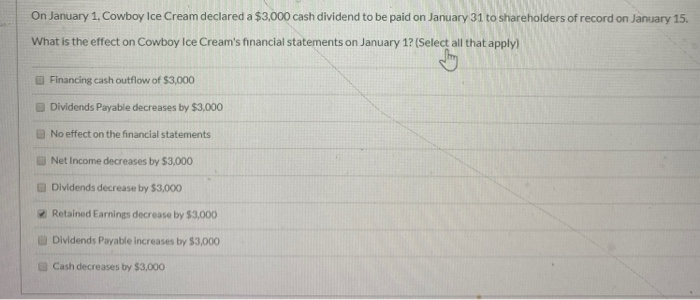

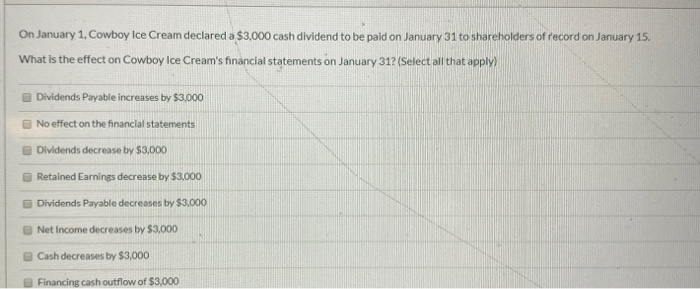

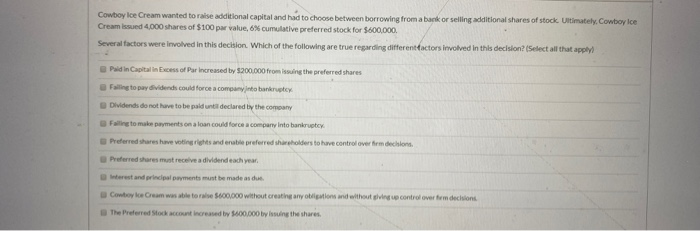

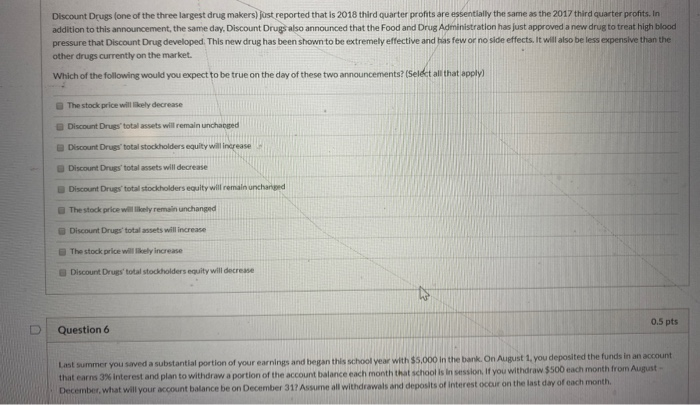

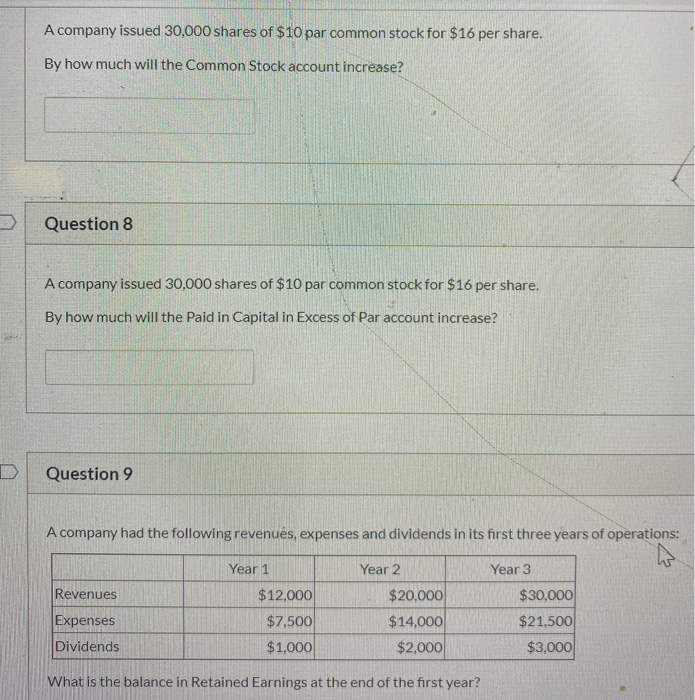

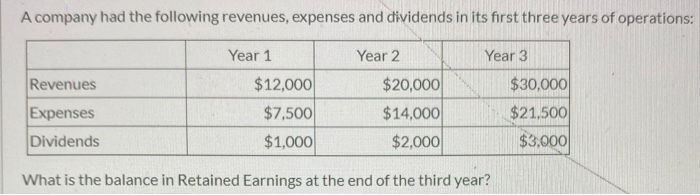

On January 1, Cowboy Ice Cream declared a $3,000 cash dividend to be paid on January 31 to shareholders of record on January 15. What is the effect on Cowboy Ice Cream's financial statements on January 1? (Select all that apply) Financing cash outflow of $3,000 Dividends Payable decreases by $3,000 No effect on the financial statements Net Income decreases by $3,000 Dividends decrease by $3,000 Retained Earnings decrease by $3,000 Dividends Payable increases by $3,000 Cash decreases by $3,000 On January 1, Cowboy Ice Cream declared a $3,000 cash dividend to be paid on January 31 to shareholders of record on January 15. What is the effect on Cowboy Ice Cream's financial statements on January 31? (Select all that apply) Dividends Payable increases by $3.000 No effect on the financial statements Dividends decrease by $3,000 Retained Earnings decrease by $3,000 Dividends Payable decreases by $3.000 Net Income decreases by $3,000 Cash decreases by $3,000 Financing cash outflow of $3.000 Cowboy Ice Cream wanted to raise additional capital and had to choose between borrowing from a bank or selling additional shares of stock. Ultimately. Cowboy ice Cream issued 4,000 shares of $100 per value, 6% cumulative preferred stock for $600,000 Several factors were involved in this dechion. Which of the following are true regarding different factors involved in this decision (Select all that apply Paldin Capital e s of Par increased by $200.000 from the preferred shares Fato de oudforces com b ate Dividends do not have to be paid until declared by the company Failing to make payments on a loan could forces company into bankroty Preferred shee r and enable preferred short have control over t his Predshest receive a nd each and principal payments must be made as du Cowboyce Cream was s tories without creating any o ne and without control over to decisions The Preferred to increased in the shares Discount Drugs one of the three largest drug makers) just reported that is 2018 third quarter profits are essentially the same as the 2017 third quarter profits. In addition to this announcement, the same day, Discount Drugs also announced that the Food and Drug Administration has just approved a new drug to treat high blood pressure that Discount Drug developed. This new drug has been shown to be extremely effective and has few or no side effects. It will also be less expensive than the other drugs currently on the market. Which of the following would you expect to be true on the day of these two announcements (Select all that applyi The stock price willy decrease Discount Drugs totales will remain unchanged Discount Drugs total stockholders equity will increase Discount Drugs total assets will decrease Discount Drugs' total stockholders equity will remain unchanged The stock price will remain unchanged Discount Drugs totalsts will increase The stock price w y increase Discount Drugs total stockholders equity will decrease Question 6 0.5 pts Last summer you saved a substantial portion of your earnings and began this school year with $5,000 in the bank. On August 1, you deposited the funds in an account that earns x interest and plan to withdraw a portion of the account balance each month that school is sin if you withdraw $500 each month from Amat December what will your account balance be on December 31T Assume all withdrawals and deposits of interest occur on the last day of each month A company issued 30,000 shares of $10 par common stock for $16 per share. By how much will the Common Stock account increase? Question 8 A company issued 30,000 shares of $10 par common stock for $16 per share. By how much will the Paid in Capital in Excess of Par account increase? Question 9 A company had the following revenues, expenses and dividends in its first three years of operations: Year 3 $30,000 Revenues Expenses Dividends Year 1 $12,000 $7,500 $1,000 Year 2 $20,000 $14,000 $2,000 $21,500 $3,000 What is the balance in Retained Earnings at the end of the first year? A company had the following revenues, expenses and dividends in its first three years of operations: Revenues Expenses Dividends Year 1 $12,000 $7,500 $1,000 Year 2 $20,000 $14,000 $2,000 Year 3 $30,000 $21,500 $3,000 What is the balance in Retained Earnings at the end of the third year