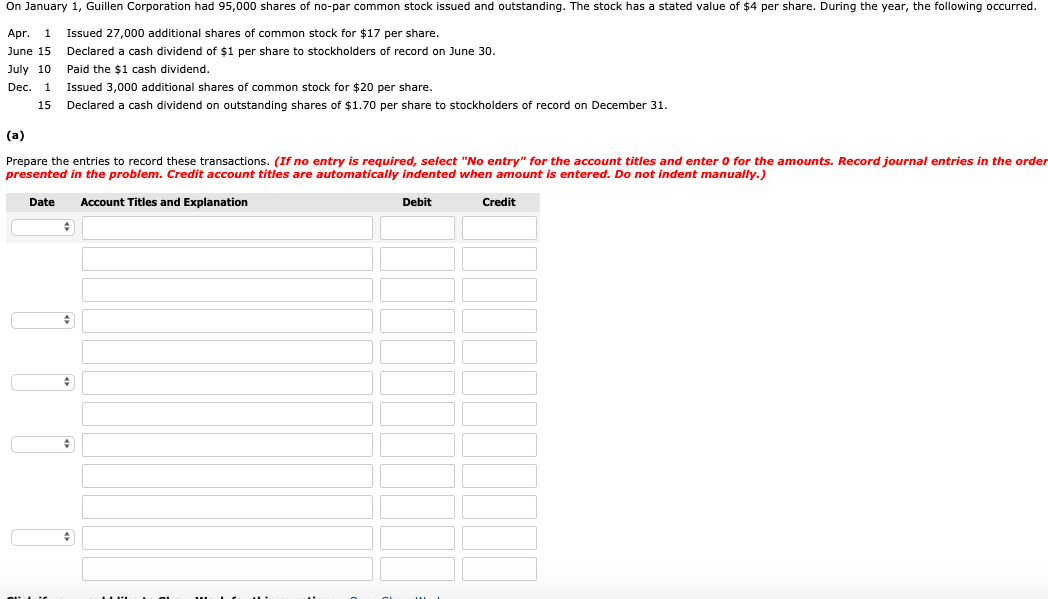

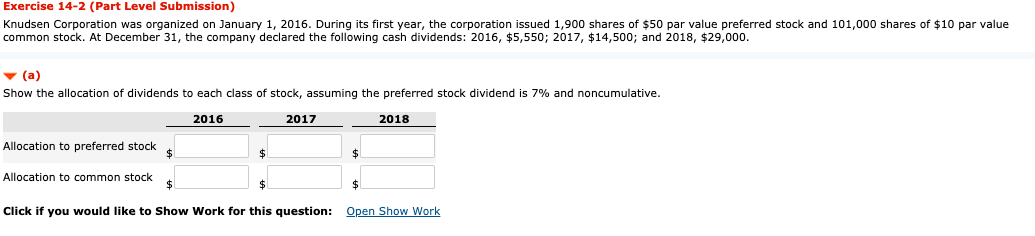

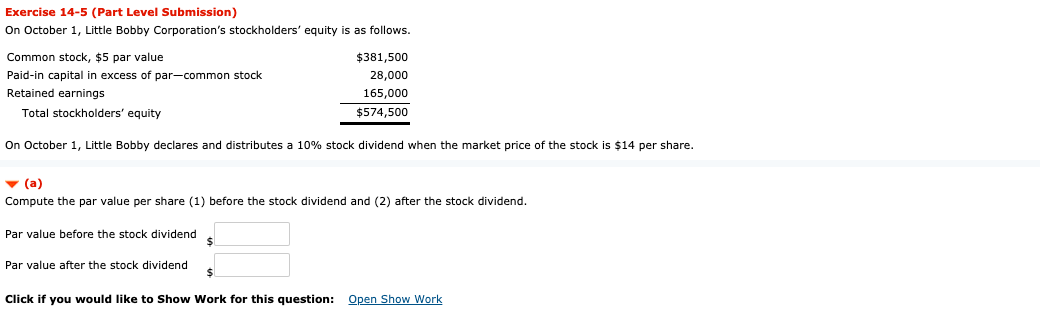

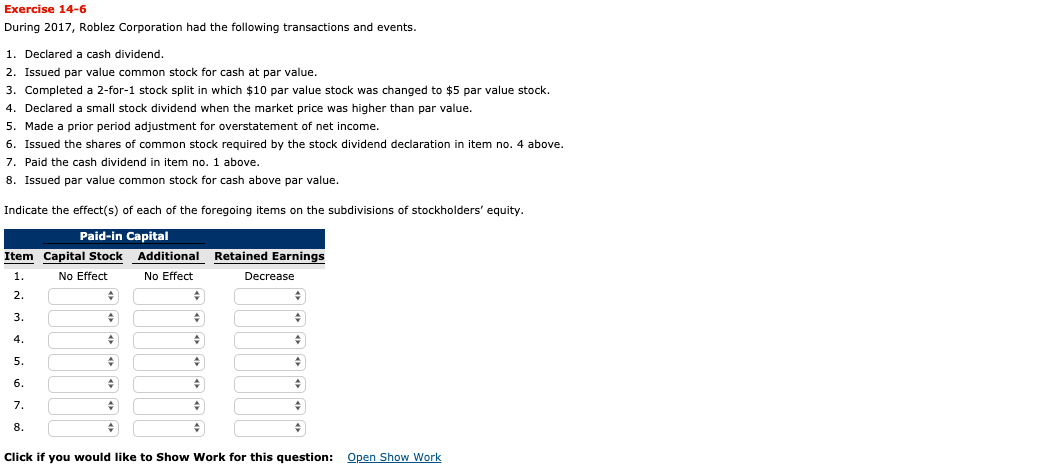

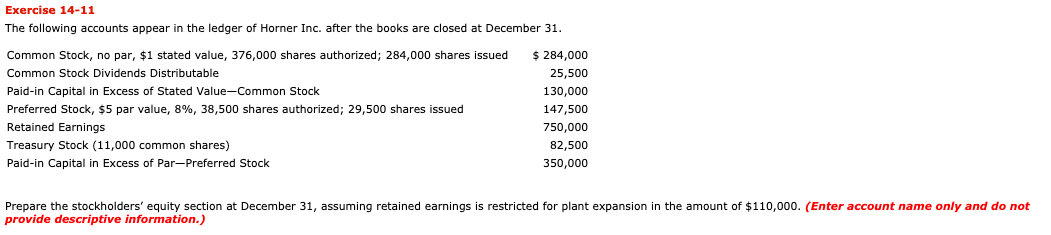

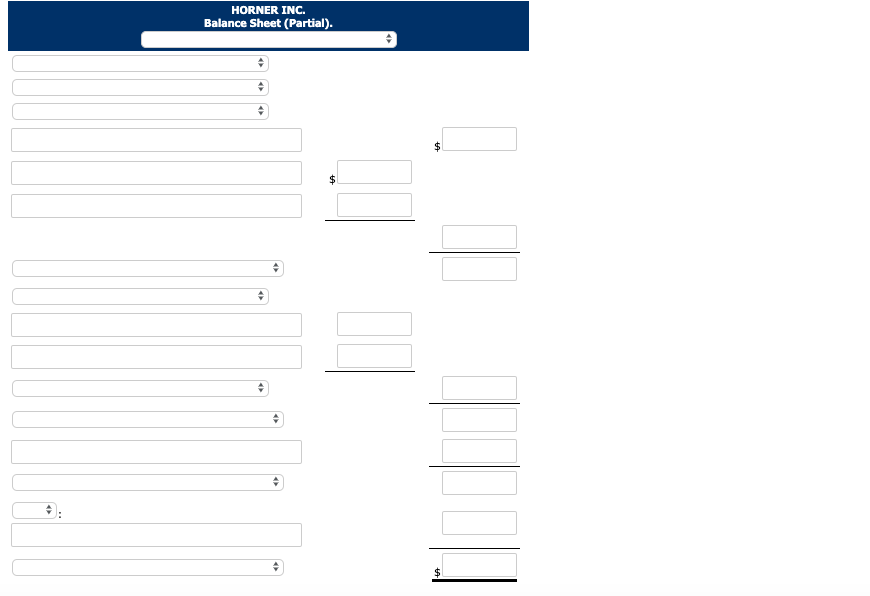

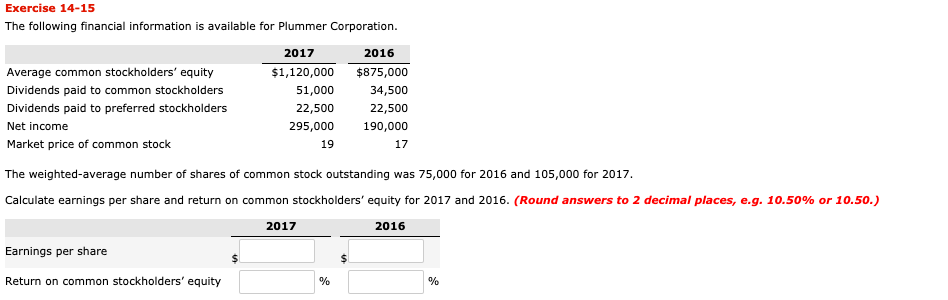

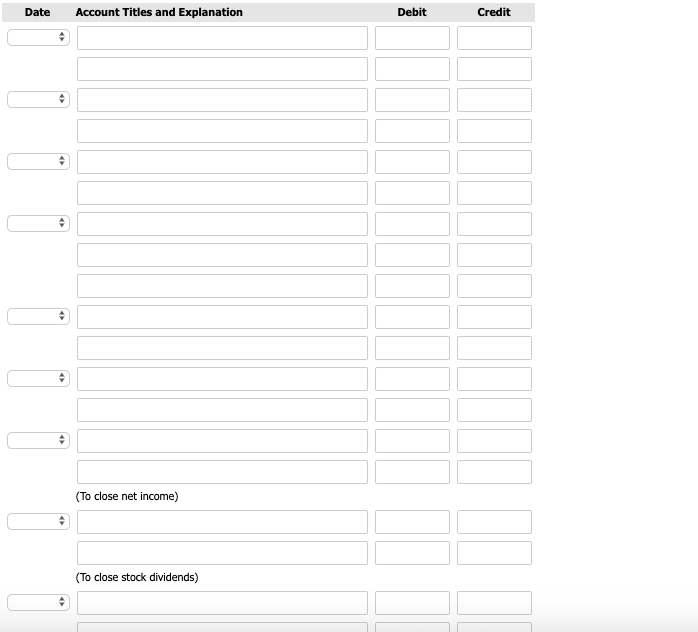

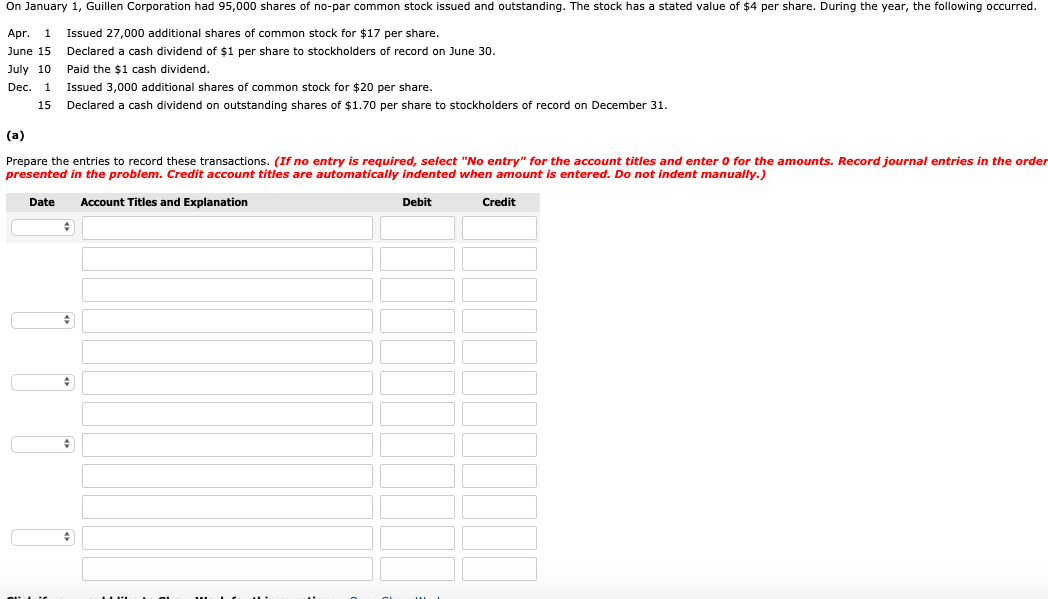

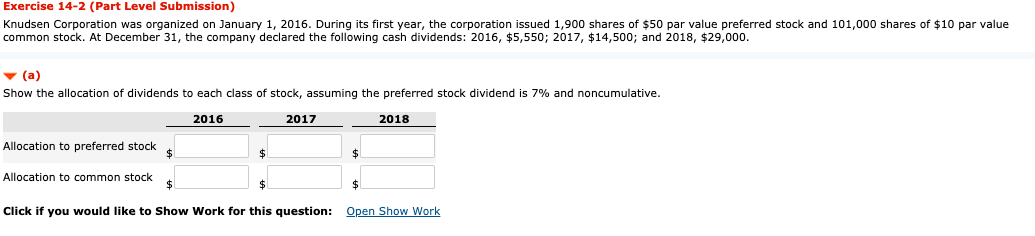

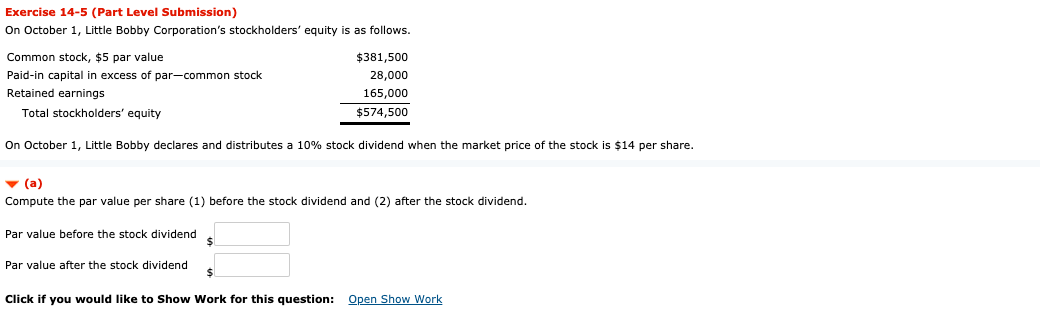

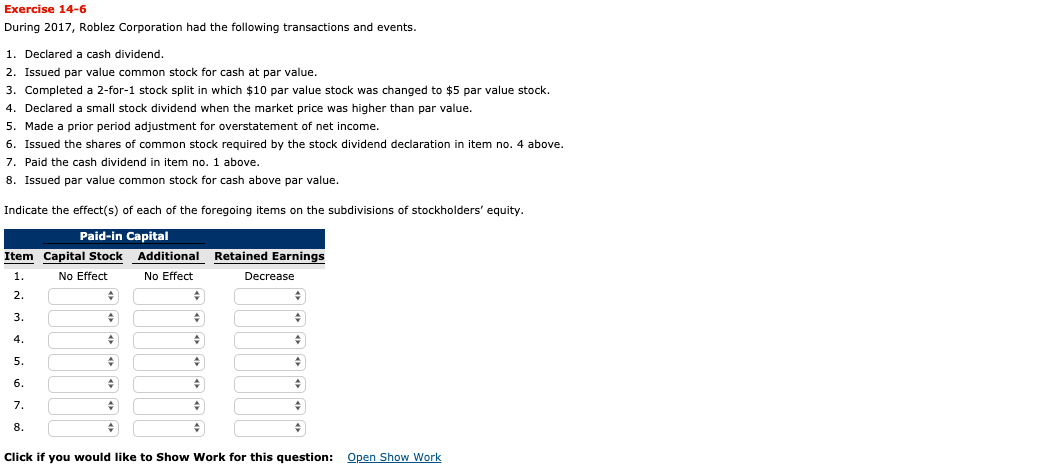

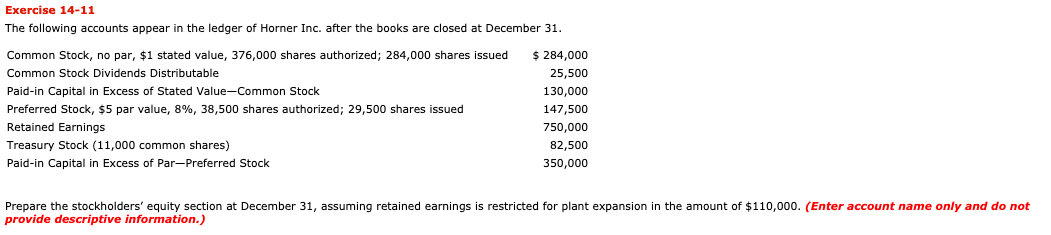

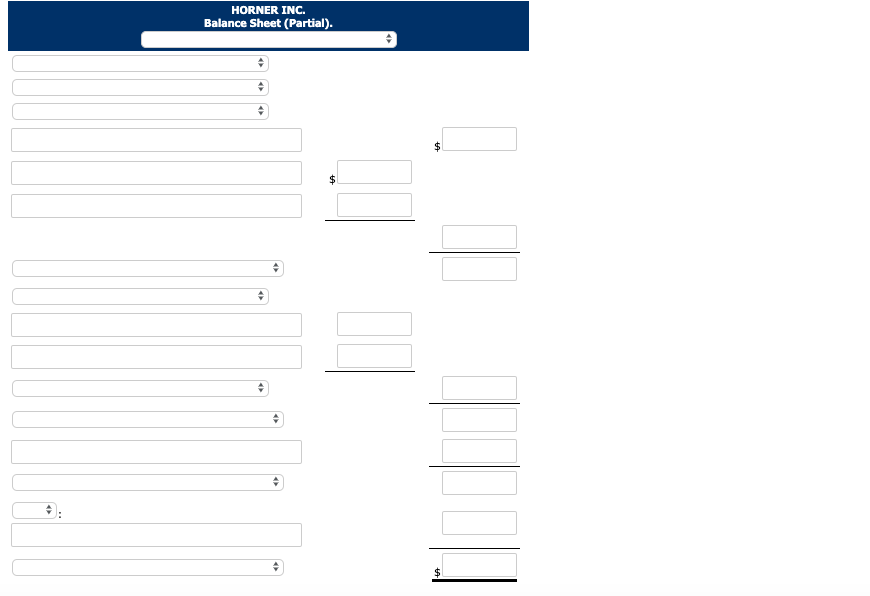

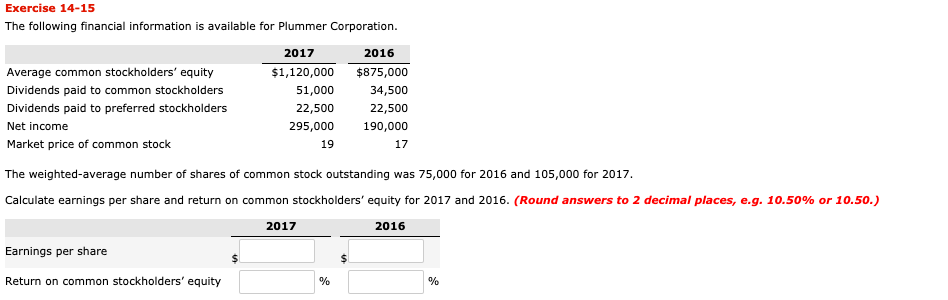

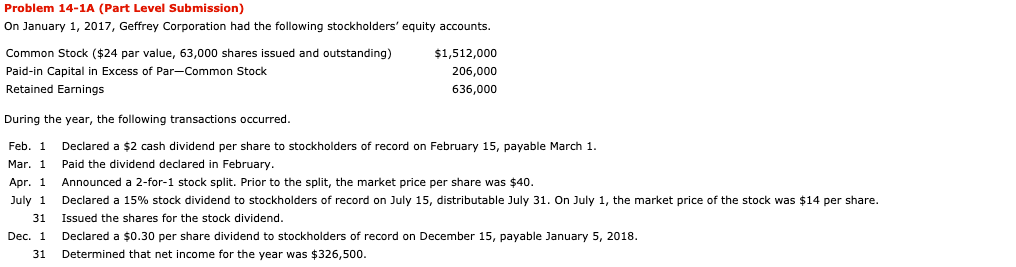

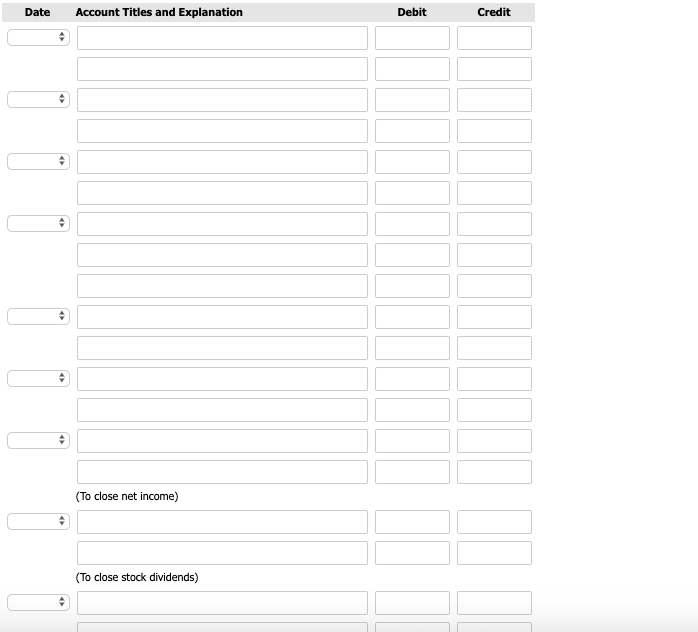

On January 1, Guillen Corporation had 95,000 shares of no-par common stock issued and outstanding. The stock has a stated value of $4 per share. During the year, the following occurred. Apr. 1 June 15 July 10 Dec. 1 15 Issued 27,000 additional shares of common stock for $17 per share. Declared a cash dividend of $1 per share to stockholders of record on June 30. Paid the $1 cash dividend. Issued 3,000 additional shares of common stock for $20 per share. Declared a cash dividend on outstanding shares of $1.70 per share to stockholders of record on December 31. (a) Prepare the entries to record these transactions. (If no entry is required, select "No entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Exercise 14-2 (Part Level Submission) Knudsen Corporation was organized on January 1, 2016. During its first year, the corporation issued 1,900 shares of $50 par value preferred stock and 101,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: 2016, $5,550; 2017, $14,500; and 2018, $29,000 (a) Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 7% and noncumulative. 2016 2017 2018 Allocation to preferred stock $ $ Allocation to common stock $ Click if you would like to Show Work for this question: Open Show Work Exercise 14-5 (Part Level Submission) On October 1, Little Bobby Corporation's stockholders' equity is as follows. Common stock, $5 par value Paid-in capital in excess of par-common stock Retained earnings Total stockholders' equity $381,500 28,000 165,000 $574,500 On October 1, Little Bobby declares and distributes a 10% stock dividend when the market price of the stock is $14 per share. (a) Compute the par value per share (1) before the stock dividend and (2) after the stock dividend. Par value before the stock dividend Par value after the stock dividend Click if you would like to Show Work for this question: Open Show Work Exercise 14-6 During 2017, Roblez Corporation had the following transactions and events. 1. Declared a cash dividend. 2. Issued par value common stock for cash at par value. 3. Completed a 2-for-1 stock split in which $10 par value stock was changed to $5 par value stock. 4. Declared a small stock dividend when the market price was higher than par value. 5. Made a prior period adjustment for overstatement of net income. 6. Issued the shares of common stock required by the stock dividend declaration in item no. 4 above. 7. Paid the cash dividend in item no. 1 above. 8. Issued par value common stock for cash above par value. Indicate the effect(s) of each of the foregoing items on the subdivisions of stockholders' equity. Paid-in Capital Item Capital Stock Additional 1. No Effect No Effect Retained Earnings Decrease 2. + 3. 4. 5. 6. 7. 8. Click if you would like to Show Work for this question: Open Show Work Exercise 14-11 The following accounts appear in the ledger of Horner Inc. after the books are closed at December 31. Common Stock, no par, $1 stated value, 376,000 shares authorized; 284,000 shares issued Common Stock Dividends Distributable Paid-in Capital in Excess of Stated Value-Common Stock Preferred Stock, $5 par value, 8%, 38,500 shares authorized; 29,500 shares issued Retained Earnings Treasury Stock (11,000 common shares) Paid-in Capital in Excess of Par-Preferred Stock $ 284,000 25,500 130,000 147,500 750,000 82,500 350,000 Prepare the stockholders' equity section at December 31, assuming retained earnings is restricted for plant expansion in the amount of $110,000. (Enter account name only and do not provide descriptive information.) HORNER INC. Balance Sheet (Partial). $ $ $ Exercise 14-15 The following financial information is available for Plummer Corporation. 2017 2016 Average common stockholders' equity $1,120,000 $875,000 Dividends paid to common stockholders 51,000 34,500 Dividends paid to preferred stockholders 22,500 22,500 Net income 295,000 190,000 Market price of common stock 19 17 The weighted average number of shares of common stock outstanding was 75,000 for 2016 and 105,000 for 2017. Calculate earnings per share and return on common stockholders' equity for 2017 and 2016. (Round answers to 2 decimal places, e.g. 10.50% or 10.50.) 2017 2016 Earnings per share $ Return on common stockholders' equity % % Problem 14-1A (Part Level Submission) On January 1, 2017, Geffrey Corporation had the following stockholders' equity accounts. Common Stock ($24 par value, 63,000 shares issued and outstanding) Paid-in Capital in Excess of Par-Common Stock Retained Earnings $1,512,000 206,000 636,000 During the year, the following transactions occurred. Feb. 1 Mar. 1 Apr. 1 July 1 31 Dec. 1 Declared a $2 cash dividend per share to stockholders of record on February 15, payable March 1. Paid the dividend declared in February. Announced a 2-for-1 stock split. Prior to the split, the market price per share was $40. Declared a 15% stock dividend to stockholders of record on July 15, distributable July 31. On July 1, the market price of the stock was $14 per share. Issued the shares for the stock dividend. Declared a $0.30 per share dividend to stockholders of record on December 15, payable January 5, 2018. Determined that net income for the year was $326,500. 31 Date Account Titles and Explanation Debit Credit + (To close net income) (To close stock dividends)