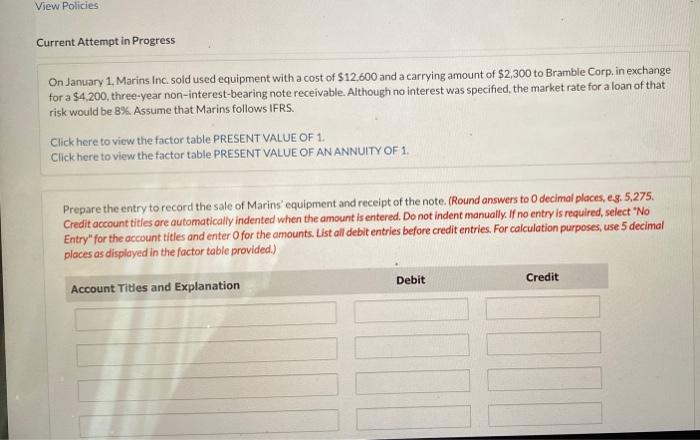

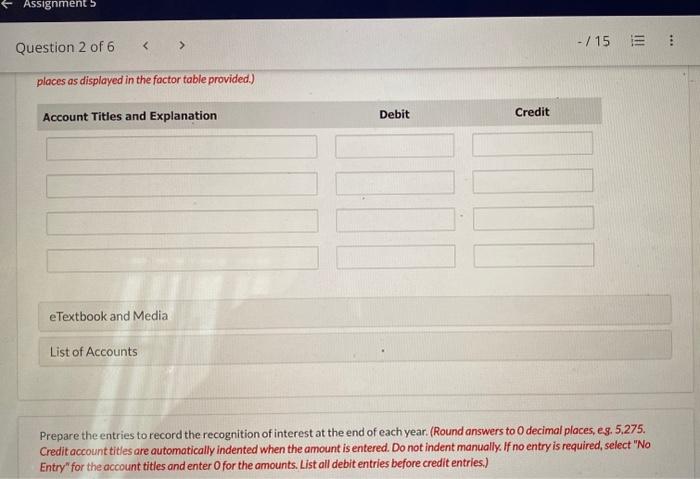

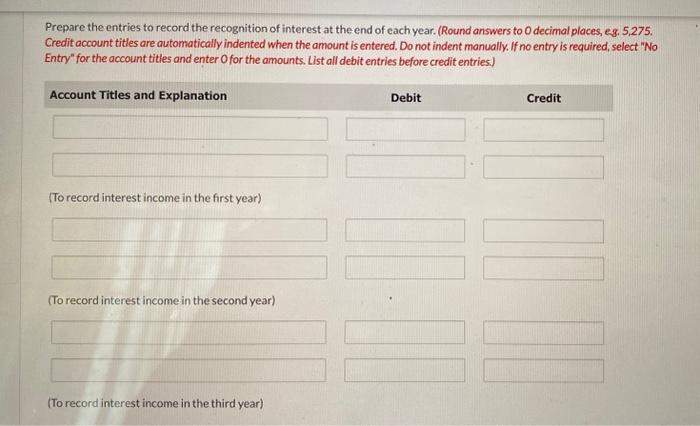

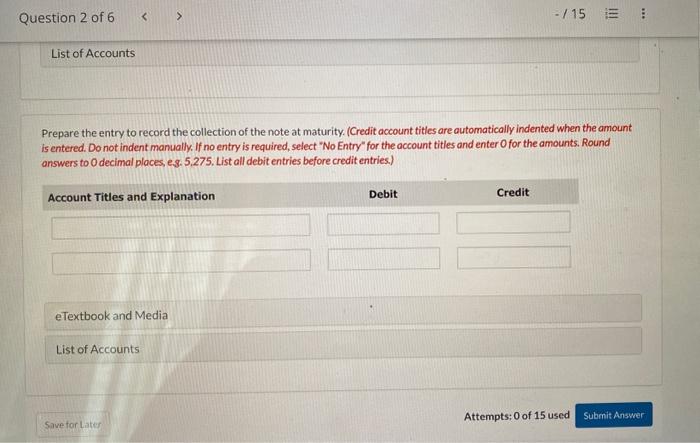

On January 1, Marins Inc. sold used equipment with a cost of $12,600 and a carrying amount of $2,300 to Bramble Corp, in exchange for a $4,200, three-year non-interest-bearing note receivable. Although no interest was specified, the market rate for a loan of that risk would be 8%. Assume that Marins follows IFRS. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Prepare the entry to record the sale of Marins' equipment and receipt of the note. (Round answers to 0 decimal places, es. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter O for the amounts. List all debit entries before credit entries. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) places as displayed in the factor table provided.) eTextbook and Media List of Accounts Prepare the entries to record the recognition of interest at the end of each year. (Round answers to 0 decimal places, eg. 5.275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the omounts. List all debit entries before credit entries.) Prepare the entries to record the recognition of interest at the end of each year. (Round answers to 0 decimal places, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required; select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Prepare the entry to record the collection of the note at maturity. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, es. 5.275. List all debit entries before credit entries.) Attempts; 0 of 15 used