Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 of the current year, Kohler Manufacturing Company purchased a metal cutting and polishing machine at a cost of $4,780,000. The installation and

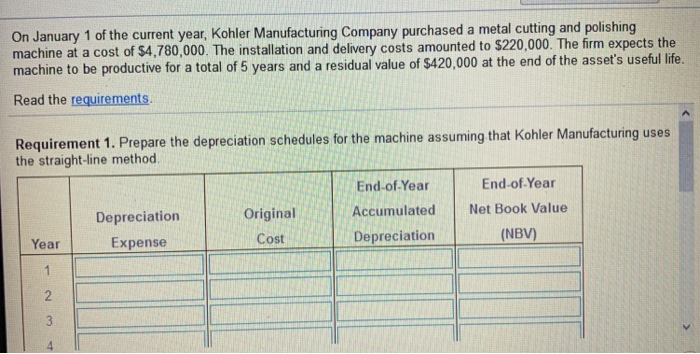

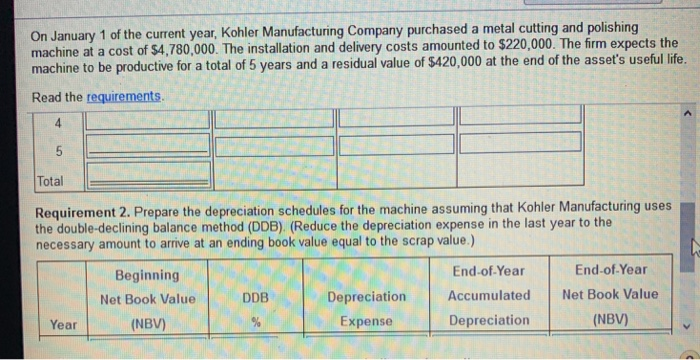

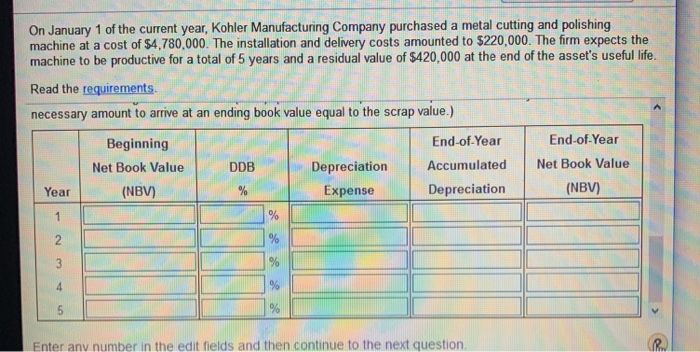

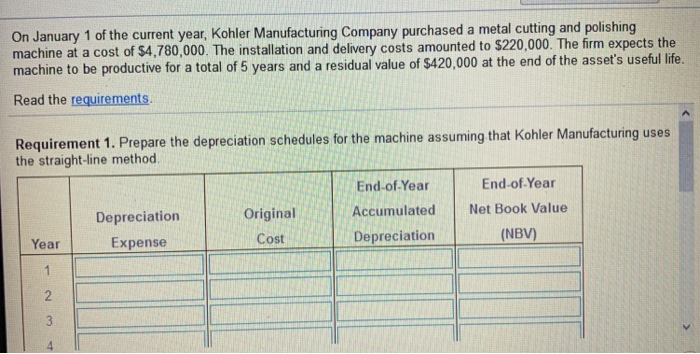

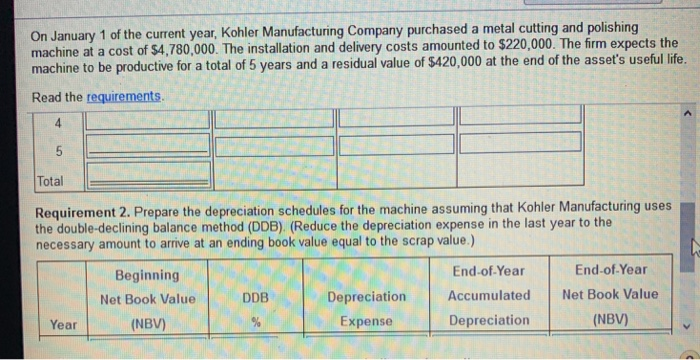

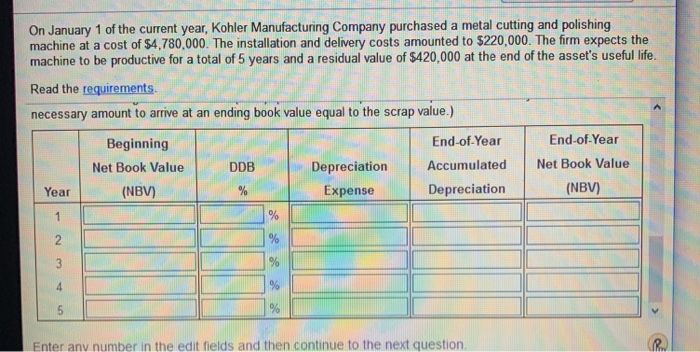

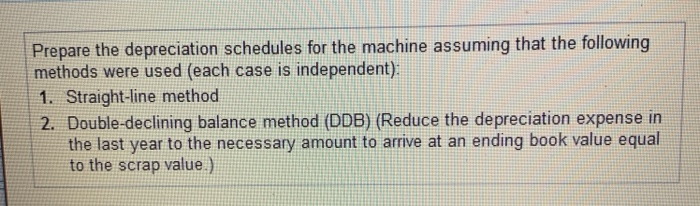

On January 1 of the current year, Kohler Manufacturing Company purchased a metal cutting and polishing machine at a cost of $4,780,000. The installation and delivery costs amounted to $220,000. The firm expects the machine to be productive for a total of 5 years and a residual value of $420,000 at the end of the asset's useful life. Read the requirements. Requirement 1. Prepare the depreciation schedules for the machine assuming that Kohler Manufacturing uses the straight-line method End-of Year Accumulated Net Book Value Depreciation End-of Year Depreciation Expense Original Cost Year (NBV) 4 On January 1 of the current year, Kohler Manufacturing Company purchased a metal cutting and polishing machine at a cost of $4,780,000. The installation and delivery costs amounted to $220,000. The firm expects the machine to be productive for a total of 5 years and a residual value of $420,000 at the end of the asset's useful life. Read the requirements Total Requirement 2. Prepare the depreciation schedules for the machine assuming that Kohler Manufacturing uses the double-declining balance method (DDB). (Reduce the depreciation expense in the last year to the necessary amount to arrive at an ending book value equal to the scrap value.) End-of-Year Beginning Net Book Value (NBV) End-of Year Accumulated Net Book Value Depreciation DDB Year Expense (NBV) On January 1 of the current year, Kohler Manufacturing Company purchased a metal cutting and polishing machine at a cost of $4,780,000. The installation and delivery costs amounted to $220,000. The firm expects the machine to be productive for a total of 5 years and a residual value of $420,000 at the end of the asset's useful life. Read the requirements necessary amount to arrive at an ending book value equal to the scrap value.) End-of Year Accumulated Net Book Value Depreciation End-of-Year Beginning Net Book Value (NBV) DDB Depreciation Expense Year (NBV) 5 Enter any number in the edit fields and then continue to the next question Prepare the depreciation schedules for the machine assuming that the following methods were used (each case is independent) 1. Straight-line method 2. Double-declining balance method (DDB) (Reduce the depreciation expense in the last year to the necessary amount to arrive at an ending book value equal to the scrap value)

On January 1 of the current year, Kohler Manufacturing Company purchased a metal cutting and polishing machine at a cost of $4,780,000. The installation and delivery costs amounted to $220,000. The firm expects the machine to be productive for a total of 5 years and a residual value of $420,000 at the end of the asset's useful life. Read the requirements. Requirement 1. Prepare the depreciation schedules for the machine assuming that Kohler Manufacturing uses the straight-line method End-of Year Accumulated Net Book Value Depreciation End-of Year Depreciation Expense Original Cost Year (NBV) 4 On January 1 of the current year, Kohler Manufacturing Company purchased a metal cutting and polishing machine at a cost of $4,780,000. The installation and delivery costs amounted to $220,000. The firm expects the machine to be productive for a total of 5 years and a residual value of $420,000 at the end of the asset's useful life. Read the requirements Total Requirement 2. Prepare the depreciation schedules for the machine assuming that Kohler Manufacturing uses the double-declining balance method (DDB). (Reduce the depreciation expense in the last year to the necessary amount to arrive at an ending book value equal to the scrap value.) End-of-Year Beginning Net Book Value (NBV) End-of Year Accumulated Net Book Value Depreciation DDB Year Expense (NBV) On January 1 of the current year, Kohler Manufacturing Company purchased a metal cutting and polishing machine at a cost of $4,780,000. The installation and delivery costs amounted to $220,000. The firm expects the machine to be productive for a total of 5 years and a residual value of $420,000 at the end of the asset's useful life. Read the requirements necessary amount to arrive at an ending book value equal to the scrap value.) End-of Year Accumulated Net Book Value Depreciation End-of-Year Beginning Net Book Value (NBV) DDB Depreciation Expense Year (NBV) 5 Enter any number in the edit fields and then continue to the next question Prepare the depreciation schedules for the machine assuming that the following methods were used (each case is independent) 1. Straight-line method 2. Double-declining balance method (DDB) (Reduce the depreciation expense in the last year to the necessary amount to arrive at an ending book value equal to the scrap value)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started