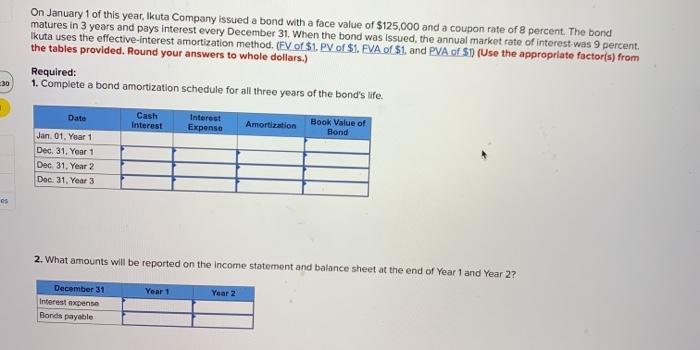

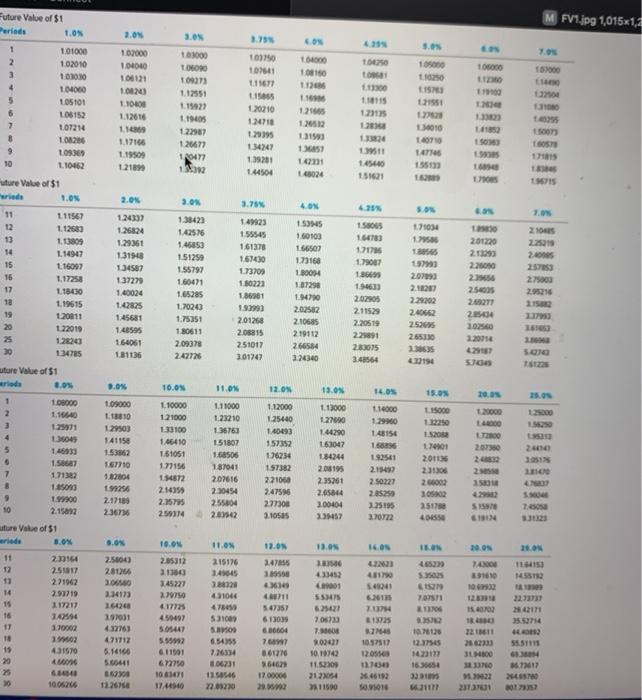

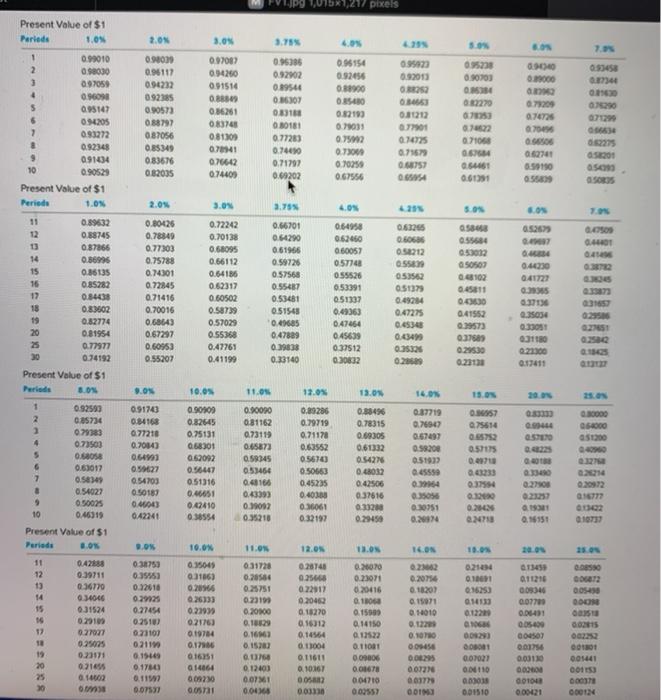

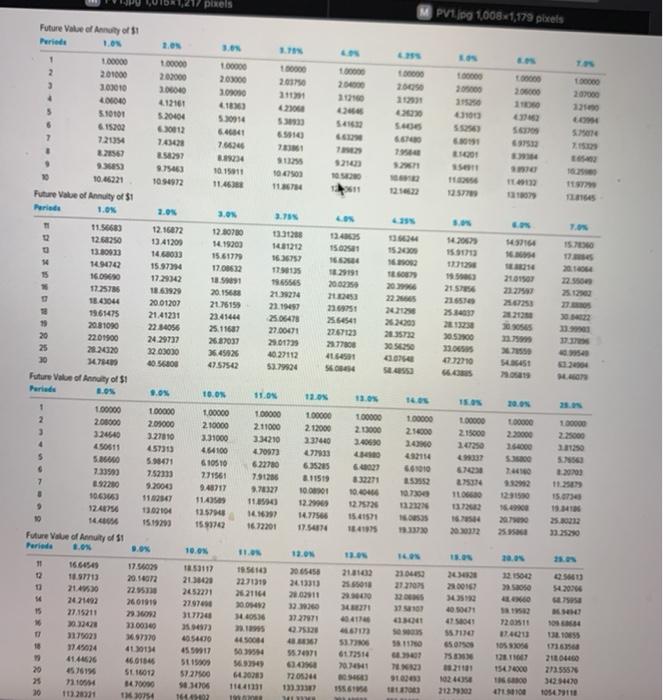

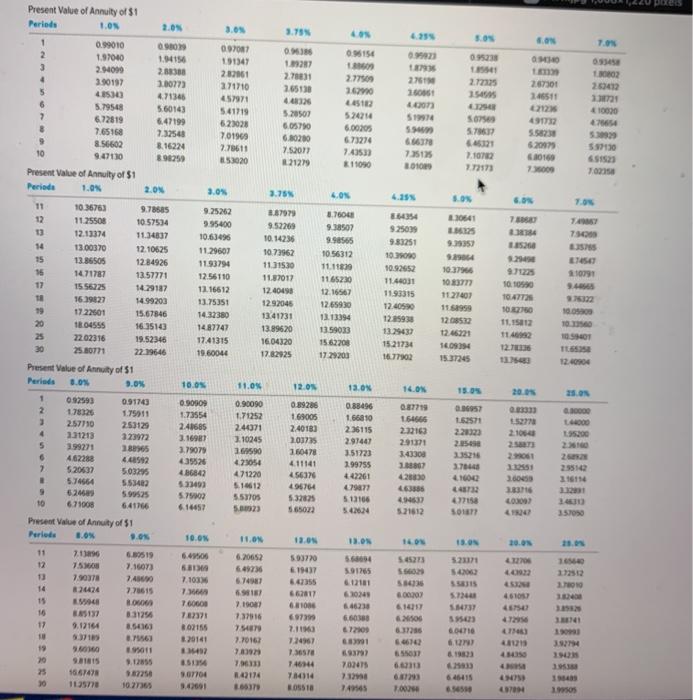

On January 1 of this year, Ikuta Company issued a bond with a face value of $125,000 and a coupon rate of 8 percent. The bond matures in 3 years and pays interest every December 31. When the bond was issued, the annual market rate of interest was 9 percent likuta uses the effective-interest amortization method. (FV of $1. PV of $1. FVA of $1. and PVA of S1) (Use the appropriate factor(s) from the tables provided. Round your answers to whole dollars.) Required: 1. Complete a bond amortization schedule for all three years of the bond's life. 30 Date Cash Interest Interest Expense Amortization Book Value of Bond Jan. 01. Year 1 Dec. 31. Year 1 Dec. 31. Year 2 Dec. 31. Year 3 es 2. What amounts will be reported on the income statement and balance sheet at the end of Year 1 and Year 2? Year 1 Year 2 December 31 Interest expense Bonds payable MFV1.jpg 1,015 1,3 2.0 15 6. 3.0 10000 7.0 104000 OSCO S. 10000 100 LOGO TO 10913 Future Value of $1 1.ON 101000 2 102010 103030 104000 105101 L08152 7 107214 101200 LOS 10 L10462 167000 1000 100121 100243 1.10400 1.12010 1.1 1.17166 1.1959 12193 100150 101 1861 LISAS 1 20210 120710 29395 134747 1.39201 144504 112 M 12160 119921 1.19403 120135 131593 13 121550 100 4010 140710 Lates 15533 CPI HOS 00 TOT 171819 120677 10477 132 HISE 1421 165024 151621 1575 Future Value of $1 1.05 2.05 3.75% S. 171034 149923 155545 161378 161430 20 2.2018 2.00 1.24302 1.26824 1.29361 1.31968 134587 137279 140024 1.42825 1.45681 148595 164061 131136 111567 12 1.12580 13 1.13309 14 1.14947 15 1.16097 16 1.17258 17 118400 13 1.19615 19 1.20011 122019 25 1220 134785 sture Value of $1 8.0 3.ON 1.33423 142576 146853 151259 1.55797 1.60471 1.65285 1.7020 1.75351 180611 2.09378 242726 4.ON 15015 1.60103 166501 1.73160 1.80054 1.87290 1.94790 202502 2.10685 219112 266584 324340 1.80223 1.86961 1909) 201260 2.08815 251017 3.01747 2010 166783 17178 1.79087 186605 1.34633 202005 2.1152 2.29519 229891 2.83075 3.48564 LO 201220 21293 2.2000 2. 25000 2.65277 285434 10250 3.2014 20700 2.320 22202 246662 25265 265330 23 42194 S. 5.10 0.0% 10.ON 11.09 12.0N 13.05 2005 10000 1 2 115000 12000 5 125971 1049 146933 1.56631 171382 1.500 1.00 2.15092 2 109000 L1810 129503 141150 1.53862 1.67710 1.2004 19125 2.17189 2.3676 1. 10000 1.11000 1.21000 1.23210 1.30100 136763 1.66410 151807 1.51051 177156 187041 154872 207616 2.145 2.30454 2.35795 2.55804 259514 209542 14.05 114000 129960 148154 1.596 192541 2.15499 2.50227 112000 1.25440 1.40093 157352 1.76234 1.97382 221060 247596 2.77300 3.10585 1.13000 127690 144290 163047 184244 2.08195 2.35261 2.65844 3.00404 2.3157 7 WRIT 1001 2011 231306 2.66002 3000 251750 1500 9 10 2.25195 2.70722 1.650 11.0 NO Neur 215176 14545 13. 27 433452 TENT 20.01 14 391610 GS SEOSES NESIS 4551 uture Value of $1 ride 8.0% 11 12 2.51817 11 2.1962 14 2.93719 15 117217 16 142594 11 1.70002 Oz 431570 20 Awn 10.05 2.85312 1130 3.45227 1.1970 41772 450497 40 4241 LO RESS 2.5000 2010 206 2.34173 2620 297031 47763 471712 5.14 5.6641 43104 7.02.18 LOG 15.000 247855 30 4634 11 5.67357 613039 6.36604 760917 801776 364621 10718 12.375 71174 13 M40 10.57511 12.05 11 26.66192 531000 SAVO 6.54355 7.26334 806231 1150546 220320 2 55.51111 22861 2162333 3400 5.55 611901 672750 10.61471 1744910 " 705730 7.31604 2.000 10.10742 115209 2121054 1150 SOCO 1636654 33 21177 1006206 12.2015 20. 2373701 0732 2 pixels PV1.18 1008x1,179 pixels Future Value of Anuty of $1 Periode 2.ON 00000 2.00000 315 1013 5.255 6.00 1001 OCES 12100 COM 50 23 DRE 11. 27 3.0 14.2022 15.173 LISCOS 37164 SEN 21.10 2010 13 2157 21 THE 3052100 PED 7 72710 451 2004 1 10000 100000 0000 2 201000 203000 2017 2005 3 300010 200040 3.000 311 31160 11201 4 4.66040 412161 42300 5.10101 5.20404 5.2014 6 615202 646041 . 7 7.2004 14340 7.6634 7331 29 . 32567 92103 9.33 9.75463 1015011 10.000 1045221 10.94972 11.46.88 116784 121422 Pure Value of Annuity of $! Parade 2.05 3.ON 11.56680 12.16072 12.80780 33128 12.6250 1341209 1419200 13.00 14.68033 15.61779 1636757 14.94742 15.97394 17062 17.90135 1829191 55 16.00 1729342 1859091 13.556 200205 20 1225735 18.60920 2016 21.39274 18.43044 20.01207 2175159 23.1949 23651 13.65475 21.41231 23.41444 25.06478 2541 26200 19 20.81030 2234056 25. 11687 27.00471 22.67123 2035732 20 2201300 24.29737 26.87037 2017 25 202020 22 03030 36.45126 40.22112 07 30 1478430 40 56000 47.57542 52.79924 Future Value of Annuity of $1 Perlede 1.09 9.0 10.0 11.ON 1s 1 1.00000 100000 100000 1.00000 100000 100000 100000 200000 2.09000 210000 211000 212000 2.3000 214000 3 3.27010 3.31000 3.34210 237440 2440 4 457313 4.54100 470173 33 492114 5 S. 5.9491 610510 622780 6.35205 640023 7.33930 7.52013 2.71561 7.91236 11519 832271 7 1.92200 9.2000 940717 2.76327 1000000 10.6406 8 10.633 1162367 11.40 11 12.29001 1275730 322 9 12.4375 13.02104 1157948 1697 1477566 15.61971 144 15.19293 1590740 16.72200 141015 33370 Future Value of Annuity of $1 Periode 8.ON 9.0% 10.0 120 17102 18.53117 19 5413 2065458 210102 21.04 12 1897713 20.14072 21.3020 2271319 201313 27 2107 13 2140 22.95 2452221 2521164 20.02011 2421492 2601919 2797000 2001412 2100 TI 11 27.15211 2016092 30774 H45 327971 4041748 200 23001 5947 613 SO TI 3179023 16.97370 40 530 181171 1745024 41.2014 55.70371 6172514 414626 46.61645 519 6.4 701 20 4519 S16012 52100 6430283 72 01244 71.100 90 34706 1141 20 112.2011 20154 1652 19 ON TOS 100% 100000 215000 3.500 2.25000 21250 1231 9 2410 DOCED 2014 100 14 15.900 2017 15.073 19.34136 25.2000 33.25250 TOATE DOS . 5420346 AREsco ECHTE SUITE PROOS NEOS CHEN 2013 2010 340 40.0071 41 5041 557170 650 753 121101 1024454 212.90 720351 11:40 1050 1540000 CON 16 COCIN 21HGO 273555 342.4470 101010 Sad 2 NO O's . 7. BO IS CE 09345 TO 17935 27611 2005 2.77135 LOT 2.67301 2.46511 2 9732 5.5823 6.2007 6.2016 2000 120 5.00 576 64521 7.1072 2.72173 . 10020 76 5.30 591130 S1521 7025 66670 SEISEL GOLO 3.09 6. 7. PRERE 115200 24 6354 525009 9.83251 1000 10.92652 11.44031 11.93315 12.4050 12.15930 13.29430 15.21734 16.77902 30641 L6125 9.79357 9064 10.3790 1072 1127401 11.5959 12.08522 12.46221 16.09094 1537245 10790 9.46 Present Value of Annuity of Periods 1.0 3.0 3.75 1 0.99010 090 09701 0.986 0.5154 2 1.97040 1.94150 191347 3 2.94019 2.08333 2.32861 2.78331 2.77900 4 3.50197 2.0077 271710 360 5 45 471348 457971 44325 2012 6 5.79548 5.60143 5.41719 5.2007 524214 6.72819 6.47199 623028 6.05790 8 7.65160 6.00205 7.32543 70190 6.80200 9 8.56602 8.16224 7.78611 7.5.2017 74353 10 9.07130 8.90259 53020 21299 11080 Present Value of Annuity of $1 Periode 1.0% 2.0 3.75 60 11 10.36763 9.78585 9.25262 3.87979 3.7600 12 11.25500 10.57534 9.95400 9.52260 9.38507 13 12.13374 11.34337 10.6496 10.14236 9.98565 14 13.00370 12.10625 11.29603 10.73962 10.56312 15 13.86505 12.84926 11.93794 11.31530 11.11829 15 1471787 13.57771 12.56110 11.87011 1165230 17 1556225 14.29137 12.16612 1240490 12.16567 16.39827 14.99203 13.75351 1292046 1265930 19 17 22501 15.67846 14.37380 13.41731 13.13394 20 18.04555 16.35143 14.87747 13.89620 1359033 25 22.02316 19.52346 17.41315 16.04320 1562200 30 25.07 22.19646 19.60044 17.82925 1723203 Present Value of Annuity of $1 Periods 8.0 9.0% 10.05 11.05 12.0 13.0 1 0.92593 091743 090909 0.90090 0.89286 0.88496 2 178326 1.75911 1.73554 1.71252 169005 166810 3 2.57710 2.53129 241685 2.40071 2.40183 236115 4 2.31213 3.23 1.16981 3.10245 203735 2.97447 5 3.99271 380905 3.79079 2.69590 160478 351723 6 4.62280 4.40502 435526 4.23054 4.11141 199755 7 5 20637 5.03295 46842 471220 456370 442261 . 5.74564 5.53402 5.33493 510612 496764 07977 9 624 5.99525 5.72 553705 532825 513166 10 671008 6.41766 565022 542624 Present Value of Annuity of 1 Perlede 8.0% 9.0% 10.0N 11.ON 13.0 7.1296 6.89519 6.4906 620652 59370 568094 7.1603 6.31 49736 6.19437 591765 13 7.90 748100 7.103 12181 14 24424 7.70615 17 662817 610249 15 1994 8. 760000 7.19087 681000 45230 16 331254 782371 7.3716 697399 6.600 17 9.17164 8.54163 802155 7587 2.1 67200 10 16 20141 7.70162 1.4967 1 19 011 47 7.839 2.367 93737 20 9.12855 514 76133 746144 702475 16.67478 9.07704 8.42114 71014 71394 30 10.27365 36537 749565 10.10980 10:47 102760 11.11 CENE GOOD TOGO OST 653 12.00 14.0 20.0 0.83333 1527 0.0000 000 195.200 0.87719 164666 2.32163 29171 343300 118807 426000 4633 499532 5.21812 152571 220323 2.50 35216 3.744 41600 2.5T ISSE GSMOT HEST 22 2.91 116114 477158 5017 L0301 357050 14N 20. 5237 CROCS SIS 4 40922 545273 566029 S8 0.00302 61417 SOS NO 584737 461037 467567 4729 50 604710 62 3.92794 6.87293 100 BISSO 4704 SOSAT