Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 of this year, Ikuta Company issued a bond with a face value of $150,000 and a coupon rate of 5 percent.

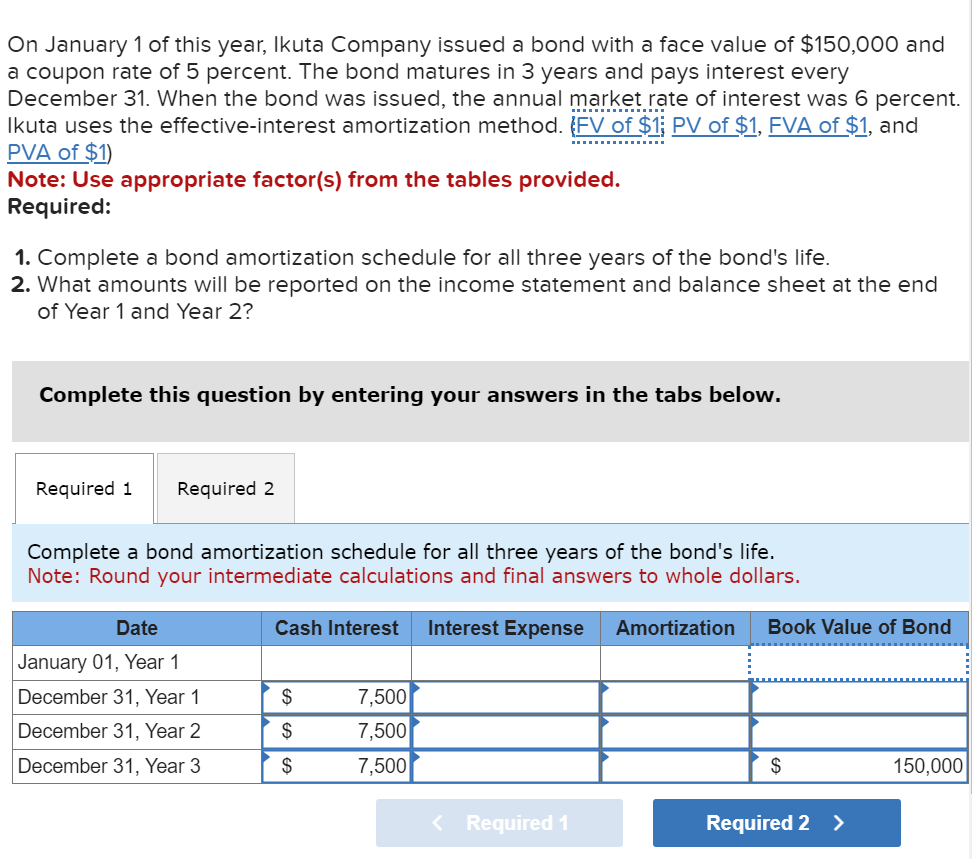

On January 1 of this year, Ikuta Company issued a bond with a face value of $150,000 and a coupon rate of 5 percent. The bond matures in 3 years and pays interest every December 31. When the bond was issued, the annual market rate of interest was 6 percent. Ikuta uses the effective-interest amortization method. (FV of $1; PV of $1, FVA of $1, and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Required: 1. Complete a bond amortization schedule for all three years of the bond's life. 2. What amounts will be reported on the income statement and balance sheet at the end of Year 1 and Year 2? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete a bond amortization schedule for all three years of the bond's life. Note: Round your intermediate calculations and final answers to whole dollars. Date Cash Interest Interest Expense Amortization Book Value of Bond January 01, Year 1 December 31, Year 1 $ 7,500 December 31, Year 2 $ 7,500 December 31, Year 3 $ 7,500 $ 150,000 < Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started