Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 of this year, the carrying value of XYZ Inc's bonds was $923,770. The face value of these bonds was $900,000. On the

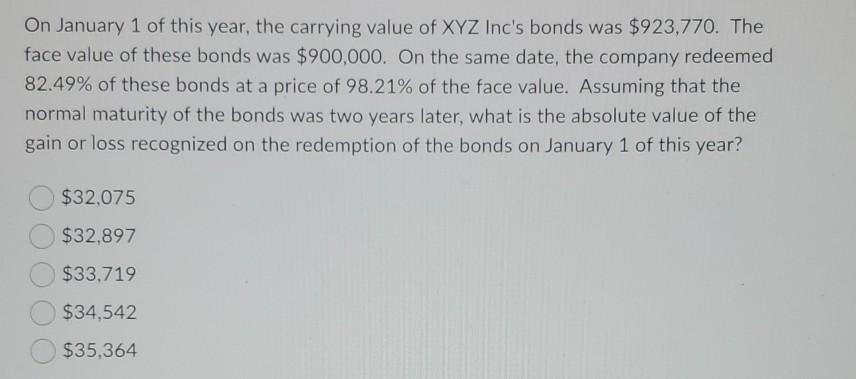

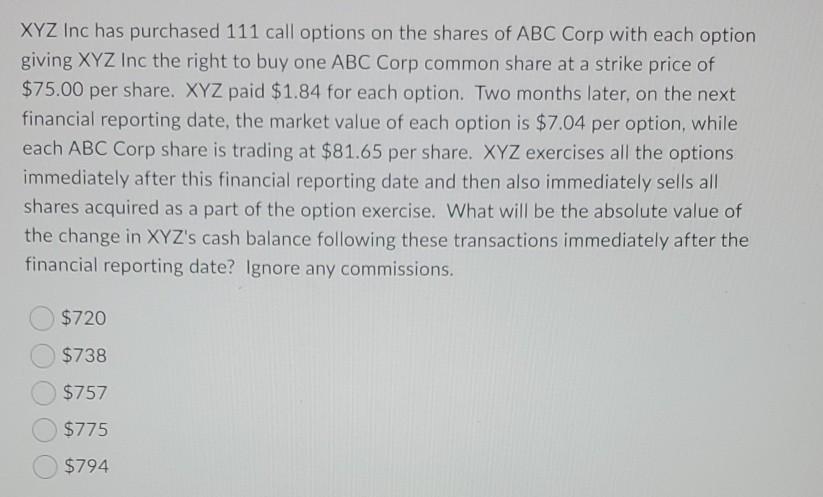

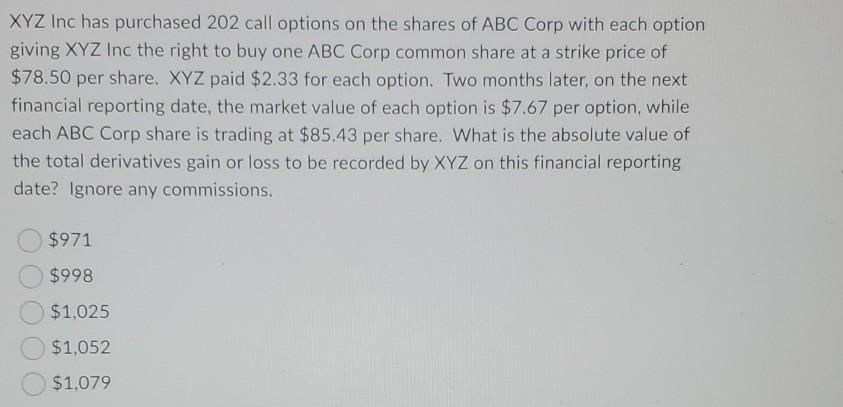

On January 1 of this year, the carrying value of XYZ Inc's bonds was $923,770. The face value of these bonds was $900,000. On the same date, the company redeemed 82.49% of these bonds at a price of 98.21% of the face value. Assuming that the normal maturity of the bonds was two years later, what is the absolute value of the gain or loss recognized on the redemption of the bonds on January 1 of this year? $32,075 $32,897 $33,719 $34,542 $35,364 XYZ Inc has purchased 111 call options on the shares of ABC Corp with each option giving XYZ Inc the right to buy one ABC Corp common share at a strike price of $75.00 per share. XYZ paid $1.84 for each option. Two months later, on the next financial reporting date, the market value of each option is $7.04 per option, while each ABC Corp share is trading at $81.65 per share. XYZ exercises all the options immediately after this financial reporting date and then also immediately sells all shares acquired as a part of the option exercise. What will be the absolute value of the change in XYZ's cash balance following these transactions immediately after the financial reporting date? Ignore any commissions. $720 $738 $757 $775 $794 XYZ Inc has purchased 202 call options on the shares of ABC Corp with each option giving XYZ Inc the right to buy one ABC Corp common share at a strike price of $78.50 per share. XYZ paid $2.33 for each option. Two months later, on the next financial reporting date, the market value of each option is $7.67 per option, while each ABC Corp share is trading at $85.43 per share. What is the absolute value of the total derivatives gain or loss to be recorded by XYZ on this financial reporting date? Ignore any commissions. $971 $998 $1,025 $1.052 $1.079

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started