Question

On January 1 of Year 1, Cane Company signed a five-year lease contract for equipment with Abel Company. The equipment had a normal selling price

On January 1 of Year 1, Cane Company signed a five-year lease contract for equipment with Abel Company. The equipment had a normal selling price of $27,500 and an estimated useful life of six years. Five annual payments of $5,908 are payable by Abel on each January 1, beginning at the lease commencement. The asset reverts to Cane at the end of the lease term. Cane’s implicit interest rate is 6%, which is known to Abel. Abel also paid legal fees in the execution of the lease of $900 on January 1 of Year 1, and the equipment is estimated to have an unguaranteed residual value of $1,500 at the end of the lease.

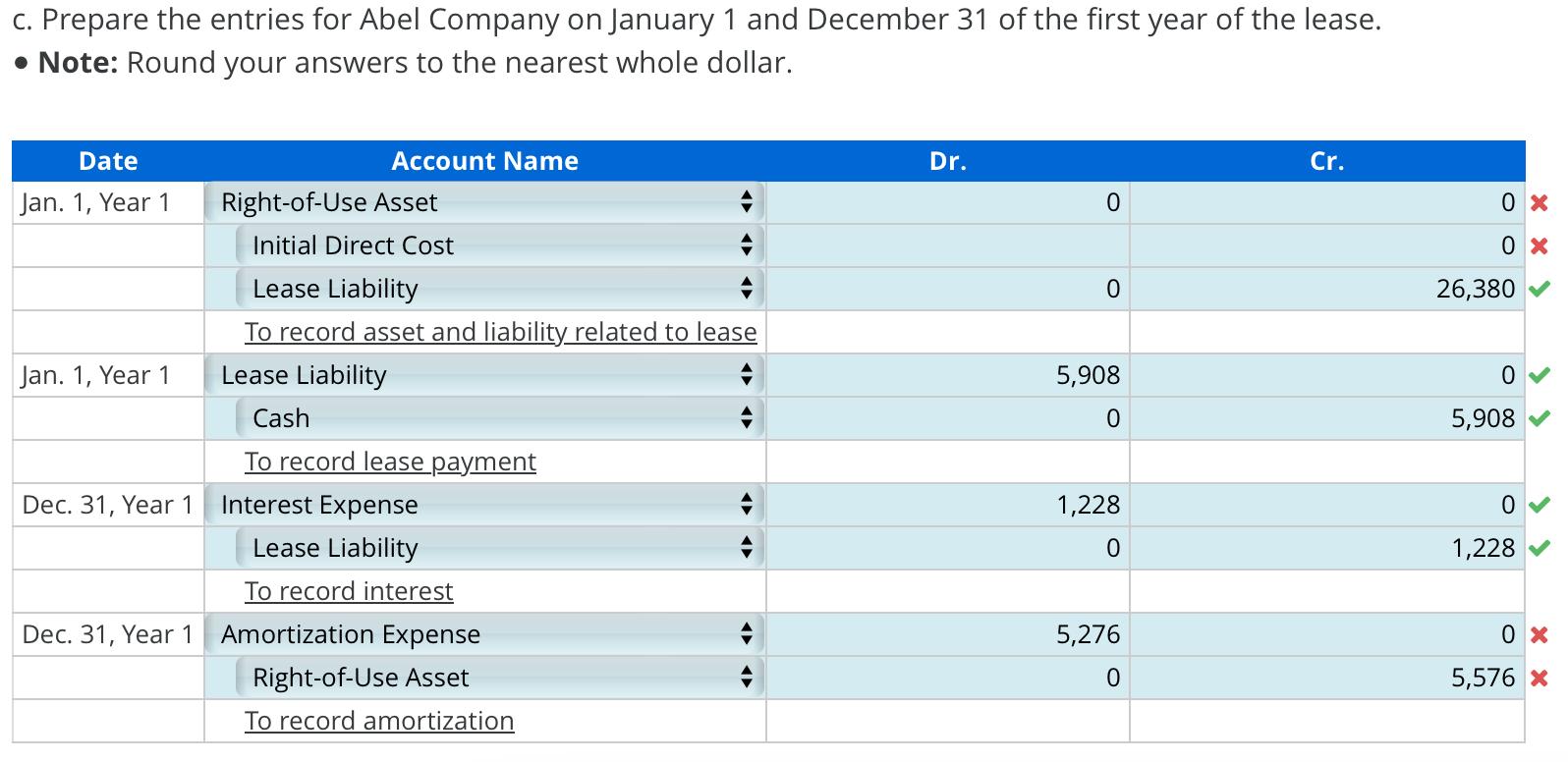

c. Prepare the entries for Abel Company on January 1 and December 31 of the first year of the lease. Note: Round your answers to the nearest whole dollar. Date Jan. 1, Year 1 Jan. 1, Year 1 Dec. 31, Year 1 Dec. 31, Year 1 Account Name Right-of-Use Asset Initial Direct Cost Lease Liability To record asset and liability related to lease Lease Liability Cash To record lease payment Interest Expense Lease Liability To record interest Amortization Expense Right-of-Use Asset To record amortization A Dr. 0 0 5,908 0 1,228 0 5,276 0 Cr. 0x 0x 26,380 0 5,908 0 1,228 0x 5,576 *

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Present Value Factors Calculated By usi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started