Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, Peter incorporates Peter Stores, Inc., a DVD store. He contributes $25,000 cash. Peter is the sole owner. 2. On January 1,

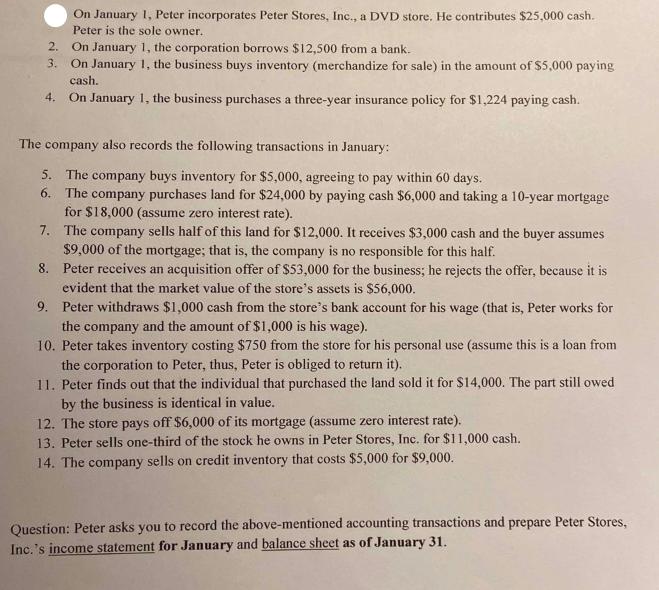

On January 1, Peter incorporates Peter Stores, Inc., a DVD store. He contributes $25,000 cash. Peter is the sole owner. 2. On January 1, the corporation borrows $12,500 from a bank. 3. On January 1, the business buys inventory (merchandize for sale) in the amount of $5,000 paying cash. 4. On January 1, the business purchases a three-year insurance policy for $1,224 paying cash. The company also records the following transactions in January: 5. The company buys inventory for $5,000, agreeing to pay within 60 days. 6. The company purchases land for $24,000 by paying cash $6,000 and taking a 10-year mortgage for $18,000 (assume zero interest rate). 7. The company sells half of this land for $12,000. It receives $3,000 cash and the buyer assumes $9,000 of the mortgage; that is, the company is no responsible for this half. 8. Peter receives an acquisition offer of $53,000 for the business; he rejects the offer, because it is evident that the market value of the store's assets is $56,000. 9. Peter withdraws $1,000 cash from the store's bank account for his wage (that is, Peter works for the company and the amount of $1,000 is his wage). 10. Peter takes inventory costing $750 from the store for his personal use (assume this is a loan from the corporation to Peter, thus, Peter is obliged to return it). 11. Peter finds out that the individual that purchased the land sold it for $14,000. The part still owed by the business is identical in value. 12. The store pays off $6,000 of its mortgage (assume zero interest rate). 13. Peter sells one-third of the stock he owns in Peter Stores, Inc. for $11,000 cash. 14. The company sells on credit inventory that costs $5,000 for $9,000. Question: Peter asks you to record the above-mentioned accounting transactions and prepare Peter Stores, Inc.'s income statement for January and balance sheet as of January 31.

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

First lets record the accounting transactions 1 Incorporation Cash 25000 Common Stock 25000 1 Borrow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started