Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, Pronghorn Co Has the following defined benefit pension plan balances. Prepare a pension worksheet for the pension plan for 2020 and 2021.

On January 1, Pronghorn Co Has the following defined benefit pension plan balances.

Prepare a pension worksheet for the pension plan for 2020 and 2021. (Enter all amounts as positive.)

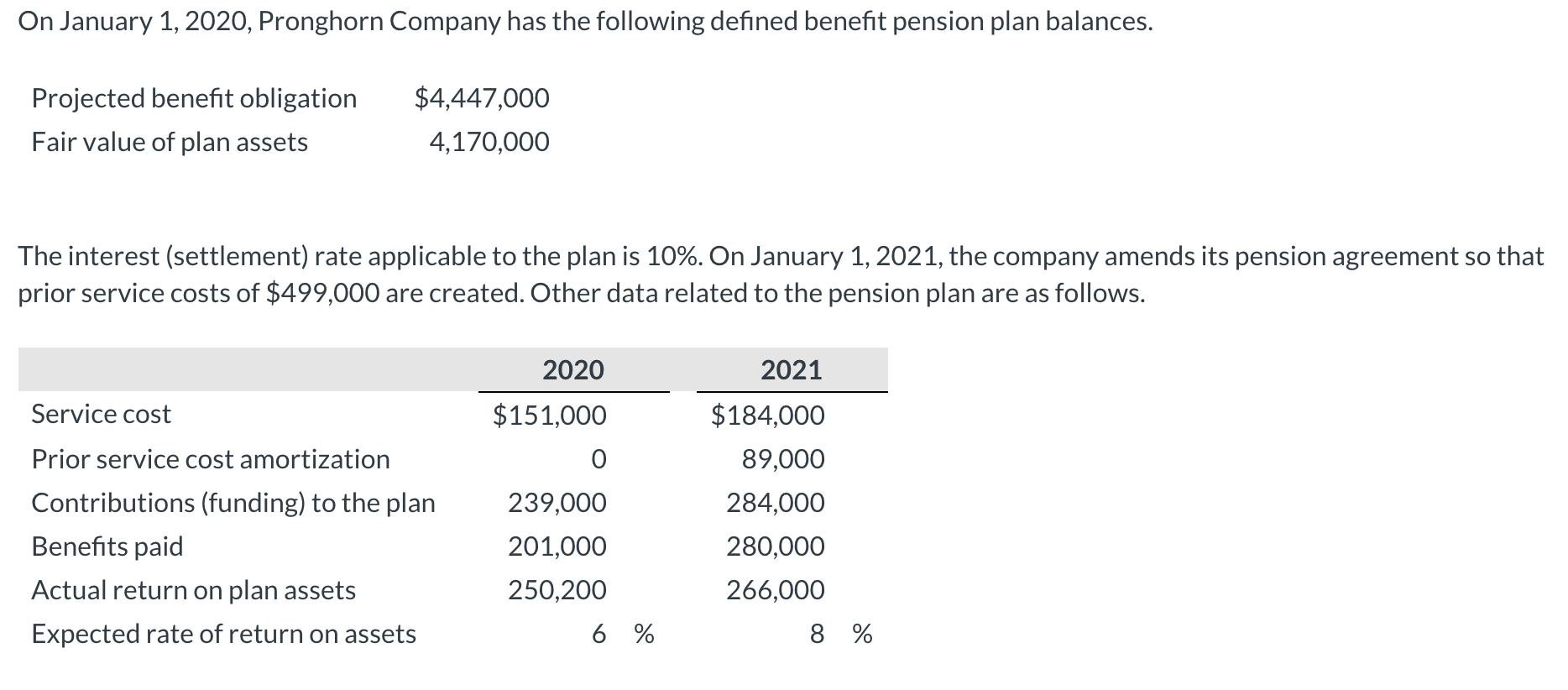

On January 1, 2020, Pronghorn Company has the following defined benefit pension plan balances. Projected benefit obligation Fair value of plan assets $4,447,000 4,170,000 The interest (settlement) rate applicable to the plan is 10%. On January 1, 2021, the company amends its pension agreement so that prior service costs of $499,000 are created. Other data related to the pension plan are as follows. 2020 2021 $151,000 0 Service cost Prior service cost amortization Contributions (funding) to the plan Benefits paid Actual return on plan assets Expected rate of return on assets 239,000 201,000 250,200 6 % $184,000 89,000 284,000 280,000 266,000 8 % On January 1, 2020, Pronghorn Company has the following defined benefit pension plan balances. Projected benefit obligation Fair value of plan assets $4,447,000 4,170,000 The interest (settlement) rate applicable to the plan is 10%. On January 1, 2021, the company amends its pension agreement so that prior service costs of $499,000 are created. Other data related to the pension plan are as follows. 2020 2021 $151,000 0 Service cost Prior service cost amortization Contributions (funding) to the plan Benefits paid Actual return on plan assets Expected rate of return on assets 239,000 201,000 250,200 6 % $184,000 89,000 284,000 280,000 266,000 8 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started