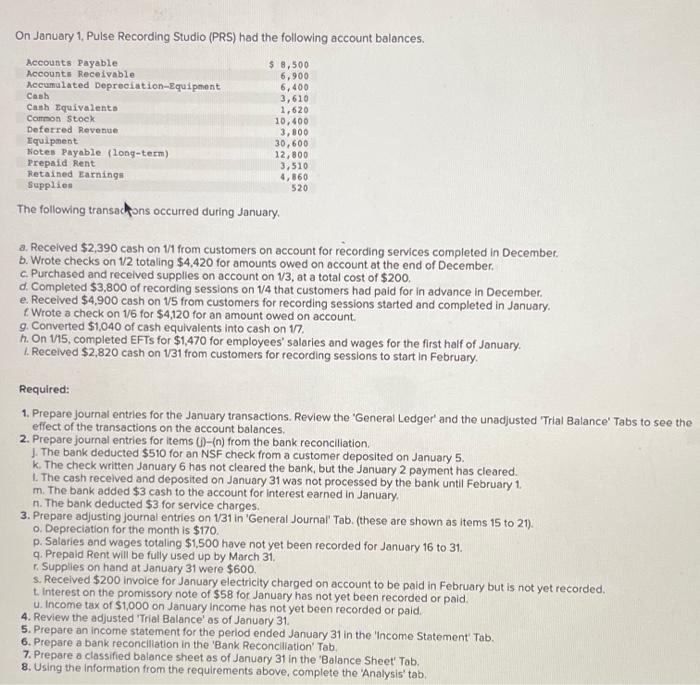

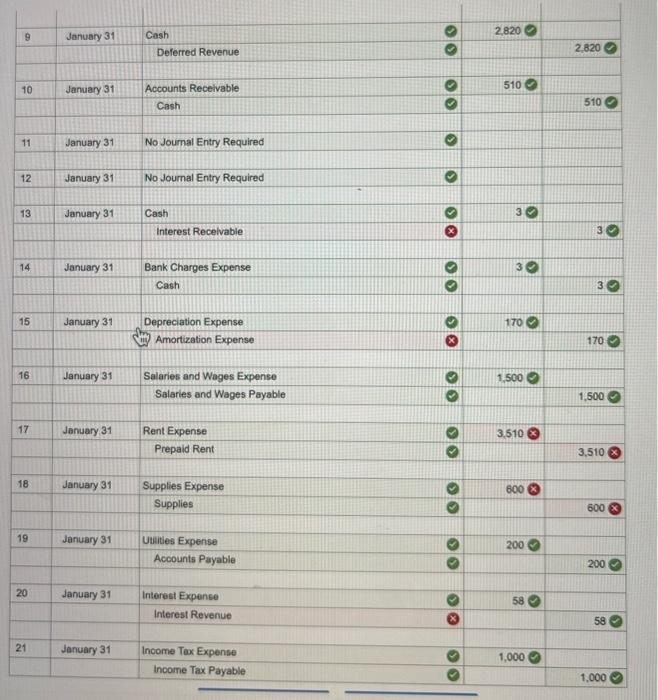

On January 1, Pulse Recording Studio (PRS) had the following account balances. The following transachons occurred during January. a. Received $2,390 cash on 1/1 from customers on account for recording services completed in December. b. Wrote checks on 1/2 totaling $4,420 for amounts owed on account at the end of December. c. Purchased and recelved supplies on account on 1/3, at a total cost of $200. d. Completed $3,800 of recording sessions on 1/4 that customers had paid for in advance in December. e. Recelved $4,900 cash on 1/5 from customers for recording sessions started and completed in January. t Wrote a check on 1/6 for $4,120 for an amount owed on account. 9. Converted $1,040 of cash equivalents into cash on 17 . h. On 1/15, completed EFTs for $1,470 for employees' salaries and wages for the first half of January. 1. Received $2,820 cash on 1/31 from customers for recording sessions to start in February. Required: 1. Prepare journal entries for the January transactions. Review the 'General Ledger' and the unadjusted 'Trial Balance' Tabs to see the effect of the transactions on the account balances. 2. Prepare journal entries for items (j)-(n) from the bank reconciliation. 1. The bank deducted $510 for an NSF check from a customer deposited on January 5. k. The check written January 6 has not cleared the bank, but the January 2 payment has cleared. 1. The cash received and deposited on January 31 was not processed by the bank until February 1 . m. The bank added $3 cash to the account for interest earned in January. n. The bank deducted $3 for service charges. 3. Prepare adjusting journal entries on 1/31 in 'General Journal' Tab. (these are shown as items 15 to 21 ). o. Depreciation for the month is $170. p. Salaries and wages totaling $1,500 have not yet been recorded for January 16 to 31 . q. Prepald Rent will be fully used up by March 31. r. Supplies on hand at January 31 were $600. s. Received $200 invoice for January electricity charged on account to be paid in February but is not yet recorded. t. Interest on the promissory note of $58 for January has not yet been recorded or paid. u. Income tax of $1,000 on January income has not yet been recorded or paid. 4. Review the adjusted 'Trial Balance' as of January 31. 5. Prepare an income statement for the period ended January 31 in the 'Income Statement' Tab. 6. Prepare a bank reconcillation in the 'Bank Reconcllation' Tab. 7. Prepare a classified balance sheet as of January 31 in the 'Balance Sheet' Tab. 8. Using the information from the requirements above, complete the 'Analysis' tab