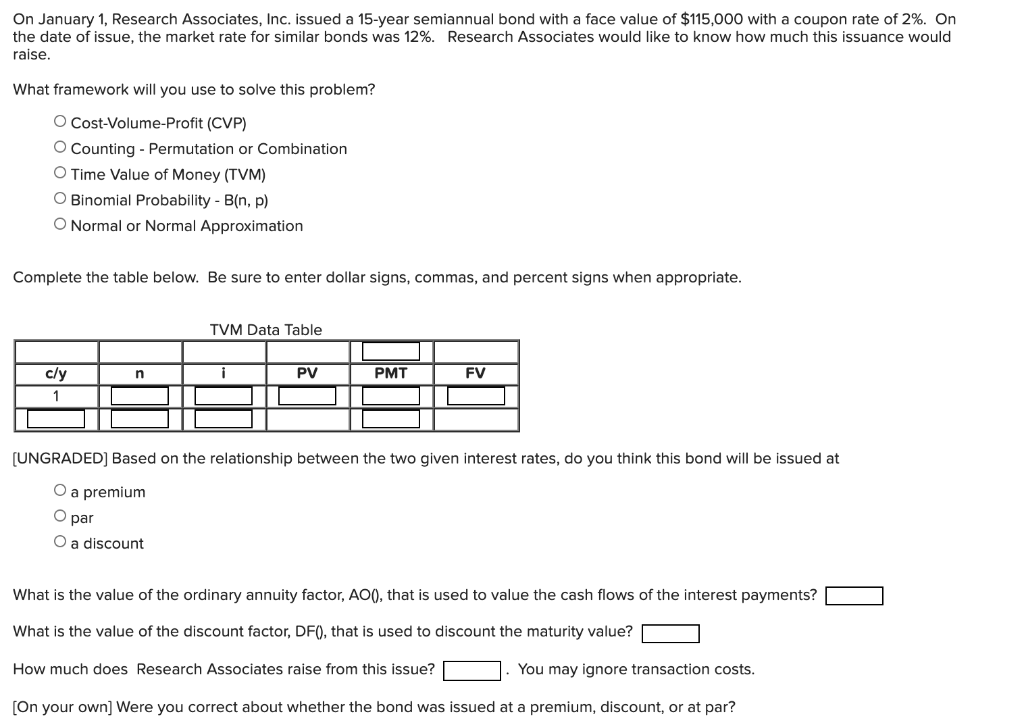

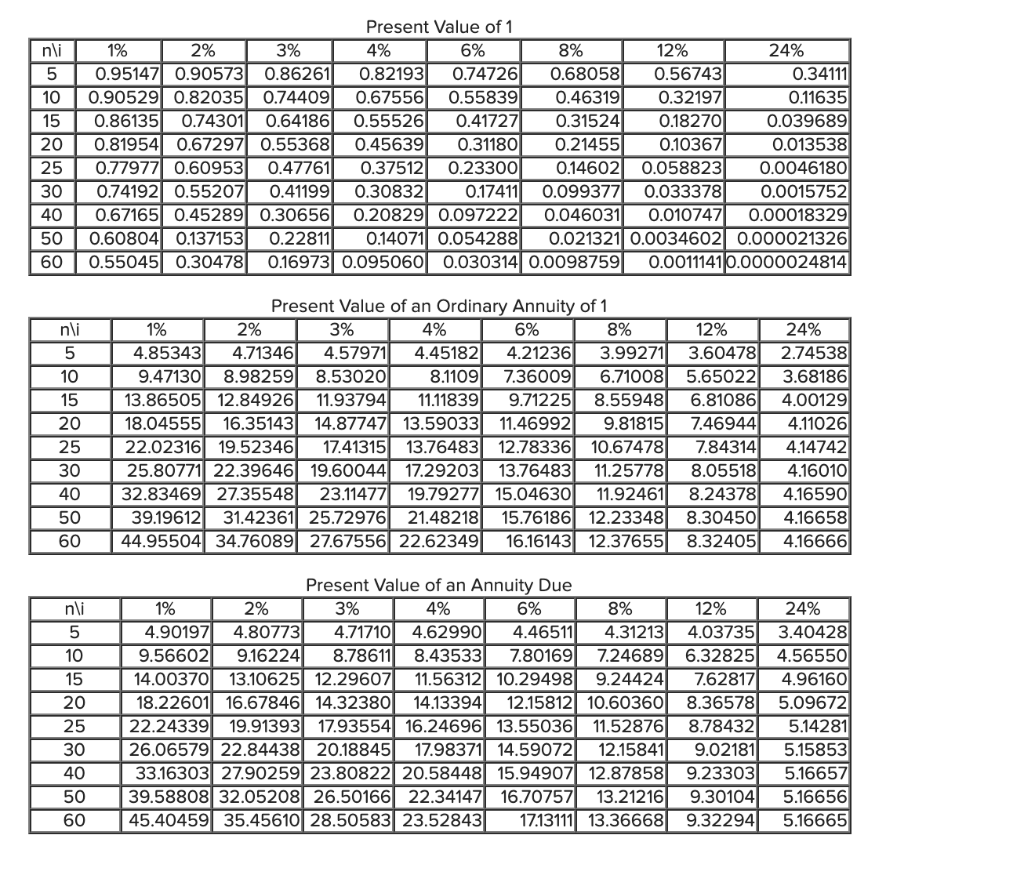

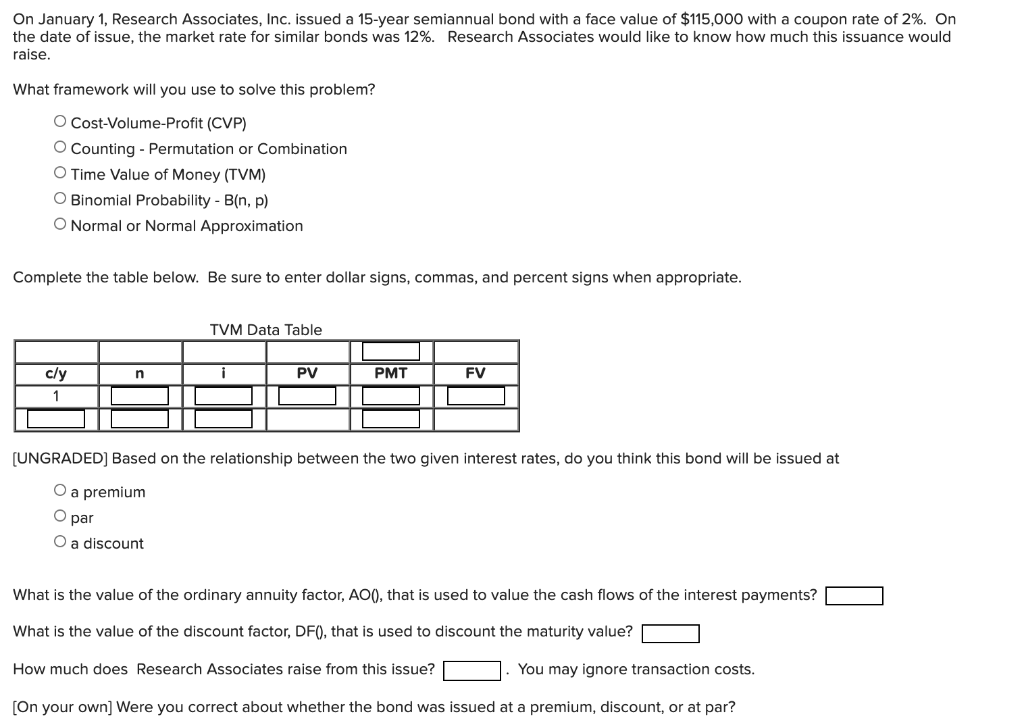

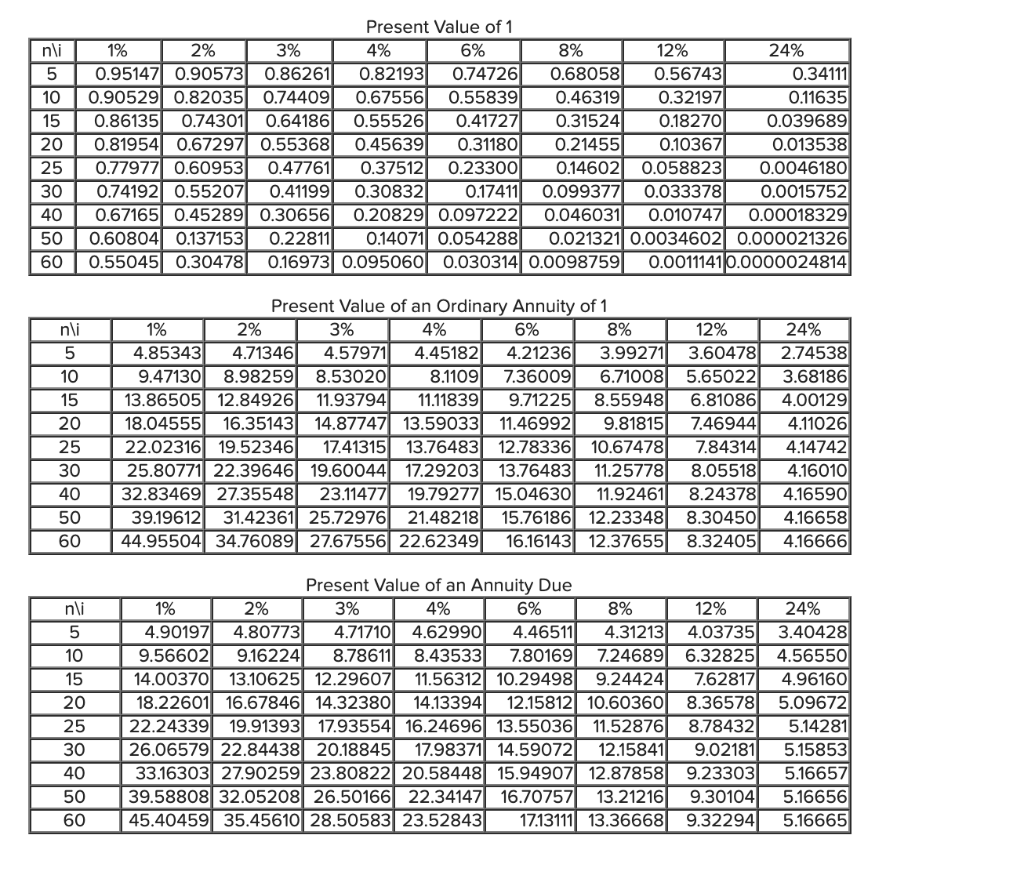

On January 1, Research Associates, Inc. issued a 15-year semiannual bond with a face value of $115,000 with a coupon rate of 2%. On the date of issue, the market rate for similar bonds was 12%. Research Associates would like to know how much this issuance would raise. What framework will you use to solve this problem? O Cost-Volume-Profit (CVP) Counting - Permutation or Combination Time Value of Money (TVM) Binomial Probability - B(n, p) O Normal or Normal Approximation Complete the table below. Be sure to enter dollar signs, commas, and percent signs when appropriate. TVM Data Table n PV PMT FV c/y 1 (UNGRADED] Based on the relationship between the two given interest rates, do you think this bond will be issued at O a premium O par O a discount What is the value of the ordinary annuity factor, AO(), that is used to value the cash flows of the interest payments? What is the value of the discount factor, DF(), that is used to discount the maturity value? How much does Research Associates raise from this issue? You may ignore transaction costs. [On your own] Were you correct about whether the bond was issued at a premium, discount, or at par? nli 5 10 15 20 25 30 40 50 60 Present Value of 1 1% 2% 3% 4% 6% 8% 12% 24% 0.95147] 0.90573 0.86261 0.82193 0.74726 0.68058 0.56743 0.34111 0.90529 0.82035 0.74409 0.67556 0.55839 0.46319 0.32197 0.11635 0.86135 0.74301 0.64186 0.55526 0.41727 0.31524 0.18270 0.039689 0.81954 0.67297 0.55368 0.45639 0.31180 0.21455 0.10367 0.013538 0.77977| 0.60953 0.47761 0.37512 0.23300 0.14602 0.0588231 0.0046180 0.74192 0.55207 0.41199 0.308321 0.17411 0.099377 0.033378 0.00157521 0.67165 0.45289 0.30656 0.20829 0.097222 0.046031 0.010747 0.00018329 0.60804 0.137153 0.22811 0.14071 0.054288 0.021321 0.0034602 0.000021326 0.55045 0.30478| 0.16973| 0.0950601 0.030314 0.0098759 0.001114110.0000024814 nli 5 10 15 20 25 30 40 50 60 Present Value of an Ordinary Annuity of 1 1% 2% 3% 4% 6% 8% 4.85343 4.71346 4.579711 4.45182 4.21236 3.99271 9.47130 8.98259 8.53020 8.1109 7.36009 6.71008 13.86505 12.84926 11.93794 11.11839 9.71225 8.55948 18.04555 16.35143 14.87747 13.59033| 11.46992 9.81815 22.02316 19.52346 17.41315 13.76483| 12.78336 10.67478 25.80771 22.39646 19.60044 17.29203 13.76483 11.25778 32.83469| 27.35548 23.11477 19.79277| 15.04630 11.92461 39.19612 31.42361 25.72976 21.48218 15.76186 12.23348 44.95504 34.76089 27.67556 22.62349 16.161430 12.37655 12% 3.60478 5.65022 6.81086 7.46944 7.84314 8.05518 8.24378 8.30450 8.32405 24% 2.74538 3.68186 4.00129 4.11026 4.14742 4.16010 4.16590 4.16658 4.16666 nli 5 10 15 20 25 30 40 50 60 Present Value of an Annuity Due 1% 2% 3% 4% 6% 8% 4.901971 4.80773 4.71710 4.62990 4.46511 4.31213 9.56602 9.16224 8.78611 8.43533 7.801691 7.24689 14.00370 13.10625 12.29607 11.56312 10.29498 9.24424 18.22601 16.67846 14.32380 14.13394 12.15812 10.60360 22.24339| 19.91393 17.93554 16.24696 13.550361 11.52876 26.06579 22.84438 20.18845 17.98371 14.59072 12.15841 33.16303 27.90259 23.80822 20.58448| 15.94907 12.87858 39.58808 32.05208 26.50166 22.34147 16.70757| 13.21216 45.40459 35.45610 28.50583 23.52843 17.13111 13.36668 12% 4.03735 6.32825 7.62817 8.36578 8.78432 9.02181 9.23303 9.30104 9.32294 24% 3.40428 4.56550 4.96160 5.09672 5.14281 5.15853 5.16657 5.16656 5.16665