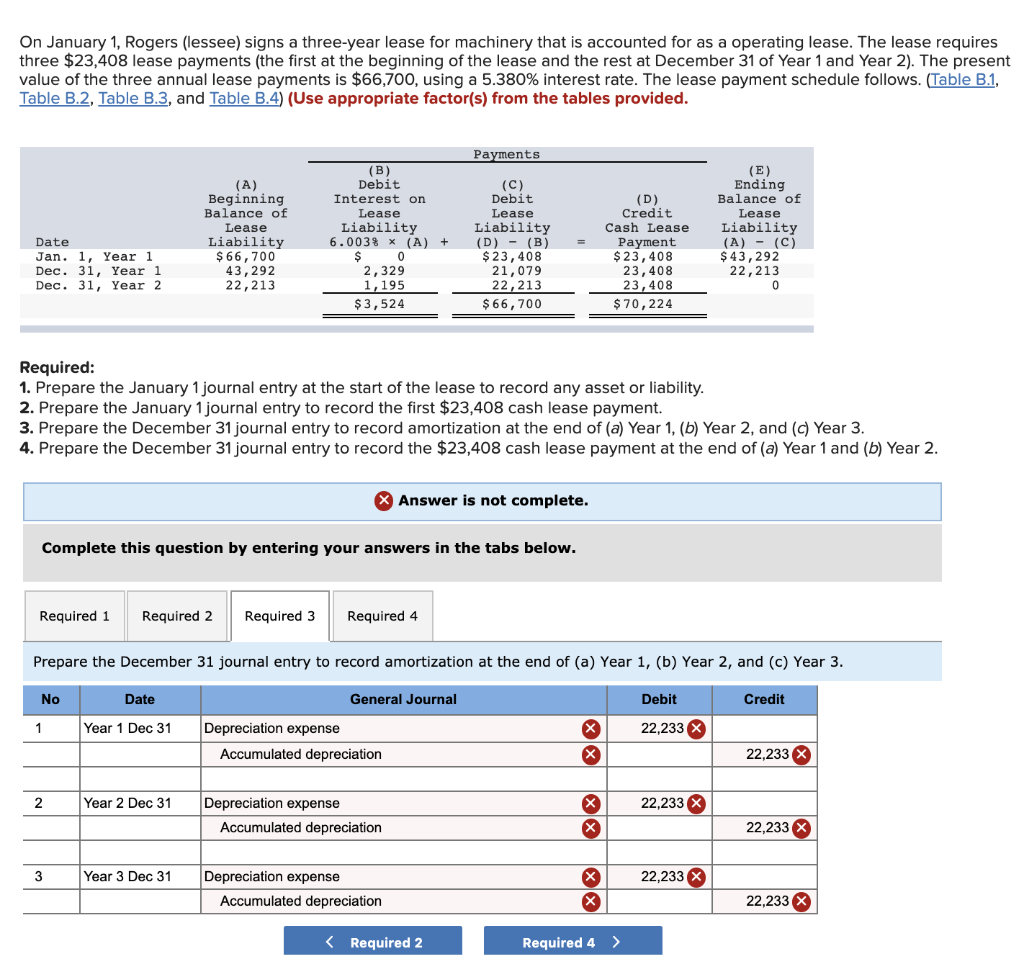

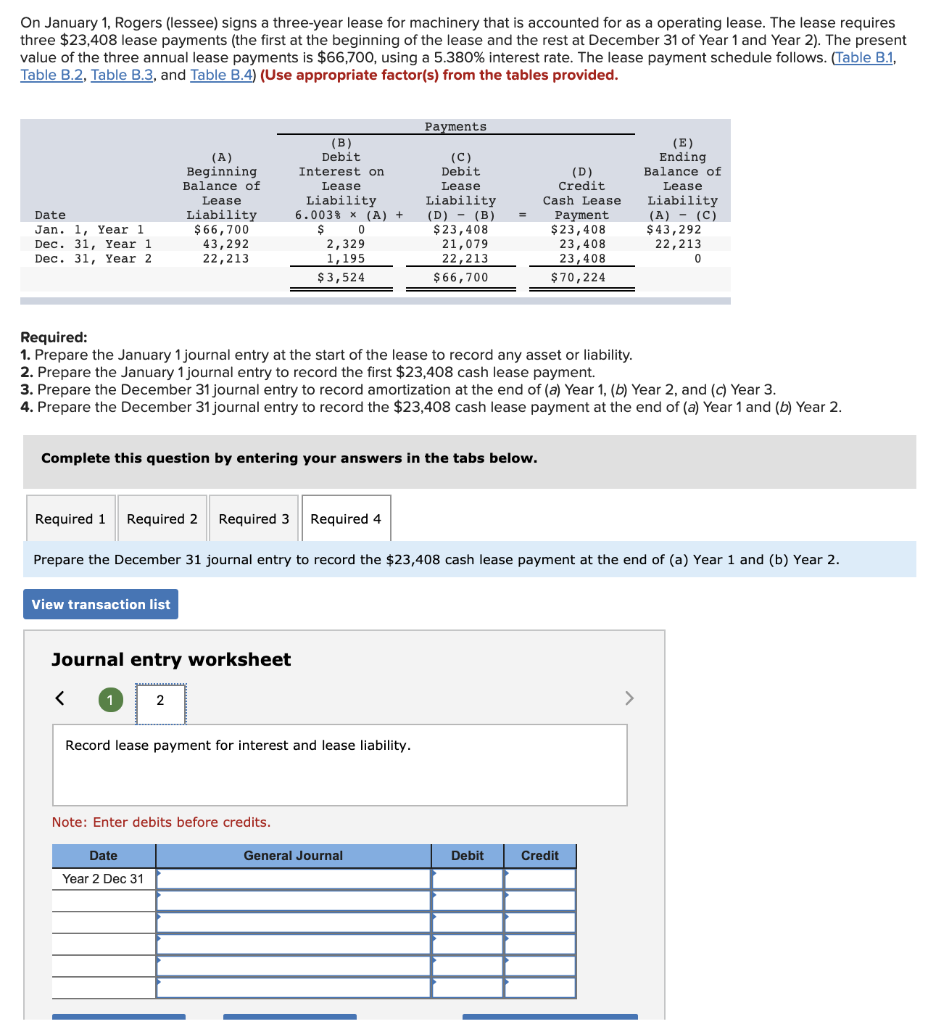

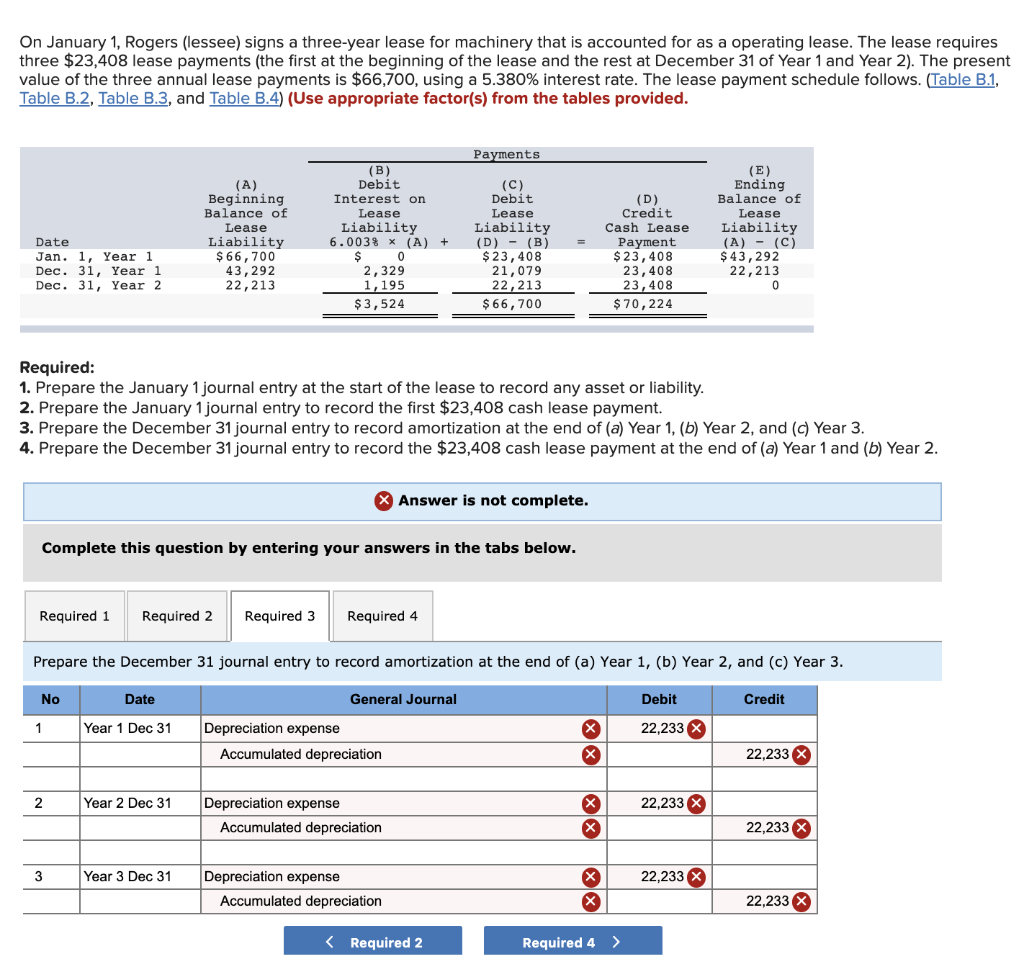

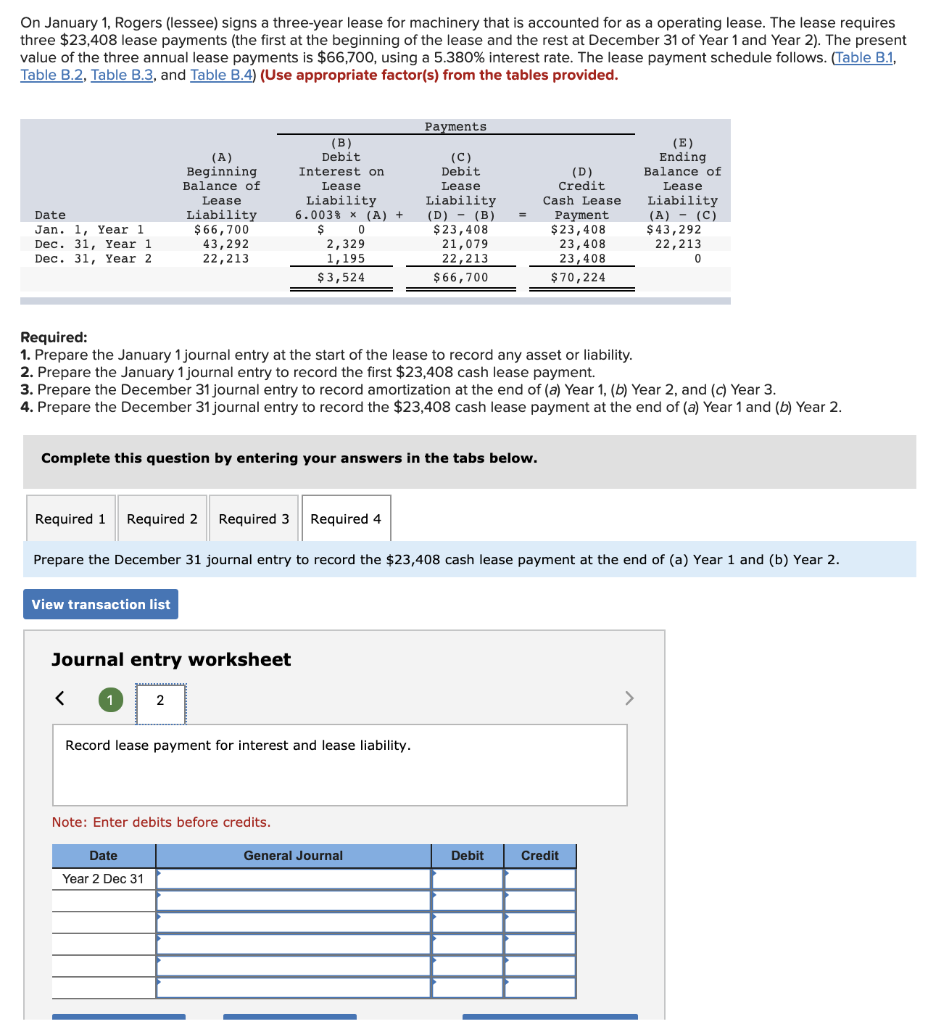

On January 1, Rogers (lessee) signs a three-year lease for machinery that is accounted for as a operating lease. The lease requires three $23,408 lease payments (the first at the beginning of the lease and the rest at December 31 of Year 1 and Year 2). The present value of the three annual lease payments is $66,700, using a 5.380% interest rate. The lease payment schedule follows. Clable B1 Table B.2, Table B.3, and Table B.4) (Use appropriate factor(s) from the tables provided Payments Debit Interest orn Lease Liability Ending Balance of Lease Liability Beginning Balance of Lease Liability $66,700 43,292 22,213 Debit Lease Liability Credit Cash Lease 6.003% (A) (D) (B) -Payment Date Jan. 1, Year 1 Dec. 31, Year 1 Dec. 31, Year 2 + - $23,408 21,079 22,213 $66,700 $23,408 23,408 23,408 $70,224 $43,292 2,329 1,195 $3,524 22,213 Required: 1. Prepare the January 1 journal entry at the start of the lease to record any asset or liability. 2. Prepare the January 1 journal entry to record the first $23,408 cash lease payment. 3. Prepare the December 31 journal entry to record amortization at the end of (a) Year 1, (b) Year 2, and (c) Year 3 4. Prepare the December 31 journal entry to record the $23,408 cash lease payment at the end of (a) Year 1 and (b) Year 2 Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required2 Required 3 Required 4 Prepare the December 31 journal entry to record amortization at the end of (a) Year 1, (b) Year 2, and (c) Year 3 No Date General Journal Debit Credit Year 1 Dec 31 Depreciation expense 22,233 Accumulated depreciation 22,233 2 Year 2 Dec 31 Depreciation expense 22,233 Accumulated depreciation 22,233 Year 3 Dec 31 Depreciation expense 22,233 Accumulated depreciation 22,233 Required 2 Required 4 On January 1, Rogers (lessee) signs a three-year lease for machinery that is accounted for as a operating lease. The lease requires three $23,408 lease payments (the first at the beginning of the lease and the rest at December 31 of Year 1 and Year 2). The present value of the three annual lease payments is $66,700, using a 5.380% interest rate. The lease payment schedule follows. (Table B1 Table B.2, Table B.3, and Table B.4) (Use appropriate factor(s) from the tables provided Payments Debit Interest on Lease Liability Ending Balance of Lease Beginning Balance of Lease Liability $66,700 43,292 22,213 Debit Lease Liability Credit Cash Lease Liability Date Jan. 1, Year1 Dec. 31, Year 1 Dec. 31, Year 2 6.003% x (A) + (D) - (B) -Payment $23,408 23,408 23,408 $70,224 $43,292 22,213 2,329 1,195 $3,524 $23,408 21,079 22,213 $66,700 Required 1. Prepare the January 1 journal entry at the start of the lease to record any asset or liability 2. Prepare the January 1 journal entry to record the first $23,408 cash lease payment. 3. Prepare the December 31 journal entry to record amortization at the end of (a) Year 1, (b) Year 2, and (c) Year 3 4. Prepare the December 31 journal entry to record the $23,408 cash lease payment at the end of (a) Year 1 and (b) Year 2 Complete this question by entering your answers in the tabs below Required 1 Required 2 Required 3 Required 4 Prepare the December 31 journal entry to record the $23,408 cash lease payment at the end of (a) Year 1 and (b) Year 2 View transaction list Journal entry worksheet Record lease payment for interest and lease liability Note: Enter debits before credits General Journal Debit Credit Year 2 Dec 31 On January 1, Rogers (lessee) signs a three-year lease for machinery that is accounted for as a operating lease. The lease requires three $23,408 lease payments (the first at the beginning of the lease and the rest at December 31 of Year 1 and Year 2). The present value of the three annual lease payments is $66,700, using a 5.380% interest rate. The lease payment schedule follows. Clable B1 Table B.2, Table B.3, and Table B.4) (Use appropriate factor(s) from the tables provided Payments Debit Interest orn Lease Liability Ending Balance of Lease Liability Beginning Balance of Lease Liability $66,700 43,292 22,213 Debit Lease Liability Credit Cash Lease 6.003% (A) (D) (B) -Payment Date Jan. 1, Year 1 Dec. 31, Year 1 Dec. 31, Year 2 + - $23,408 21,079 22,213 $66,700 $23,408 23,408 23,408 $70,224 $43,292 2,329 1,195 $3,524 22,213 Required: 1. Prepare the January 1 journal entry at the start of the lease to record any asset or liability. 2. Prepare the January 1 journal entry to record the first $23,408 cash lease payment. 3. Prepare the December 31 journal entry to record amortization at the end of (a) Year 1, (b) Year 2, and (c) Year 3 4. Prepare the December 31 journal entry to record the $23,408 cash lease payment at the end of (a) Year 1 and (b) Year 2 Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required2 Required 3 Required 4 Prepare the December 31 journal entry to record amortization at the end of (a) Year 1, (b) Year 2, and (c) Year 3 No Date General Journal Debit Credit Year 1 Dec 31 Depreciation expense 22,233 Accumulated depreciation 22,233 2 Year 2 Dec 31 Depreciation expense 22,233 Accumulated depreciation 22,233 Year 3 Dec 31 Depreciation expense 22,233 Accumulated depreciation 22,233 Required 2 Required 4 On January 1, Rogers (lessee) signs a three-year lease for machinery that is accounted for as a operating lease. The lease requires three $23,408 lease payments (the first at the beginning of the lease and the rest at December 31 of Year 1 and Year 2). The present value of the three annual lease payments is $66,700, using a 5.380% interest rate. The lease payment schedule follows. (Table B1 Table B.2, Table B.3, and Table B.4) (Use appropriate factor(s) from the tables provided Payments Debit Interest on Lease Liability Ending Balance of Lease Beginning Balance of Lease Liability $66,700 43,292 22,213 Debit Lease Liability Credit Cash Lease Liability Date Jan. 1, Year1 Dec. 31, Year 1 Dec. 31, Year 2 6.003% x (A) + (D) - (B) -Payment $23,408 23,408 23,408 $70,224 $43,292 22,213 2,329 1,195 $3,524 $23,408 21,079 22,213 $66,700 Required 1. Prepare the January 1 journal entry at the start of the lease to record any asset or liability 2. Prepare the January 1 journal entry to record the first $23,408 cash lease payment. 3. Prepare the December 31 journal entry to record amortization at the end of (a) Year 1, (b) Year 2, and (c) Year 3 4. Prepare the December 31 journal entry to record the $23,408 cash lease payment at the end of (a) Year 1 and (b) Year 2 Complete this question by entering your answers in the tabs below Required 1 Required 2 Required 3 Required 4 Prepare the December 31 journal entry to record the $23,408 cash lease payment at the end of (a) Year 1 and (b) Year 2 View transaction list Journal entry worksheet Record lease payment for interest and lease liability Note: Enter debits before credits General Journal Debit Credit Year 2 Dec 31