Question

On January 1, Sweet Pleasures, Inc., begins business. The company has $14,000 cash on hand and is attempting to project cash receipts and disbursements through

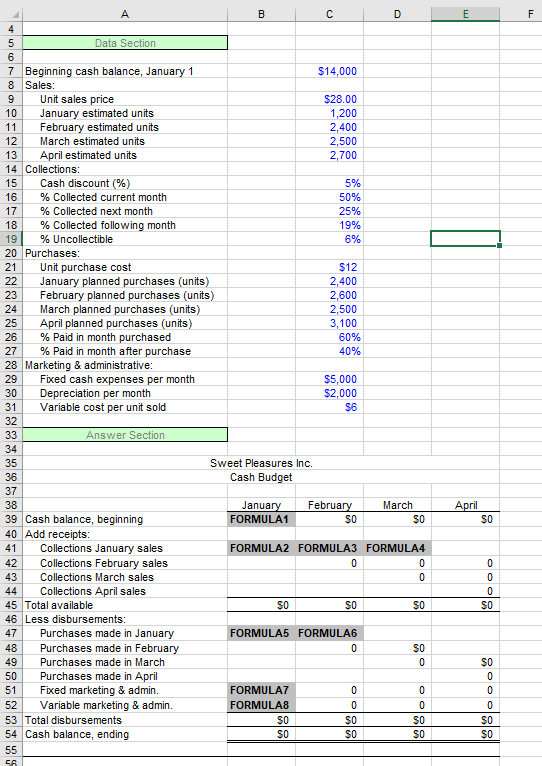

On January 1, Sweet Pleasures, Inc., begins business. The company has $14,000 cash on hand and is attempting to project cash receipts and disbursements through April 30. On May 1, a note payable of $10,000 will be due. This amount was borrowed on January 1 to carry the company through its first four months of operation. The unit purchase cost of the companys single product, a box of Sweet Pleasures chocolates, is $12. The unit sales price is $28. Projected purchases and sales in units for the first four months are: Purchases Sales January 2,400 1,200 February 2,600 2,400 March 2,500 2,500 April 3,100 2,700 Sales terms call for a 5% discount if paid within the same month that the sale occurred. It is expected that 50% of the billings will be collected within the discount period, 25% by the end of the month after purchase, 19% in the following month, and 6% will be uncollectible. Approximately 60% of the purchases are paid for in the month purchased. The rest are due and payable in the next month. Total fixed marketing and administrative expenses for each month include cash expenses of $5,000 and depreciation on equipment of $2,000. Variable marketing and administrative expenses total $6 per unit sold. All marketing and administrative expenses are paid as incurred.

Please show formulas. Thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started