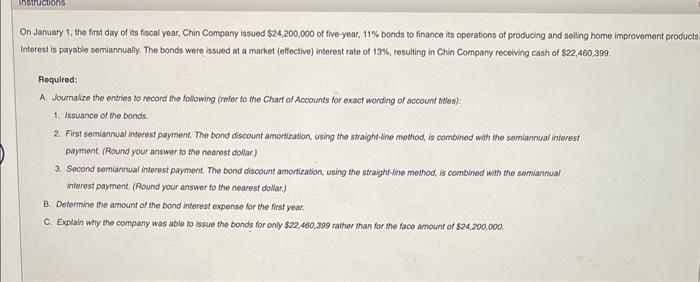

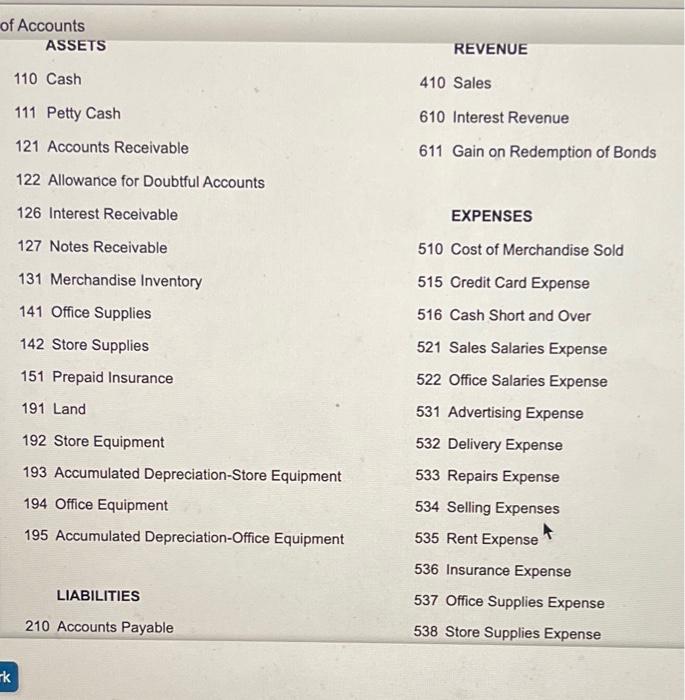

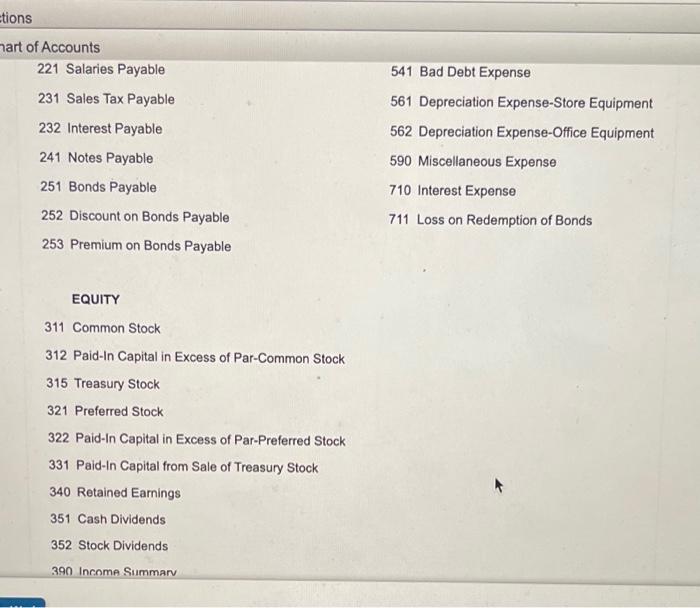

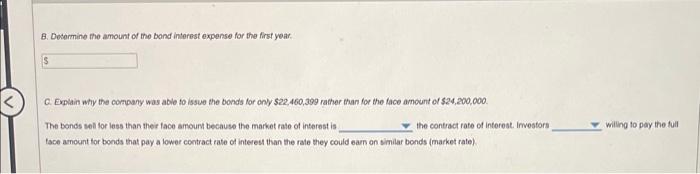

On January 1, the first day of its fiscal year, Chin Compary issued $24,200,000 of five-year, 11% bonds to finance its operations of producing and selling home improvement produe Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 13\%, resulting in Chin Company receiving cash of $22,460,399. Required: A. Journalize the entries to record the following (refer to the Chart of Accounts for exact wording of account tiles): 1. Issuance of the bonds. 2. First semiannual interest payment. The bond discount amorization, using the straight-line method, is cambined with the semiannual interest payment. (Round your answer to the nearost dollar.) 3. Second semiannuat interest payment. The bond discount amortization, using the straght-line mothod, is combined with the semiannual interest payment. (Round your answer to the nearest dollar.) B. Determine the amount of the bond interest expense for the first yeaz C. Explain why the company was able to issue the bonds for only $22,460,399 rather than for the face amount of $24,200,000 : of Accounts ASSETS REVENUE 110 Cash 410 Sales 111 Petty Cash 610 Interest Revenue 121 Accounts Receivable 611 Gain on Redemption of Bonds 122 Allowance for Doubtful Accounts 126 Interest Receivable EXPENSES 127 Notes Receivable 510 Cost of Merchandise Sold 131 Merchandise Inventory 515 Credit Card Expense 141 Office Supplies 516 Cash Short and Over 142 Store Supplies 521 Sales Salaries Expense 151 Prepaid Insurance 522 Office Salaries Expense 191 Land 531 Advertising Expense 192 Store Equipment 532 Delivery Expense 193 Accumulated Depreciation-Store Equipment 533 Repairs Expense 194 Office Equipment 534 Selling Expenses 195 Accumulated Depreciation-Office Equipment 535 Rent Expense 536 Insurance Expense LIABILITIES 537 Office Supplies Expense 210 Accounts Payable 538 Store Supplies Expense hart of Accounts 221SalariesPayable231SalesTaxPayable232InterestPayable241NotesPayable251BondsPayable252DiscountonBondsPayable541BadDebtExpense561DepreciationExpense-StoreEquipment562DepreciationExpense-OfficeEquipment590MiscellaneousExpense710InterestExpense711LossonRedemptionofBonds 253 Premium on Bonds Payable EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par-Common Stock 315 Treasury Stock 321 Preferred Stock 322 Paid-In Capital in Excess of Par-Preferred Stock 331 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 351 Cash Dividends 352 Stock Dividends 390 income Summarv mact is JOURAAL. accounfing EquKTION CAIt ofsce:Pno4 rost ari beait cutcr kikts iviumes teurr 8. Determine the amount of the bond interest expense for the frst year. c. Explain why the company was able to issue the bonds for ony $22,460,399 rather than for the tace amount of $24,200,000. The bonds sell for less than thei face amourv because the market rate of interest is the contract rate of interest. Investors willing to pay the full tace amount tor bonds that pay a lower contract rate of interes than the rale they could earn on similar bonds (market rate)