Question

On January 1, X6, Duxian paid $393,120 to purchase 60% of the Hong Kong Excellence Company and obtained control of the Excellence Company, and monopolized

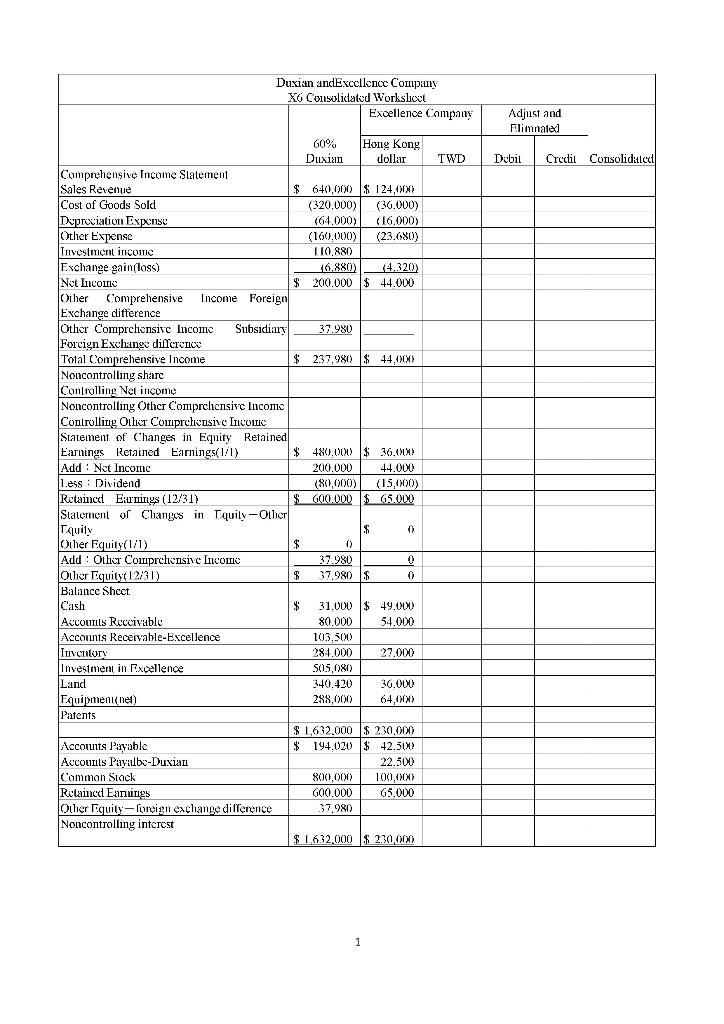

On January 1, X6, Duxian paid $393,120 to purchase 60% of the Hong Kong Excellence Company and obtained control of the Excellence Company, and monopolized non-controlling interests based on the proportion of identifiable net assets. It is worthy of the company’s unrecorded patent patent The identifiable assets and book value of the patent acquisition date for ten years have the same reputation value, and there is no consolidated goodwill. The patent acquisition date still has a ten-year period. Excellent company uses Hong Kong as its functional currency, and the exchange rate on the acquisition date is 42. In X6, Duxian Company was awarded NT$500 to outstanding companies on the 15th of 103.5. Fashion companies are short-term in nature, and the exchange rate on the day was 4.1. Excellent company issued a dividend of HK$15,000 on October 1, X6, at an exchange rate of 4.1 on that day. The exchange rate on December 31, X6 was 4.6, and the annual average exchange rate for X6 was 4.4. The information on the X6 annual financial statements of Duxian Company and Excellence Company is as shown on the next page. The functionality of Duxian Company is in New Taiwan Dollars. Try to prepare the work paper for the merger of Duxian Company and Excellence Company X6 in New Taiwan dollars.

Comprehensive Income Statement Sales Revenue Cost of Goods Sold Depreciation Expense Other Expense Investment income Exchange gain(loss) Net Income Other Comprehensive Income Foreign Exchange difference Other Comprehensive Income Subsidiary Foreign Exchange difference Total Comprehensive Income controlling share Controlling Net income Noncontrolling Other Comprehensive Income comfor Controlling Other Comprehensive Income Statement of Changes in Equity Retained Earnings Retained Earnings(1/1) Add Net Income Less Dividend 10 Retained Earnings (12/31) Statement of Changes in Equity-Other Equity Other Equity(1/1) Add Other Comprehensive Income Other Equity(12/31) Balance Sheet. Cash Carh Duxian andExcellence Company X6 Consolidated Worksheet Accounts Receivable Accounts Receivable-Excellence Inventory Investment in Excellence Land Equipment(net) Patents Accounts Payable Accounts Payalbe-Duxian Common Stock Retained Earnings Other Equity-foreign exchange difference Noncontrolling interest $ 640,000 $ 124,000 (320.000) (36.000) (64.000) (16.000) (23.680) $ $ 60% Duxian (6.880) (4.320) $ 200.000 $ 44.000 $ $ (160,000) 110,880 $ 237,980 $ 44,000 $ Excellence Company |Hong Kong dollar 37.980 480,000 $36.000 200.000 44.000 (80,000) (15,000) 600.000 $ 65.000 $ (0) 37.980 37.980 $ 0 1 0 0 31.000 $49.000 80.000 54.000 103,500 284.000 505,080 340.420 288,000 27,000 36.000 64,000 81632.000 $ 230.000 $194.020 $ 42.500 22.500 800,000 100,000 600.000 65.000 37,980 $ 1.632,000 $ 230,000 TWD Adjust and Flimmated Debil Credit Consolidated

Step by Step Solution

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Equity Method Investment in Subsidiary at Book Value in NT Duxians investment in Excellence Compan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started