Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, Year 1, Assembly Line Manufacturing uses a capital/Type A lease to finance the transfer of a large piece of machinery to Sansa

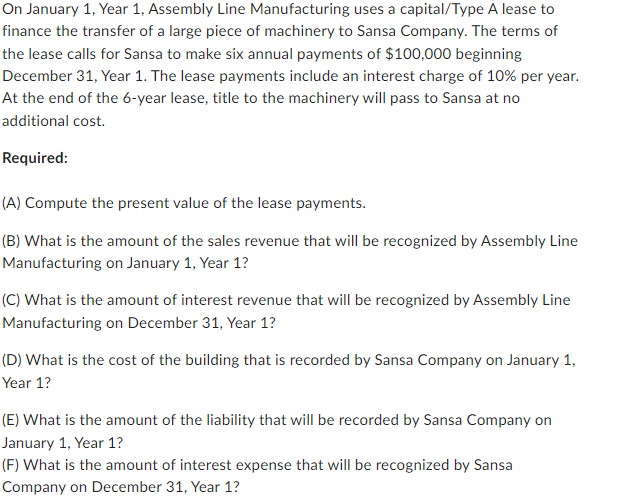

On January 1, Year 1, Assembly Line Manufacturing uses a capital/Type A lease to finance the transfer of a large piece of machinery to Sansa Company. The terms of the lease calls for Sansa to make six annual payments of $100,000 beginning December 31, Year 1 . The lease payments include an interest charge of 10% per year. At the end of the 6-year lease, title to the machinery will pass to Sansa at no additional cost. Required: (A) Compute the present value of the lease payments. (B) What is the amount of the sales revenue that will be recognized by Assembly Line Manufacturing on January 1 , Year 1 ? (C) What is the amount of interest revenue that will be recognized by Assembly Line Manufacturing on December 31, Year 1? (D) What is the cost of the building that is recorded by Sansa Company on January 1, Year 1? (E) What is the amount of the liability that will be recorded by Sansa Company on January 1, Year 1? (F) What is the amount of interest expense that will be recognized by Sansa Company on December 31, Year 1

On January 1, Year 1, Assembly Line Manufacturing uses a capital/Type A lease to finance the transfer of a large piece of machinery to Sansa Company. The terms of the lease calls for Sansa to make six annual payments of $100,000 beginning December 31, Year 1 . The lease payments include an interest charge of 10% per year. At the end of the 6-year lease, title to the machinery will pass to Sansa at no additional cost. Required: (A) Compute the present value of the lease payments. (B) What is the amount of the sales revenue that will be recognized by Assembly Line Manufacturing on January 1 , Year 1 ? (C) What is the amount of interest revenue that will be recognized by Assembly Line Manufacturing on December 31, Year 1? (D) What is the cost of the building that is recorded by Sansa Company on January 1, Year 1? (E) What is the amount of the liability that will be recorded by Sansa Company on January 1, Year 1? (F) What is the amount of interest expense that will be recognized by Sansa Company on December 31, Year 1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started