Question

On January 1, Year 1, Bainbridge Company borrowed $100,000 cash from a bank by issuing a 10-year, 9 percent note. The principal and interest are

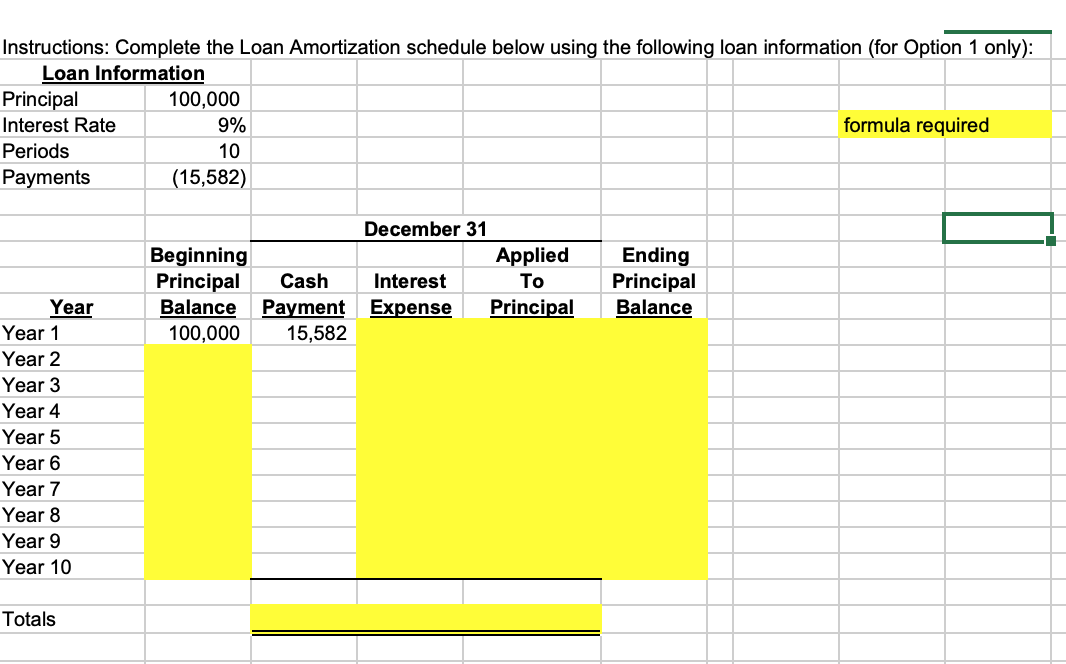

On January 1, Year 1, Bainbridge Company borrowed $100,000 cash from a bank by issuing a 10-year, 9 percent note. The principal and interest are to be paid by making annual payments in the amount of $15,582. Payments are to be made December 31 of each year beginning December 31, Year 1.

Required

-

Set up the spreadsheet as shown below. Notice that Excel can be set up to calculate the loan payment. If youre unfamiliar with this, see the following Spreadsheet Tips section. The Beginning Principal Balance (B12) and Cash Payment (C12) can be referenced from the Loan Information section. The interest rate used to calculate Interest Expense (D12) can also be referenced from the Loan Information section.

-

Complete the spreadsheet for the 10 periods.Page 590

-

In Row 23, calculate totals for cash payments, interest expense, and applied to principal.

-

Consider how the amounts would differ if Bainbridge were to borrow the $100,000 at different interest rates and time periods. The results of the original data (option 1) have been entered in the following schedule. In the spreadsheet, delete 9 percent and 10 from cells B4 and B5, respectively. Enter the data for the second option (8 percent and 10 years) in cells B4 and B5. Enter the recomputed payment and total interest in the schedule for the second option. Continue the same process for options 3 through 9 by deleting the prior rate and number of periods in the spreadsheet and entering in the next options data. The number of years scheduled (rows 12 through 21) will have to be shortened for the 7-year options and lengthened for the 13-year options.

-

******* PLEASE SHOW ME IN FORMULA FORM AS MY PROFESSORS GRADE THE FORMULA VERSION RATHER THAN JUST THE ANSWER *****

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started