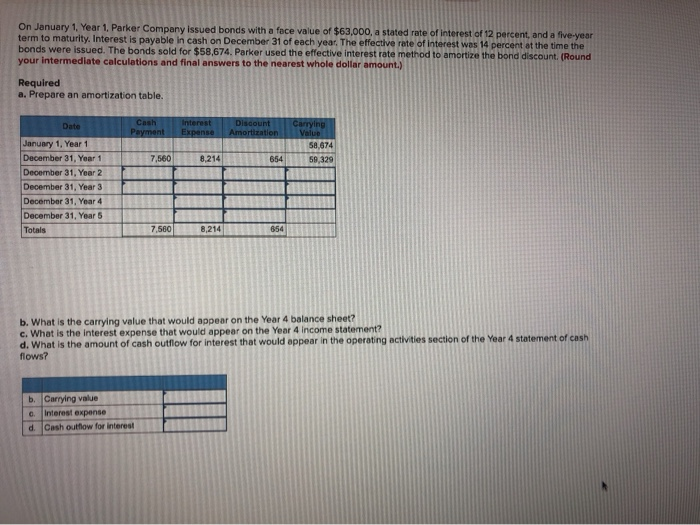

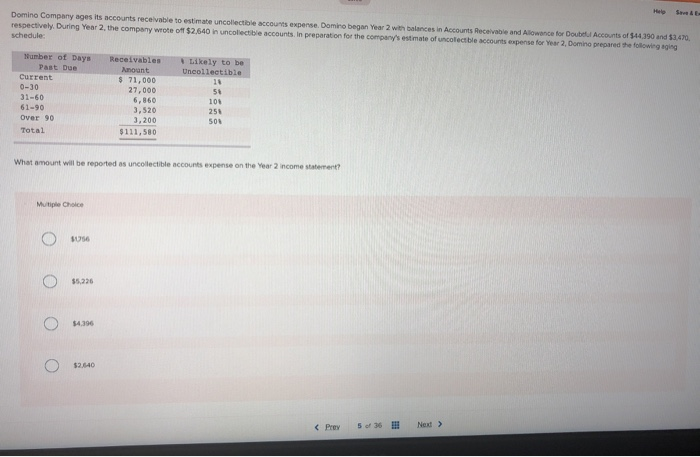

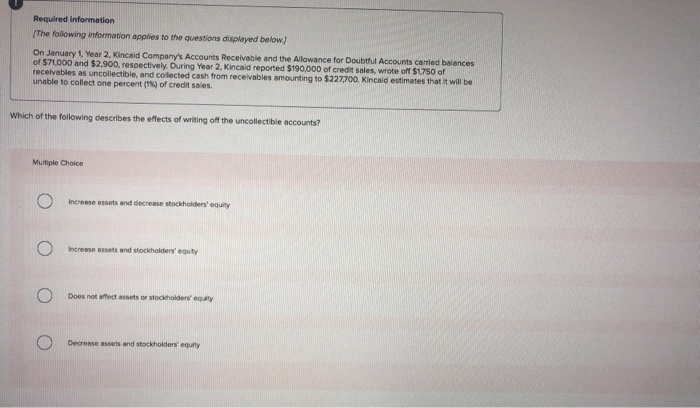

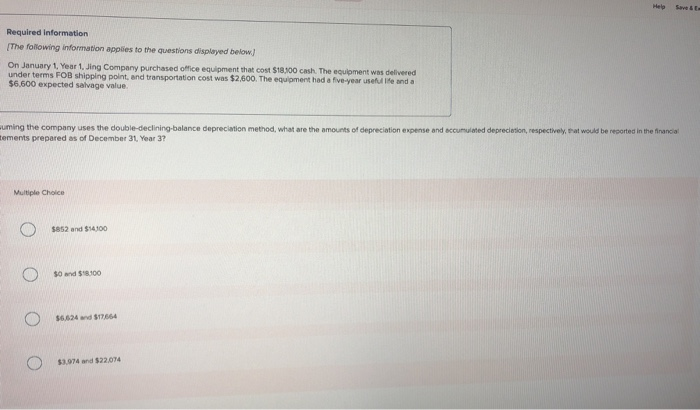

On January 1, Year 1. Parker Company issued bonds with a face value of $63,000, a stated rate of interest of 12 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 14 percent at the time the bonds were issued. The bonds sold for $58,674. Parker used the effective interest rate method to amortize the bond discount. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) Required a. Prepare an amortization table, Cash Payment Interest Expense Discount Amortization Carrying Value 58,674 59 329 7,560 8,214 654 Date January 1, Year 1 December 31, Year 1 December 31, Year 2 December 31, Year 3 December 31, Year 4 December 31, Year 5 Totals 7,560 8,214 854 b. What is the carrying value that would appear on the Year 4 balance sheet? c. What is the interest expense that would appear on the Year 4 Income statement? d. What is the amount of cash outflow for interest that would appear in the operating activities section of the Year 4 statement of cash flows? b. Carrying value 0 Interest expense Cash outflow for interest Help Domino Company ages its accounts receivable to estimate uncollectible accounts expense Domino began Year 2 with balances in Accounts Receivable and Allowance for Doute Accounts of $44.390 and $3.470 respectively. During Year 2, the company wrote of $2.640 in uncollectible accounts. In preparation for the company's estimate of uncollectible accounts expense for Year 2, Domino prepared the following aging schedule Number of Days Pant Due Current 0-30 31-60 61-90 Over 90 Total Receivables Angont $ 71,000 27,000 6,860 3,520 3,200 $111,580 Likely to be Uncollectible 18 58 105 255 500 What amount will be reported as uncollectible accounts expense on the Year 2 income statement? Multiple Choice O SU56 o $5,226 O $4.396 $2.640 Required information The following information applies to the questions displayed below! On January 1 Year 2. Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $71.000 and $2,900, respectively. During Year 2, Kincaid reported $190,000 of credit sales, wrote off $1750 of receivables as uncollectible, and collected cash from receivables amounting to $227,700. Kincaid estimates that it will be unable to collect one percent() of credit sales. Which of the following describes the effects of writing off the uncollectible accounts? Multiple Choice o increase assets and decrease stockholders' equity O Increase assets and stockholders' equity Does not affect assets or stockholders equity o Decrease assets and stockholders' equity Help Required information The following information applies to the questions displayed below! On January 1, Year 1, Jing Company purchased office equipment that cost $18300 cash. The equipment was delivered under terms FOB shipping point, and transportation cost was $2,600. The equipment had a five-year useful life and a $6.600 expected salvage value suming the company uses the double-declining-balance depreciation method, what are the amounts of depreciation expense and accumulated depreciation, respectively, at would be reported in the financial tements prepared as of December 31 Year 3? Multiple Choice $852 and $14100 $0 $'8100 $6,624 and 17664 $3.074 and 22.074