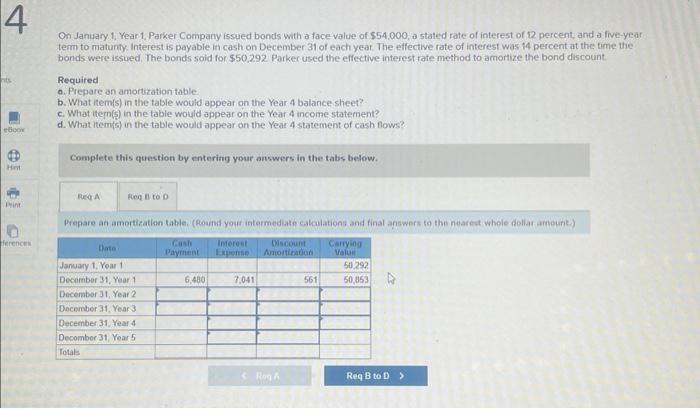

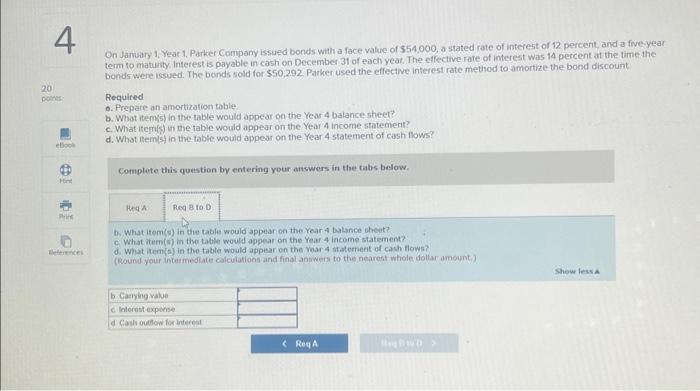

On January 1, Year 1. Parker Company issued bonds with a face value of $54,000,a stated rate of interest of 12 percent, and a five-year tem to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 14 percent at the time the bonds were issued. The bonds soid for $50,292 Parker used the effective interest rate method to amortize the bond discount. Required a. Prepare on amortization table. b. What item(s) in the table would appear on the Year 4 balance sheet? c. What item(s) in the table would appear on the Year 4 incorne statement? d. What item(s) in the table would appear on the Year 4 statement of cash fows? Complete this question by entering your answers in the tabs below. Prepare an amertiration tahle. (Poand your intermedite calculations and final answers to the nearect whole dollat arnount) On Jamuary 1, Year 1, Parker Company issued bonds with a face value of $54,000, a stated rate of interest of 12 percent, and a five yeat term to maturity. Interest is payable in cash on December 31 of each yeat. The effective rate of interest was 14 percent at the time the bonds were issued. The bonds sold for $50,292 Parker used the effective interest rate method to amortize the bond discount Required Q. Prepare an amortization table b. What item(s) in the table would appear on the Year 4 balance sheer? c. What item(s) in the table would appear on the Year 4 income statement? d. What liemist in the table would appear on the Year 4 statement of cash flows? Complote this question by entering your answers in the tabs below. b. What item(s) in the table would appear on the Year 4 batance sheet? c. What item(in) in the table would appear on the Year 4 income statement? C. What ifem (F) in the table would appear on the rear 4 income statement On January 1, Year 1. Parker Company issued bonds with a face value of $54,000,a stated rate of interest of 12 percent, and a five-year tem to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 14 percent at the time the bonds were issued. The bonds soid for $50,292 Parker used the effective interest rate method to amortize the bond discount. Required a. Prepare on amortization table. b. What item(s) in the table would appear on the Year 4 balance sheet? c. What item(s) in the table would appear on the Year 4 incorne statement? d. What item(s) in the table would appear on the Year 4 statement of cash fows? Complete this question by entering your answers in the tabs below. Prepare an amertiration tahle. (Poand your intermedite calculations and final answers to the nearect whole dollat arnount) On Jamuary 1, Year 1, Parker Company issued bonds with a face value of $54,000, a stated rate of interest of 12 percent, and a five yeat term to maturity. Interest is payable in cash on December 31 of each yeat. The effective rate of interest was 14 percent at the time the bonds were issued. The bonds sold for $50,292 Parker used the effective interest rate method to amortize the bond discount Required Q. Prepare an amortization table b. What item(s) in the table would appear on the Year 4 balance sheer? c. What item(s) in the table would appear on the Year 4 income statement? d. What liemist in the table would appear on the Year 4 statement of cash flows? Complote this question by entering your answers in the tabs below. b. What item(s) in the table would appear on the Year 4 batance sheet? c. What item(in) in the table would appear on the Year 4 income statement? C. What ifem (F) in the table would appear on the rear 4 income statement