Question

This problem consists of two parts. Part A. On January 1, Year 1, Stone Company issued 100 stock options with an exercise price of $38

This problem consists of two parts.

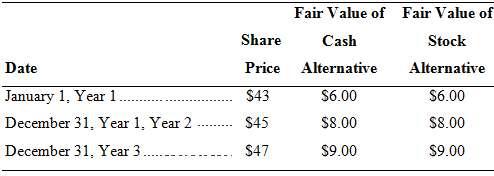

Part A. On January 1, Year 1, Stone Company issued 100 stock options with an exercise price of $38 each to 10 employees (1,000 options in total). The employees can choose to settle the options either (a) in shares of stock ($1 par value) or (b) in cash equal to the intrinsic value of the options on the vesting date. The options vest on December 31, Year 3, after the employees have completed three years of service. Stone Company expects that only seven employees will remain with the company for three years and vest in the options. Two employees resign in Year 1, and the company continues to assume an overall forfeiture rate of 30 percent at December 31, Year 1. In Year 2, one more employee resigns. As expected, seven employees vest on December 31, Year 3, and exercise their stock options.

The following represents the share price and fair value at the relevant dates:

Required:

Determine the fair value of the stock options at the grant date and the amount to be recognized as compensation expense in Year 1, Year 2, and Year 3. Prepare journal entries assuming that the vested employees choose (a) the cash alternative and (b) the stock alternative.

Part B. Now assume that if the employees choose to settle the stock options in shares of stock, the employees receive a 10 percent discount on the exercise price (i.e., the exercise price would be $34.20). As a result, the fair value of the share alternative on the grant date is $8.80.

Required:

Determine the fair value of the stock options at the grant date and the amount to be recognized as compensation expense in Year 1.

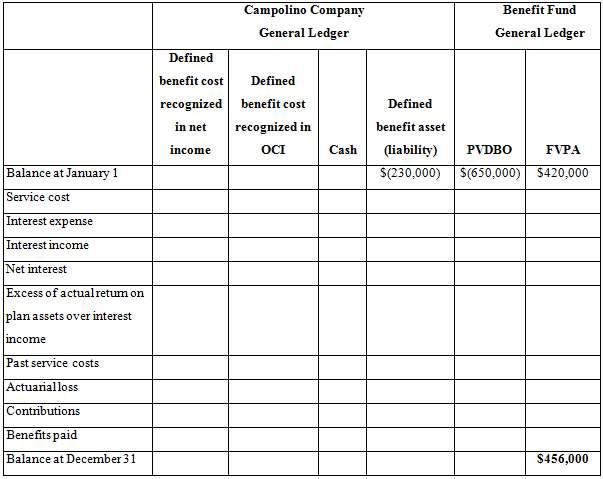

Campolino Company Benefit Fund General Ledger General Ledger Defined benefit cost Defined recognized benefit cost Defined in net recognized in benefit asset OCI Cash income (liability) PVDBO FVPA Balance at January 1 S(230,000) S(650,000) $420,000 Service cost Interest expense Interest income Net interest Excess of actual retum on plan assets over interest income Past service costs Actuarialloss Contributions Benefits paid Balance at December 31 $456,000

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635db8d2a2f02_178314.pdf

180 KBs PDF File

635db8d2a2f02_178314.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started