On January 1, Year 1, the general ledger of a company includes the following account balances:

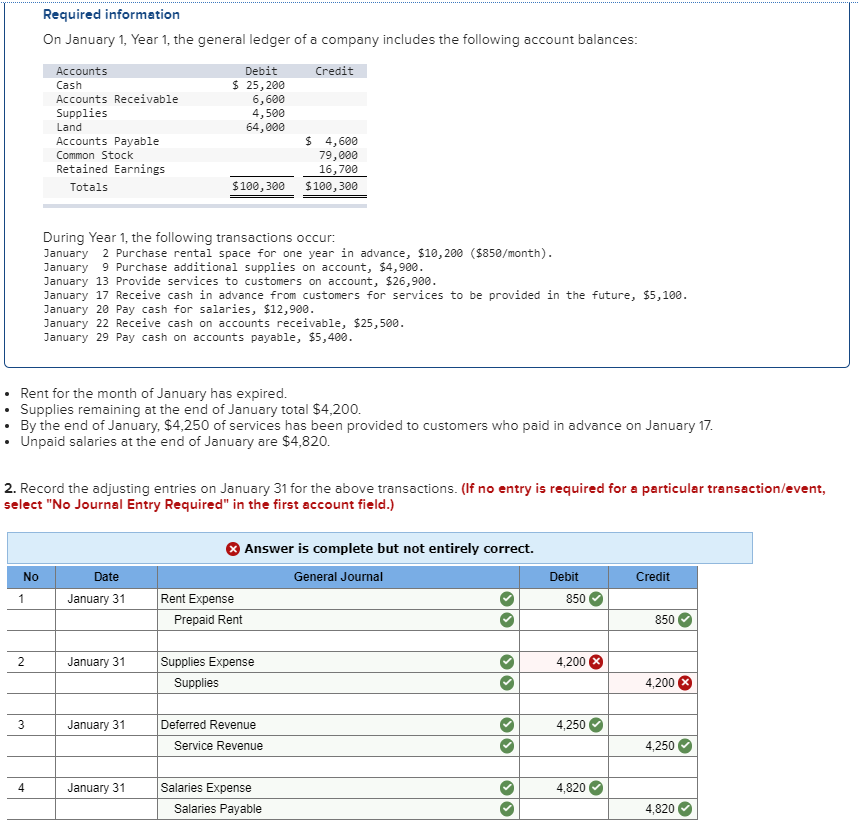

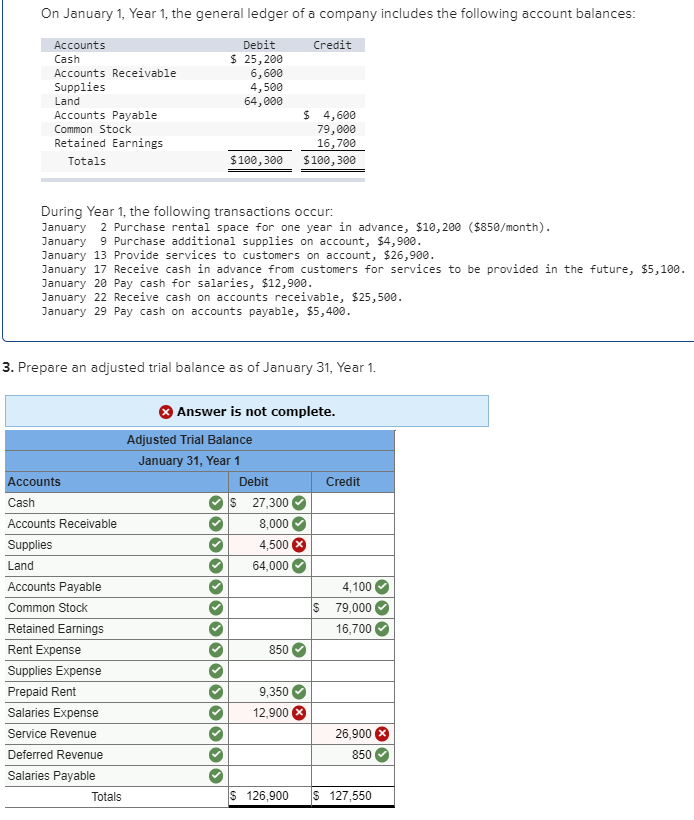

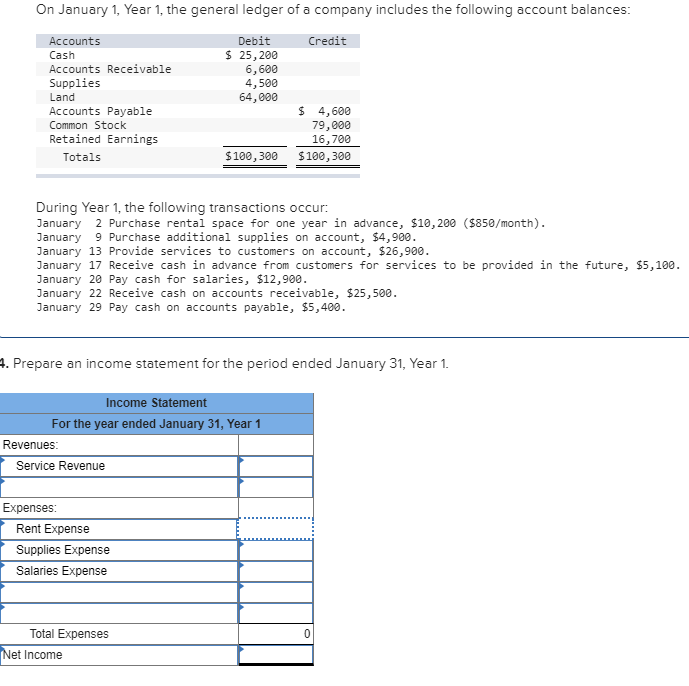

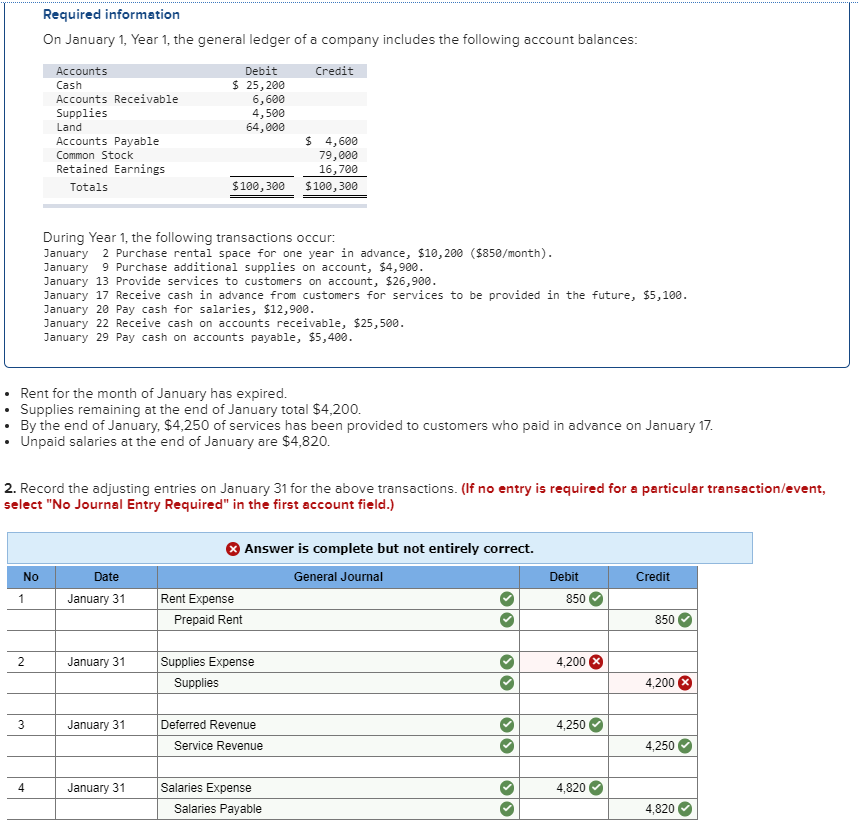

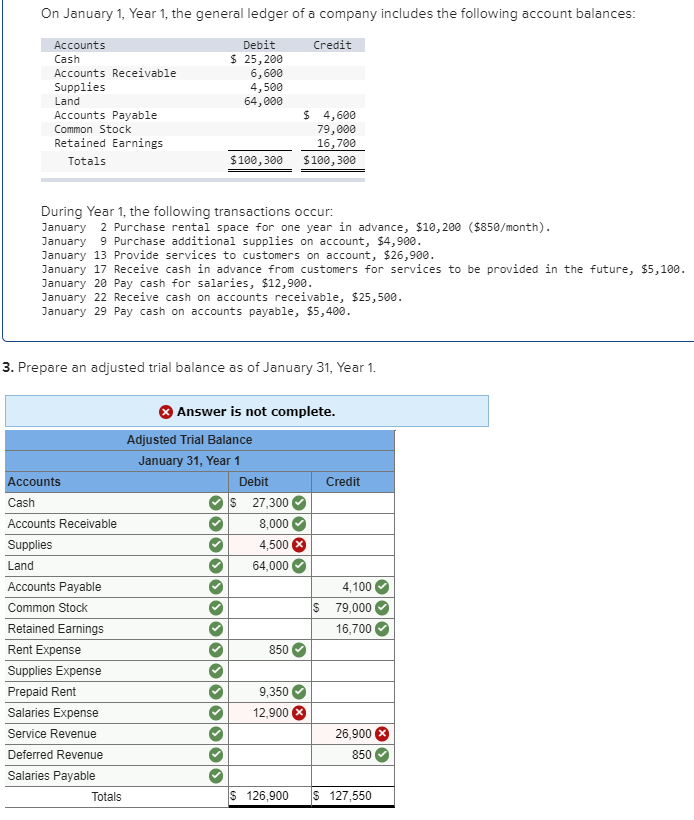

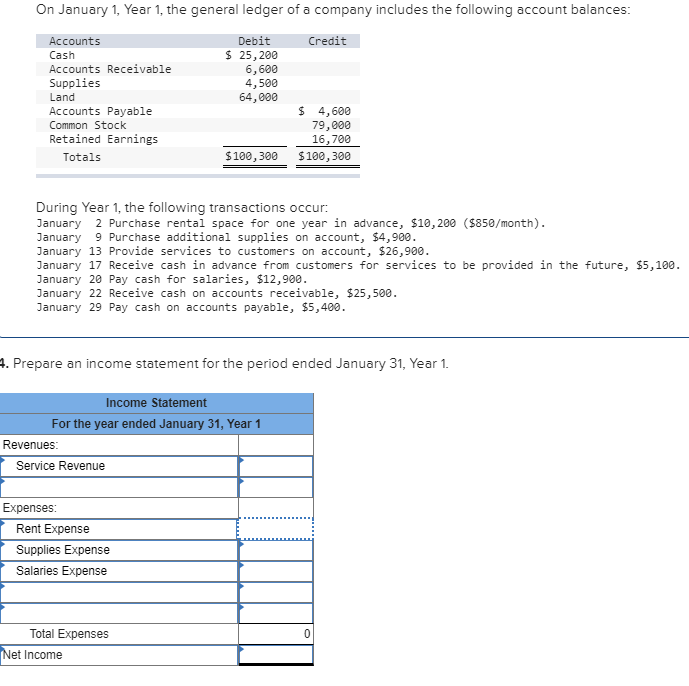

Required information On January 1, Year 1, the general ledger of a company includes the following account balances: Credit Accounts Cash Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Totals Debit $ 25,200 6,600 4,500 64,000 $ 4,600 79,000 16,700 $100,300 $100,300 During Year 1, the following transactions occur January 2 Purchase rental space for one year in advance, $10,200 ($850/month). January 9 Purchase additional supplies on account, $4,900. January 13 Provide services to customers on account, $26,900. January 17 Receive cash in advance from customers for services to be provided in the future, $5,100. January 20 Pay cash for salaries, $12,900. January 22 Receive cash on accounts receivable, $25,500. January 29 Pay cash on accounts payable, $5,400. Rent for the month of January has expired. Supplies remaining at the end of January total $4,200. By the end of January, $4,250 of services has been provided to customers who paid in advance on January 17. Unpaid salaries at the end of January are $4,820. 2. Record the adjusting entries on January 31 for the above transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required in the first account field.) X Answer is complete but not entirely correct. No General Journal Credit Date January 31 850 Rent Expense Prepaid Rent 850 January 31 4,200 X Supplies Expense Supplies 4,200 X OOOO 3 January 31 4,250 Deferred Revenue Service Revenue 4,250 January 31 Salaries Expense 4.820 Salaries Payable 4,820 On January 1, Year 1, the general ledger of a company includes the following account balances: Credit Accounts Cash Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Totals Debit $ 25,200 6,600 4,500 64,000 $ 4,600 79,000 16,700 $100,300 $100,300 During Year 1, the following transactions occur January 2 Purchase rental space for one year in advance, $10,200 ($850/month). January 9 Purchase additional supplies on account, $4,900. January 13 Provide services to customers on account, $26,900. January 17 Receive cash in advance from customers for services to be provided in the future, $5,100. January 20 Pay cash for salaries, $12,900. January 22 Receive cash on accounts receivable, $25,500. January 29 Pay cash on accounts payable, $5,400. 4. Prepare an income statement for the period ended January 31, Year 1. Income Statement For the year ended January 31, Year 1 Revenues: Service Revenue Expenses: Rent Expense Supplies Expense Salaries Expense Total Expenses Net Income