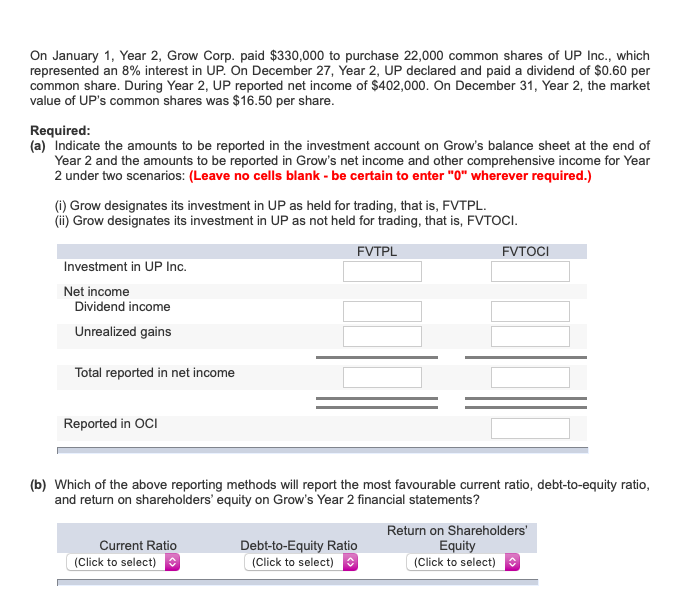

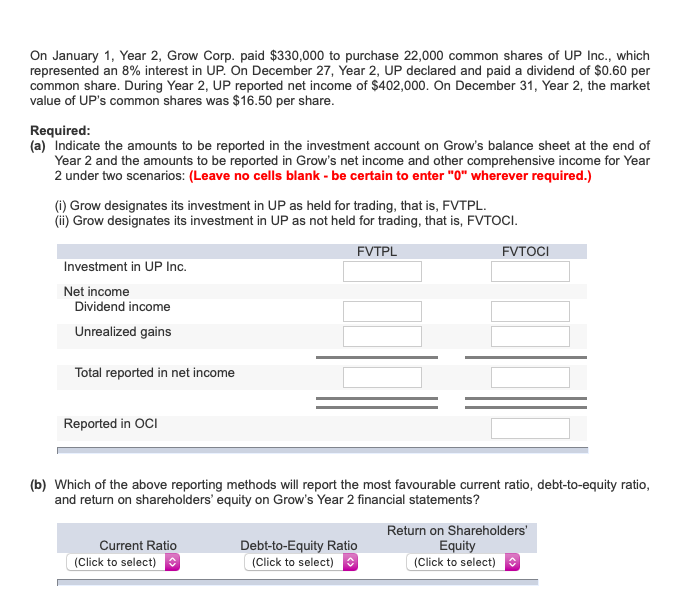

On January 1, Year 2, Grow Corp. paid $330,000 to purchase 22,000 common shares of UP Inc., which represented an 8% interest in UP. On December 27, Year 2, UP declared and paid a dividend of $0.60 per common share. During Year 2, UP reported net income of $402,000. On December 31, Year 2, the market value of UP's common shares was $16.50 per share Required (a) Indicate the amounts to be reported in the investment account on Grow's balance sheet at the end of Year 2 and the amounts to be reported in Grow's net income and other comprehensive income for Year 2 under two scenarios: (Leave no cells blank- be certain to enter "O" wherever required.) (i) Grow designates its investment in UP as held for trading, that is, FVTPL (ii) Grow designates its investment in UP as not held for trading, that is, FVTOCI FVTPL FVTOCI Investment in UP Inc. Net income Dividend income Unrealized gains Total reported in net income Reported in OCl (b) Which of the above reporting methods will report the most favourable current ratio, debt-to-equity ratio and return on shareholders' equity on Grow's Year 2 financial statements? Return on Shareholders' Equity (Click to select) Current Ratio Debt-to-Equity Ratio (Click to select) (Click to select) On January 1, Year 2, Grow Corp. paid $330,000 to purchase 22,000 common shares of UP Inc., which represented an 8% interest in UP. On December 27, Year 2, UP declared and paid a dividend of $0.60 per common share. During Year 2, UP reported net income of $402,000. On December 31, Year 2, the market value of UP's common shares was $16.50 per share Required (a) Indicate the amounts to be reported in the investment account on Grow's balance sheet at the end of Year 2 and the amounts to be reported in Grow's net income and other comprehensive income for Year 2 under two scenarios: (Leave no cells blank- be certain to enter "O" wherever required.) (i) Grow designates its investment in UP as held for trading, that is, FVTPL (ii) Grow designates its investment in UP as not held for trading, that is, FVTOCI FVTPL FVTOCI Investment in UP Inc. Net income Dividend income Unrealized gains Total reported in net income Reported in OCl (b) Which of the above reporting methods will report the most favourable current ratio, debt-to-equity ratio and return on shareholders' equity on Grow's Year 2 financial statements? Return on Shareholders' Equity (Click to select) Current Ratio Debt-to-Equity Ratio (Click to select) (Click to select)