Answered step by step

Verified Expert Solution

Question

1 Approved Answer

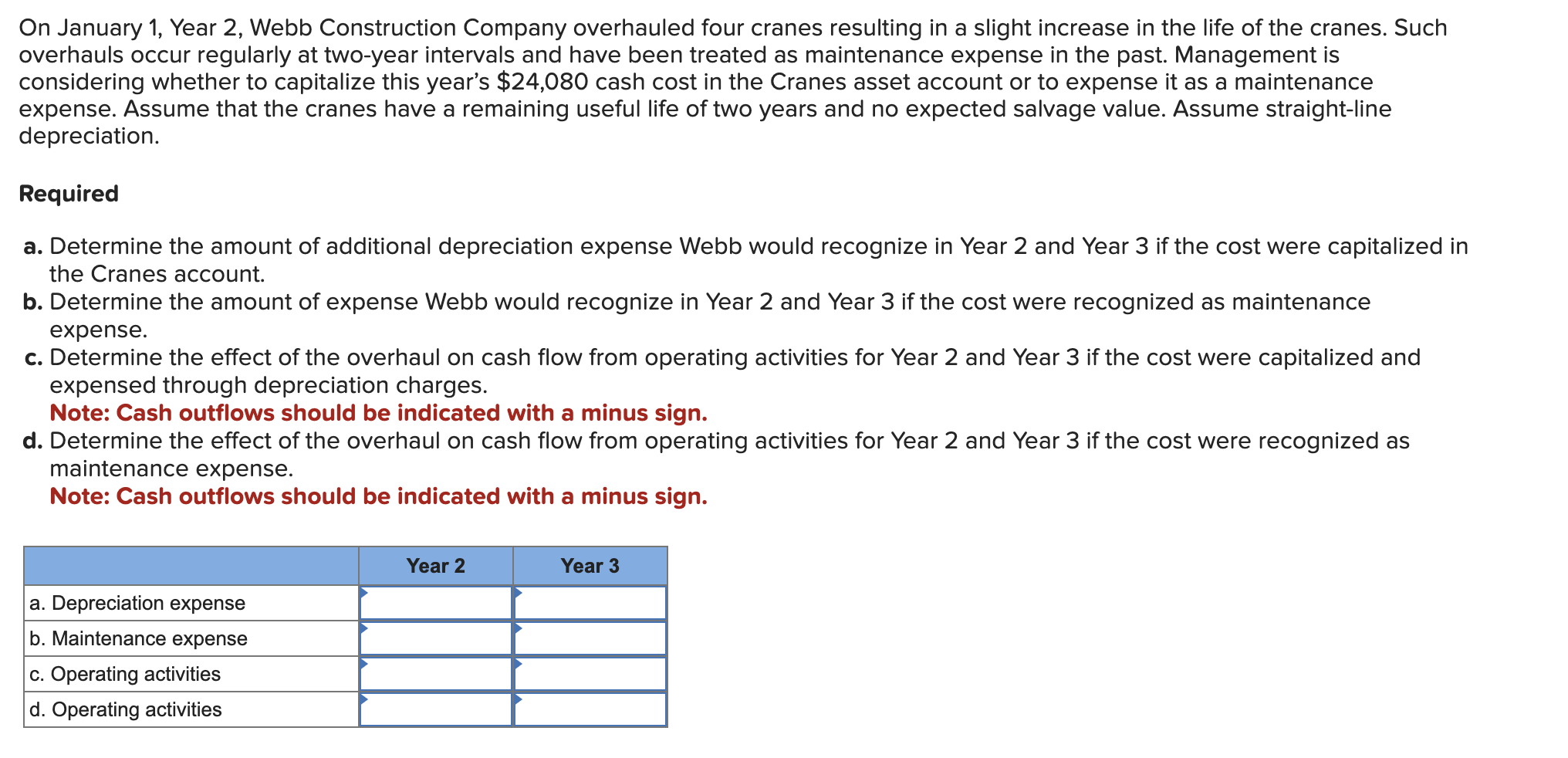

On January 1 , Year 2 , Webb Construction Company overhauled four cranes resulting in a slight increase in the life of the cranes. Such

On January Year Webb Construction Company overhauled four cranes resulting in a slight increase in the life of the cranes. Such

overhauls occur regularly at twoyear intervals and have been treated as maintenance expense in the past. Management is

considering whether to capitalize this year's $ cash cost in the Cranes asset account or to expense it as a maintenance

expense. Assume that the cranes have a remaining useful life of two years and no expected salvage value. Assume straightline

depreciation.

Required

a Determine the amount of additional depreciation expense Webb would recognize in Year and Year if the cost were capitalized in

the Cranes account.

b Determine the amount of expense Webb would recognize in Year and Year if the cost were recognized as maintenance

expense.

c Determine the effect of the overhaul on cash flow from operating activities for Year and Year if the cost were capitalized and

expensed through depreciation charges.

Note: Cash outflows should be indicated with a minus sign.

d Determine the effect of the overhaul on cash flow from operating activities for Year and Year if the cost were recognized as

maintenance expense.

Note: Cash outflows should be indicated with a minus sign.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started