Answered step by step

Verified Expert Solution

Question

1 Approved Answer

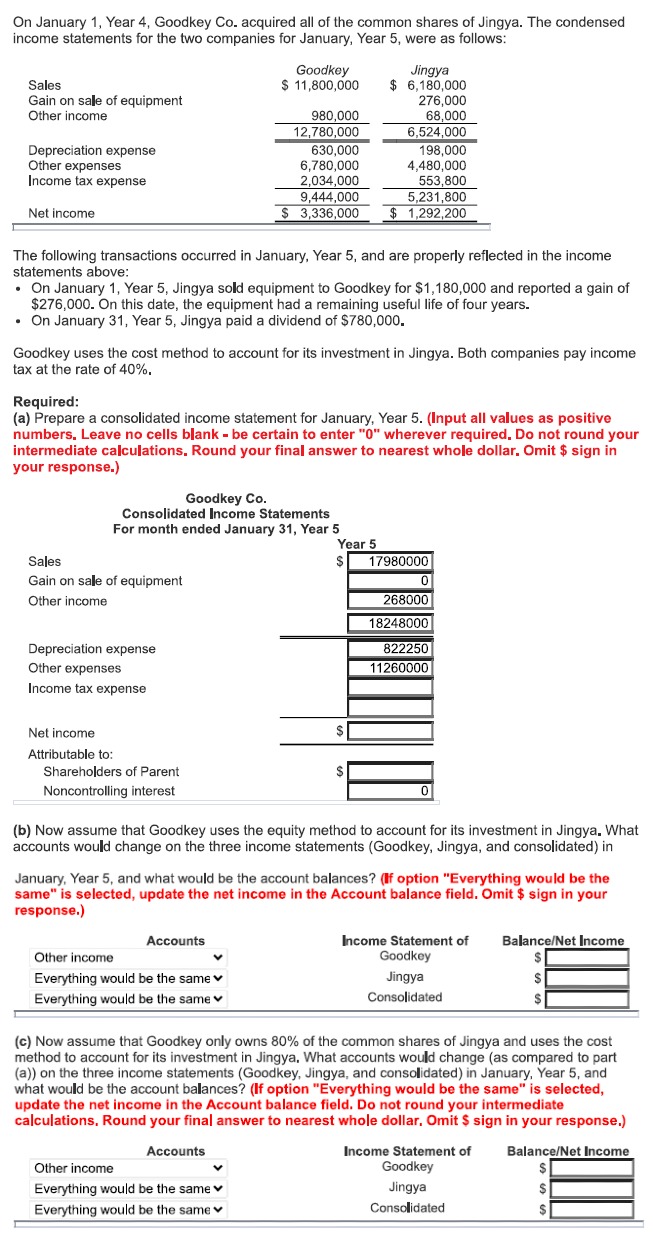

On January 1 , Year 4 , Goodkey Co . acquired all of the common shares of Jingya. The condensed income statements for the two

On January Year Goodkey Co acquired all of the common shares of Jingya. The condensed

income statements for the two companies for January, Year were as follows:

The following transactions occurred in January, Year and are properly reflected in the income

statements above:

On January Year Jingya sold equipment to Goodkey for $ and reported a gain of

$ On this date, the equipment had a remaining useful life of four years.

On January Year Jingya paid a dividend of $

Goodkey uses the cost method to account for its investment in Jingya. Both companies pay income

tax at the rate of

Required:

a Prepare a consolidated income statement for January, Year Input all values as positive

numbers, Leave no cells blank be certain to enter wherever required, Do not round your

intermediate calculations. Round your final answer to nearest whole dollar. Omit $ sign in

your response.

b Now assume that Goodkey uses the equity method to account for its investment in Jingya. What

accounts would change on the three income statements Goodkey Jingya, and consolidated in

January, Year and what would be the account balances? If option "Everything would be the

same" is selected, update the net income in the Account balance field. Omit $ sign in your

response.

c Now assume that Goodkey only owns of the common shares of Jingya and uses the cost

method to account for its investment in Jingya. What accounts would change as compared to part

a on the three income statements Goodkey Jingya, and consolidated in January, Year and

what would be the account balances? If option "Everything would be the same" is selected,

update the net income in the Account balance field. Do not round your intermediate

calculations, Round your final answer to nearest whole dollar. Omit $ sign in your response.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started