Question

On January 1, Year 4, Hodgskin Bakeries, a producer and wholesaler of baked goods, invested in Howell Distributors, a seller of baking spices, such as

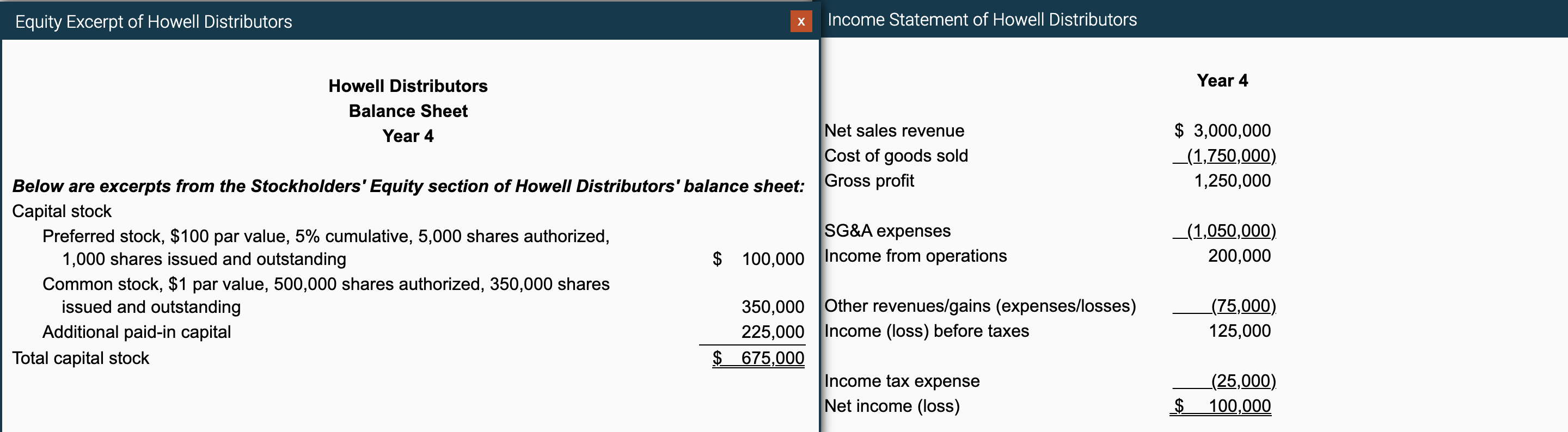

On January 1, Year 4, Hodgskin Bakeries, a producer and wholesaler of baked goods, invested in Howell Distributors, a seller of baking spices, such as cinnamon, allspice, and nutmeg. As an accountant on the consolidations team in the corporate offices of Hodgskin Bakeries, you are responsible for preparing the journal entries related to Hodgskin's investment in Howell following the company's year-end of December 31, Year 4. Both Hodgskin's and Howell's fiscal year-end is December 31.

Using the exhibits and transaction information provided, prepare the Year 4 journal entries for the investment in Howell as of year-end.

To prepare each required journal entry:

-

Click on a cell in the Account Name column and select the appropriate account. An account may be used once or not at all for a journal entry.

-

Enter the corresponding debit or credit amount in the associated column.

-

All amounts will be automatically rounded to the nearest dollar.

-

If no journal entry is needed, check the "No Entry Required" box at the top of the table as your response.

1. Record Hodgskin's initial investment in Howell Corp.

2. Recognize Hodgskin Co.'s net income (loss) in Howell Corp.

3. Record amortization of investment premium for undervalued equipment (premium excludes goodwill).

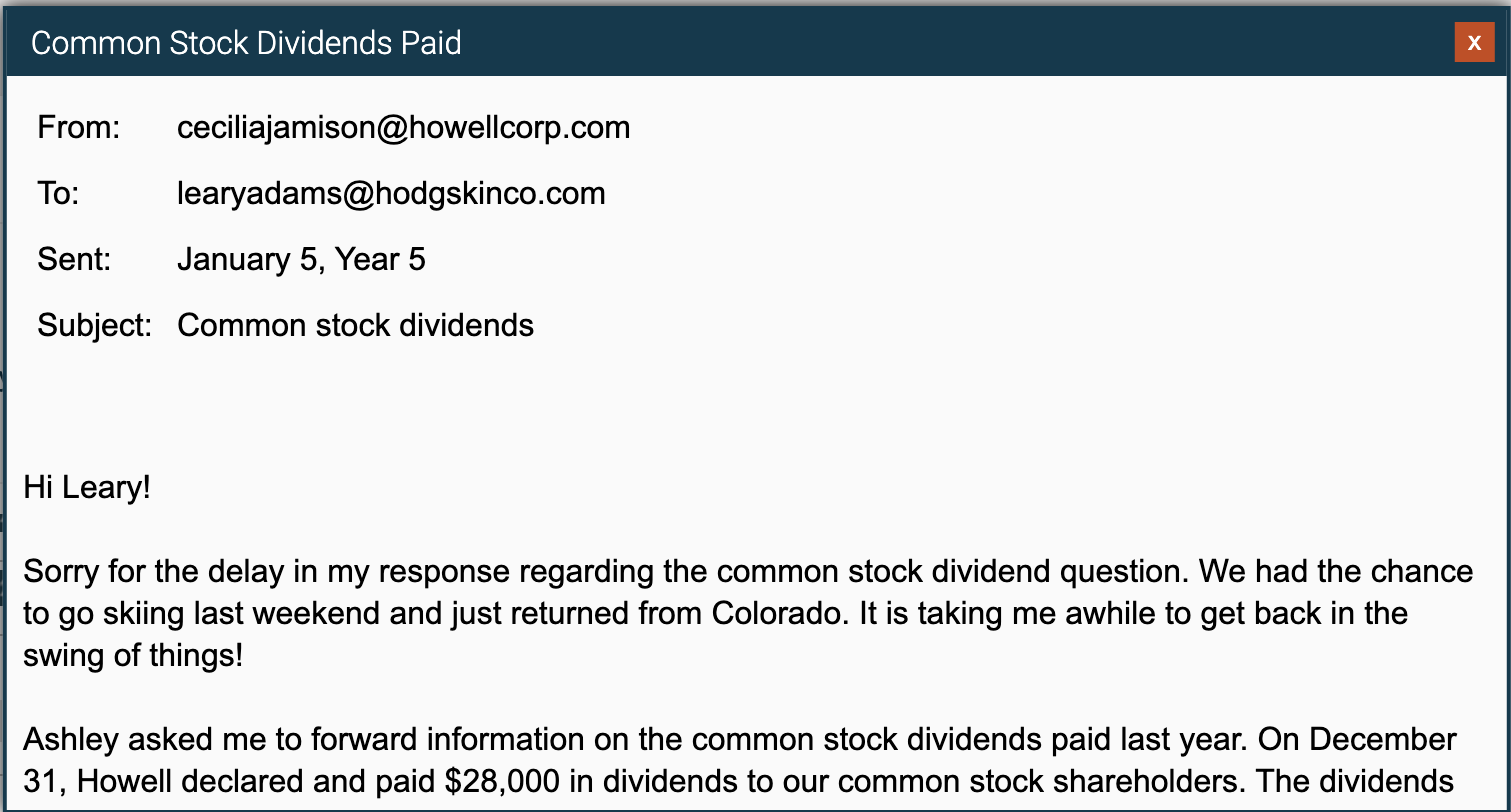

4. Record dividend paid by Howell Corp. to common shareholders.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started