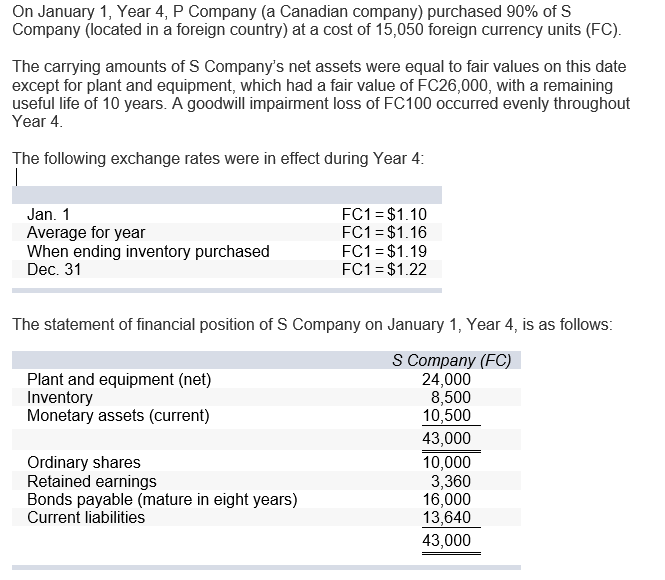

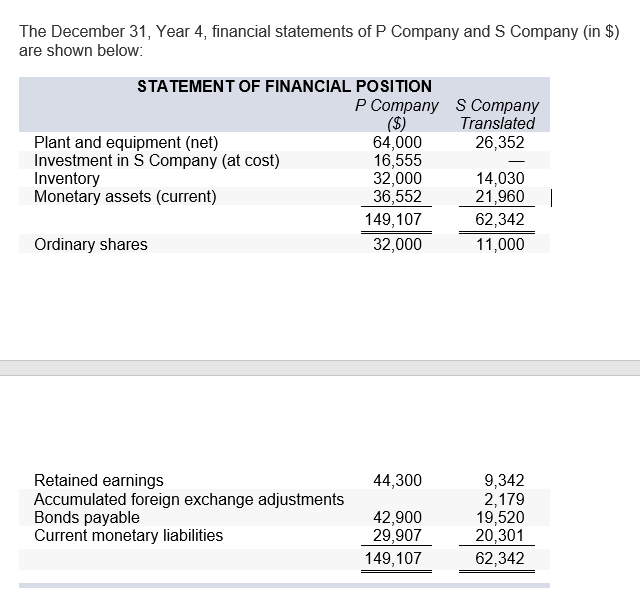

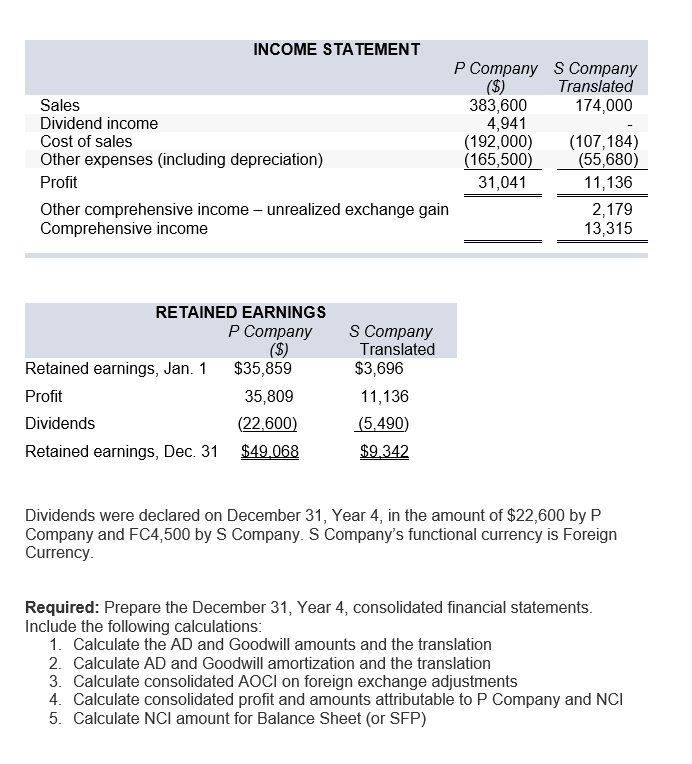

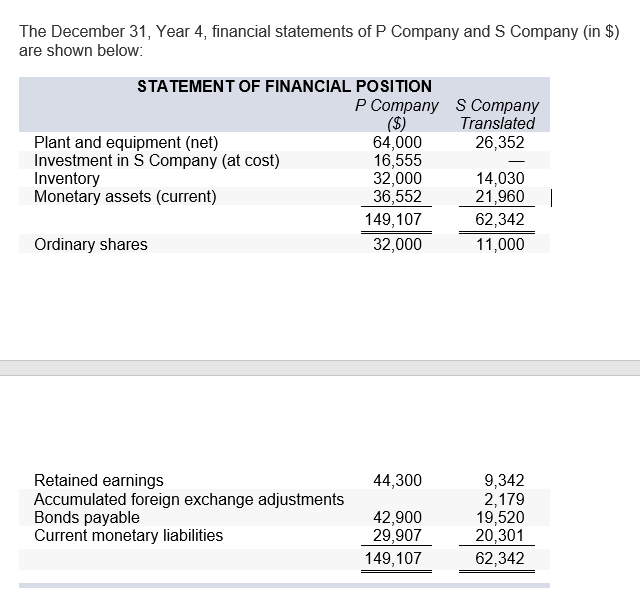

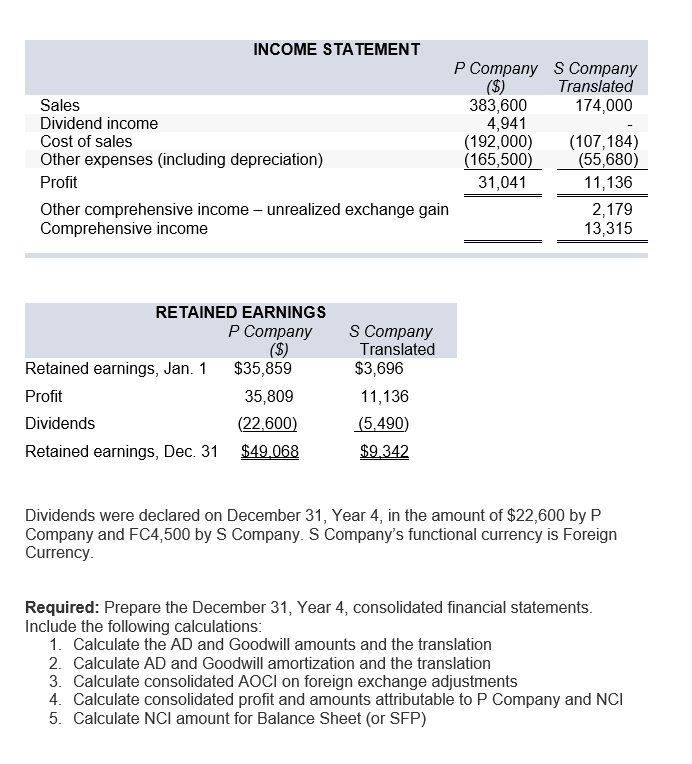

On January 1, Year 4, P Company (a Canadian company) purchased 90% of S Company (located in a foreign country) at a cost of 15,050 foreign currency units (FC). The carrying amounts of S Company's net assets were equal to fair values on this date except for plant and equipment, which had a fair value of FC26,000, with a remaining useful life of 10 years. A goodwill impairment loss of FC100 occurred evenly throughout Year 4. The following exchange rates were in effect during Year 4: Jan. 1 Average for year When ending inventory purchased Dec. 31 FC1 = $1.10 FC1 = $1.16 FC1 = $1.19 FC1 = $1.22 The statement of financial position of S Company on January 1, Year 4, is as follows: S Company (FC) Plant and equipment (net) 24,000 Inventory 8,500 Monetary assets (current) 10,500 43,000 Ordinary shares 10,000 Retained earnings 3,360 Bonds payable (mature in eight years) 16,000 Current liabilities 13,640 43,000 The December 31, Year 4, financial statements of P Company and S Company (in $) are shown below: STATEMENT OF FINANCIAL POSITION P Company S Company Translated Plant and equipment (net) 64,000 26,352 Investment in S Company (at cost) 16,555 Inventory 32,000 14,030 Monetary assets (current) 36,552 21,9601 149,107 62,342 Ordinary shares 32,000 11,000 44,300 Retained earnings Accumulated foreign exchange adjustments Bonds payable Current monetary liabilities 42,900 29,907 149, 107 9,342 2,179 19,520 20,301 62,342 INCOME STATEMENT P Company S Company ($) Translated Sales 383,600 174,000 Dividend income 4,941 Cost of sales (192,000) (107,184) Other expenses (including depreciation) (165,500) (55,680) Profit 31,041 11,136 Other comprehensive income - unrealized exchange gain 2,179 Comprehensive income 13,315 RETAINED EARNINGS P Company ($) Retained earnings, Jan. 1 Profit Dividends Retained earnings, Dec. 31 $35,859 35,809 (22,600) $49.068 S Company Translated $3,696 11,136 (5,490) $9.342 Dividends were declared on December 31, Year 4, in the amount of $22,600 by P Company and FC4,500 by S Company. S Company's functional currency is Foreign Currency Required: Prepare the December 31, Year 4, consolidated financial statements. Include the following calculations: 1. Calculate the AD and Goodwill amounts and the translation 2. Calculate AD and Goodwill amortization and the translation 3. Calculate consolidated AOCI on foreign exchange adjustments 4. Calculate consolidated profit and amounts attributable to P Company and NCI 5. Calculate NCI amount for Balance Sheet (or SFP) On January 1, Year 4, P Company (a Canadian company) purchased 90% of S Company (located in a foreign country) at a cost of 15,050 foreign currency units (FC). The carrying amounts of S Company's net assets were equal to fair values on this date except for plant and equipment, which had a fair value of FC26,000, with a remaining useful life of 10 years. A goodwill impairment loss of FC100 occurred evenly throughout Year 4. The following exchange rates were in effect during Year 4: Jan. 1 Average for year When ending inventory purchased Dec. 31 FC1 = $1.10 FC1 = $1.16 FC1 = $1.19 FC1 = $1.22 The statement of financial position of S Company on January 1, Year 4, is as follows: S Company (FC) Plant and equipment (net) 24,000 Inventory 8,500 Monetary assets (current) 10,500 43,000 Ordinary shares 10,000 Retained earnings 3,360 Bonds payable (mature in eight years) 16,000 Current liabilities 13,640 43,000 The December 31, Year 4, financial statements of P Company and S Company (in $) are shown below: STATEMENT OF FINANCIAL POSITION P Company S Company Translated Plant and equipment (net) 64,000 26,352 Investment in S Company (at cost) 16,555 Inventory 32,000 14,030 Monetary assets (current) 36,552 21,9601 149,107 62,342 Ordinary shares 32,000 11,000 44,300 Retained earnings Accumulated foreign exchange adjustments Bonds payable Current monetary liabilities 42,900 29,907 149, 107 9,342 2,179 19,520 20,301 62,342 INCOME STATEMENT P Company S Company ($) Translated Sales 383,600 174,000 Dividend income 4,941 Cost of sales (192,000) (107,184) Other expenses (including depreciation) (165,500) (55,680) Profit 31,041 11,136 Other comprehensive income - unrealized exchange gain 2,179 Comprehensive income 13,315 RETAINED EARNINGS P Company ($) Retained earnings, Jan. 1 Profit Dividends Retained earnings, Dec. 31 $35,859 35,809 (22,600) $49.068 S Company Translated $3,696 11,136 (5,490) $9.342 Dividends were declared on December 31, Year 4, in the amount of $22,600 by P Company and FC4,500 by S Company. S Company's functional currency is Foreign Currency Required: Prepare the December 31, Year 4, consolidated financial statements. Include the following calculations: 1. Calculate the AD and Goodwill amounts and the translation 2. Calculate AD and Goodwill amortization and the translation 3. Calculate consolidated AOCI on foreign exchange adjustments 4. Calculate consolidated profit and amounts attributable to P Company and NCI 5. Calculate NCI amount for Balance Sheet (or SFP)