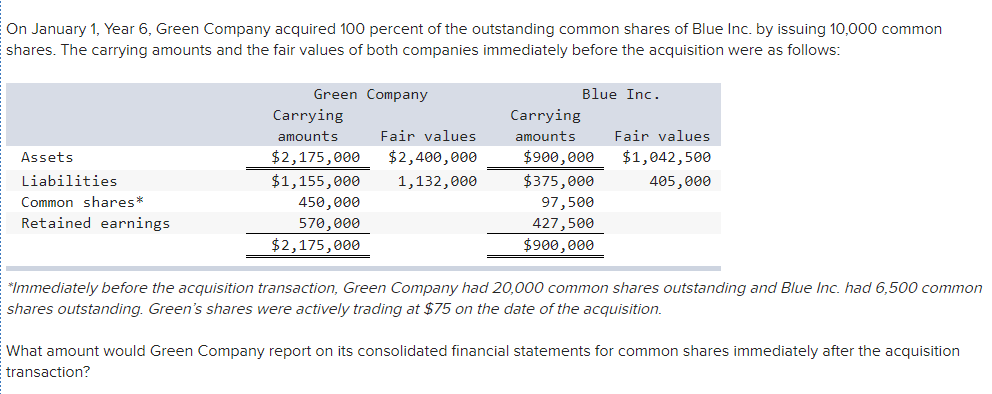

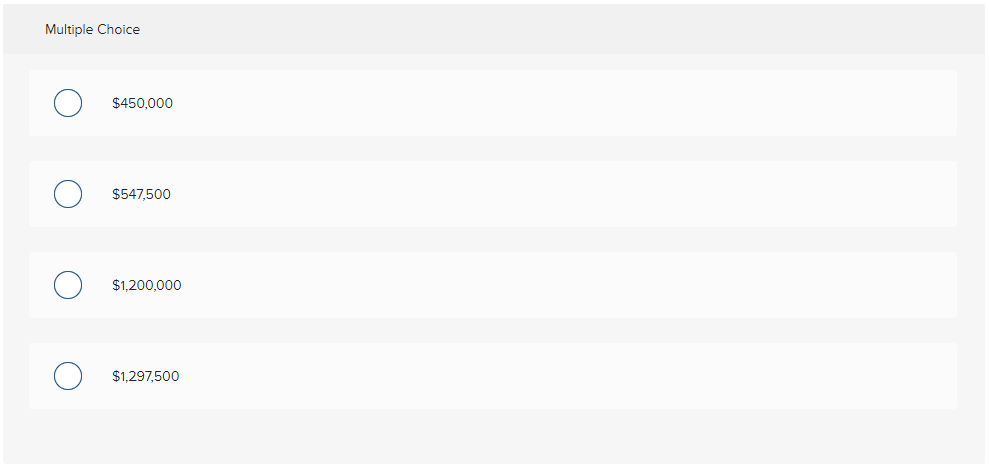

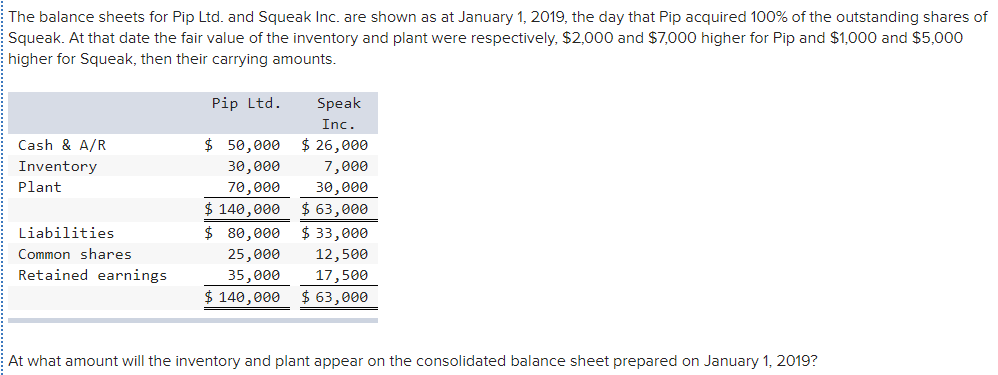

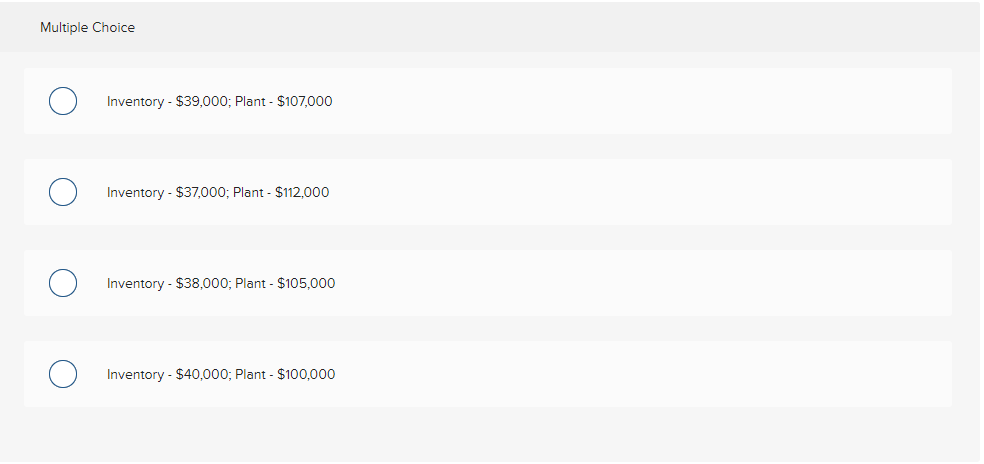

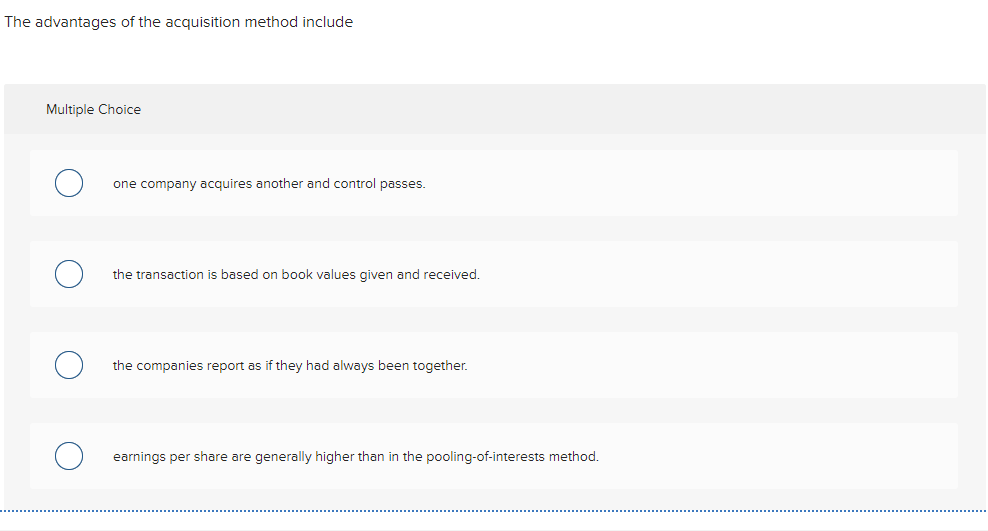

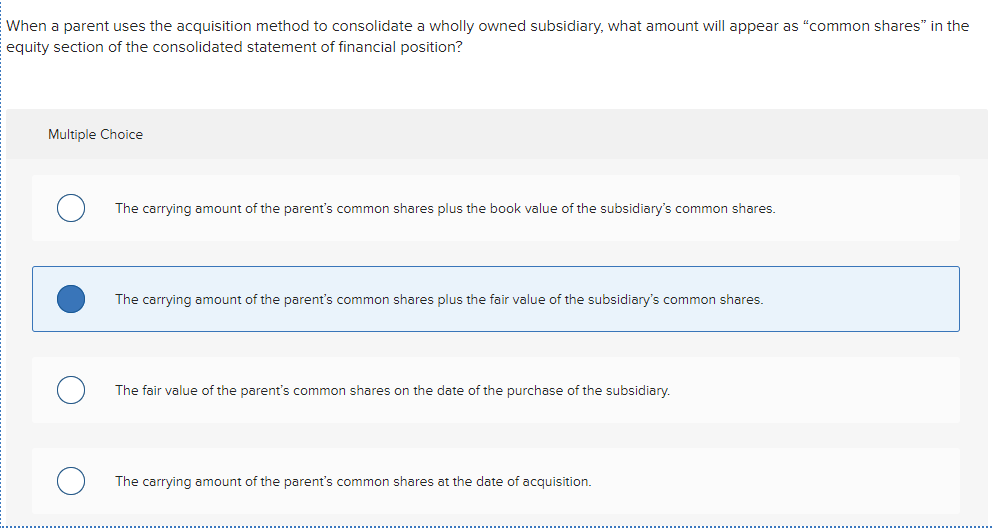

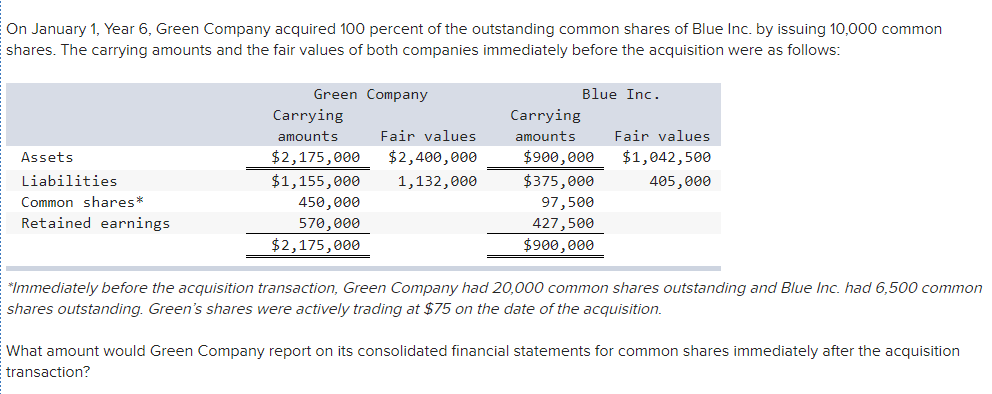

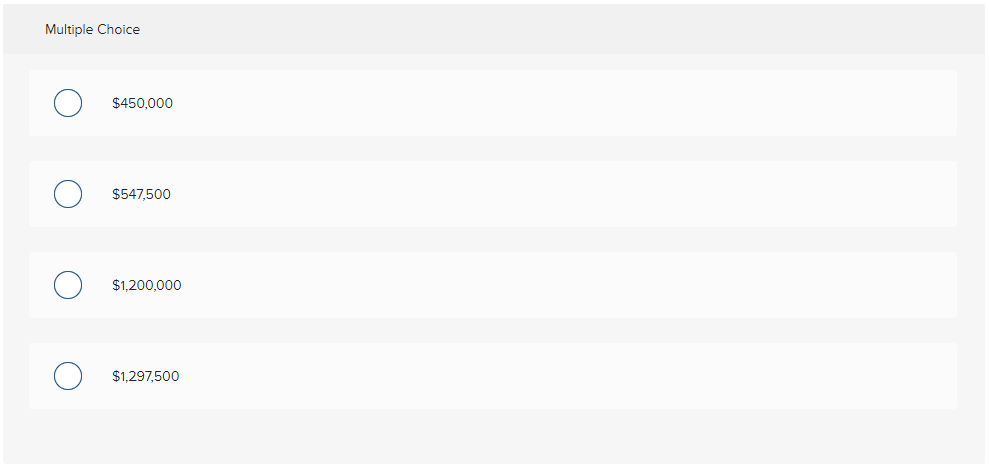

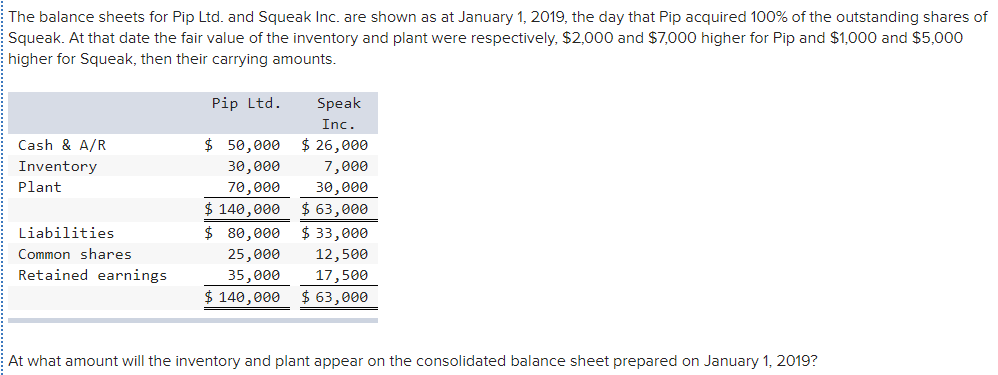

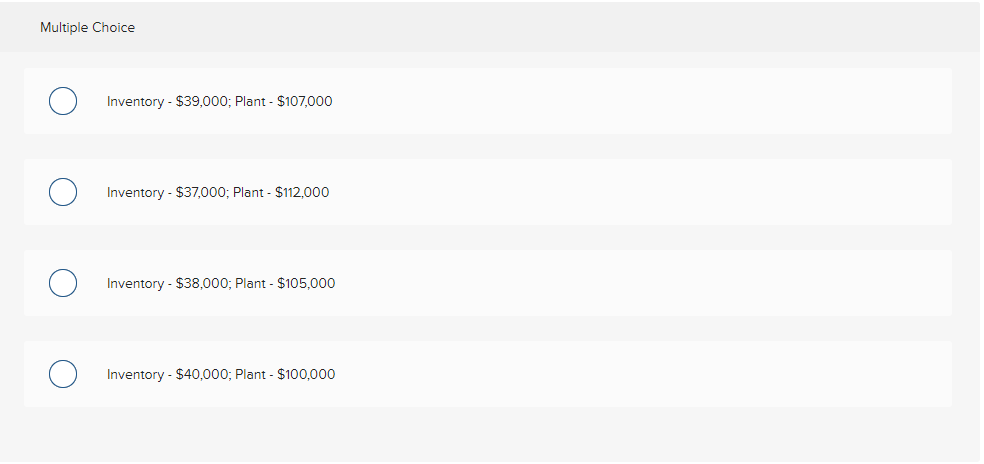

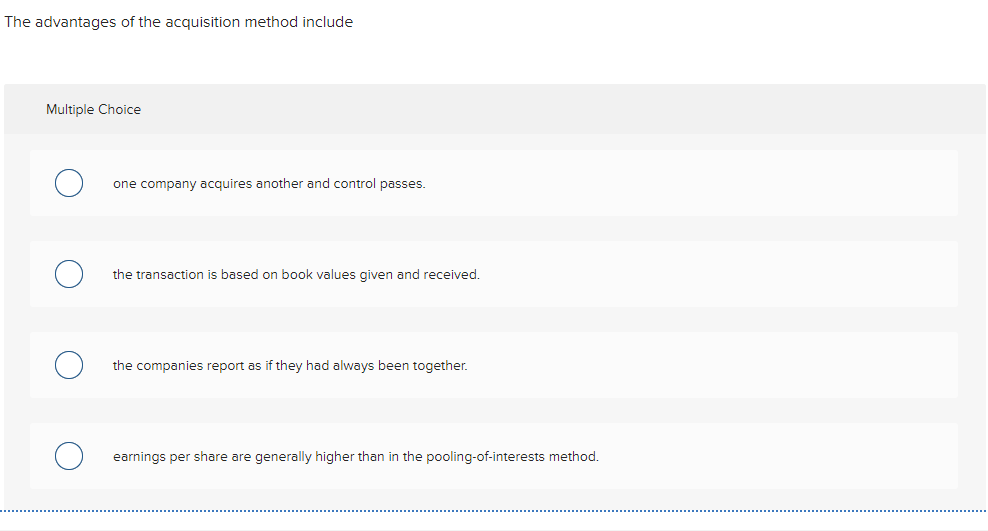

On January 1, Year 6, Green Company acquired 100 percent of the outstanding common shares of Blue Inc. by issuing 10,000 common shares. The carrying amounts and the fair values of both companies immediately before the acquisition were as follows: Assets Liabilities Common shares* Retained earnings Green Company Carrying amounts Fair values $2,175,000 $2,400,000 $1,155,000 1,132,000 450,000 570,000 $2,175,000 Blue Inc. Carrying amounts Fair values $900,000 $1,042,500 $375,000 405,000 97,500 427,500 $900,000 *Immediately before the acquisition transaction, Green Company had 20,000 common shares outstanding and Blue Inc. had 6,500 common shares outstanding. Green's shares were actively trading at $75 on the date of the acquisition. What amount would Green Company report on its consolidated financial statements for common shares immediately after the acquisition transaction? Multiple Choice O $450,000 $547,500 O $1.200.000 O $1,297,500 The balance sheets for Pip Ltd. and Squeak Inc. are shown as at January 1, 2019, the day that Pip acquired 100% of the outstanding shares of Squeak. At that date the fair value of the inventory and plant were respectively, $2,000 and $7,000 higher for Pip and $1,000 and $5,000 higher for Squeak, then their carrying amounts. Cash & A/R Inventory Plant Pip Ltd. Speak Inc. $ 50,000 $ 26,000 30,000 7,000 70,000 30,000 $ 140,000 $ 63,000 $ 80,000 $33,000 25,000 12,500 35,000 17,500 $ 140,000 $63,000 Liabilities Common shares Retained earnings At what amount will the inventory and plant appear on the consolidated balance sheet prepared on January 1, 2019? Multiple Choice Inventory - $39,000; Plant - $107.000 Inventory - $37,000; Plant - $112,000 O O Inventory - $38,000; Plant - $105,000 O Inventory - $40,000; Plant - $100,000 The advantages of the acquisition method include Multiple Choice one company acquires another and control passes. the transaction is based on book values given and received. O the companies report as if they had always been together. earnings per share are generally higher than in the pooling-of-interests method. When a parent uses the acquisition method to consolidate a wholly owned subsidiary, what amount will appear as "common shares" in the equity section of the consolidated statement of financial position? Multiple Choice The carrying amount of the parent's common shares plus the book value of the subsidiary's common shares. The carrying amount of the parent's common shares plus the fair value of the subsidiary's common shares. The fair value of the parent's common shares on the date of the purchase of the subsidiary. The carrying amount of the parent's common shares at the date of acquisition