Question

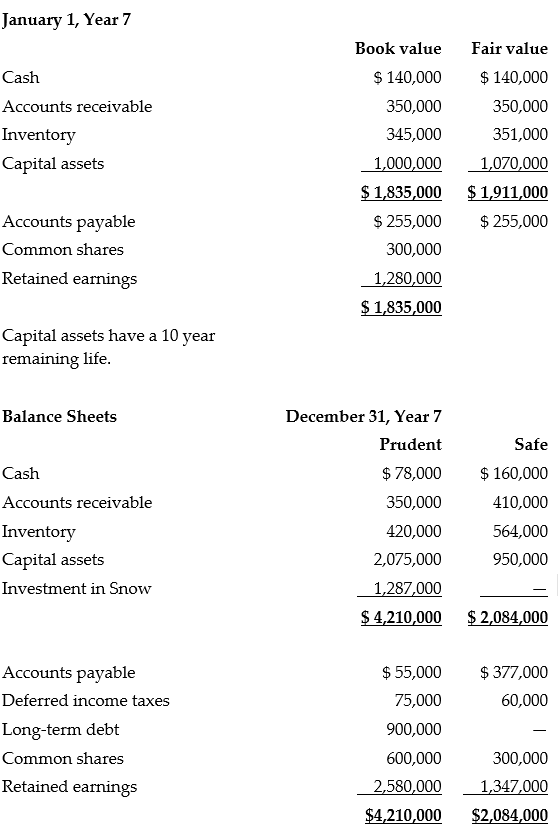

On January 1, Year 7, Prudent purchased 75% of the outstanding shares of Safe for $1,287,000. At that time, Safe`s assets and liabilities had the

On January 1, Year 7, Prudent purchased 75% of the outstanding shares of Safe for $1,287,000.

At that time, Safe`s assets and liabilities had the following book and fair values.

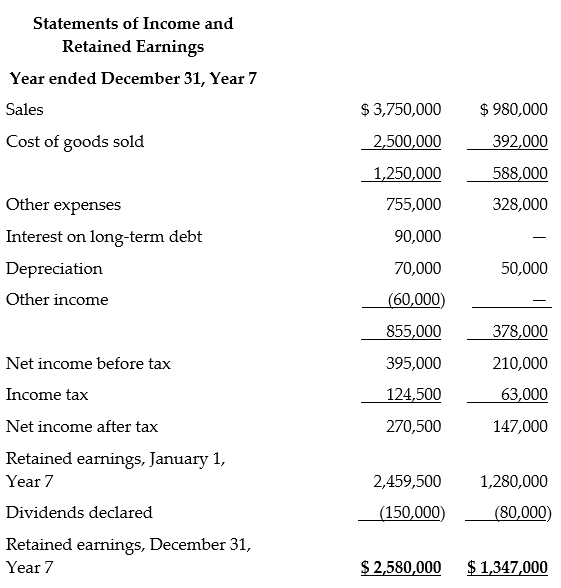

During Year 7, Prudence sold goods to Safe for $130,000. These goods cost Prudence $85,000. Safe sold 60% of these goods during Year 7. Also during Year 7, Safe sold goods to Prudence for $90,000, earning a gross profit of 40%. Prudence had 20% of these goods in its Year 7 ending inventory. The tax rate for both companies is 30%. On December 31, Year 7, Port determined that there was a $3000 goodwill impairment.

Both companies use straight-line depreciation.

Prudence accounts for Safe using the Fair Value Enterprise method (Entity theory) and cost methods.

Required:

Calculate goodwill using fair values.

Calculate acquisition differential and prepare the ADA table.

Calculate unrealized inventory profits before and after tax.

Calculate consolidated net income and the NCI share.

Calculate consolidated retained earnings and NCI Balance Sheet.

Calculations above are required in order to earn marks on Part B. Assignments submitted without supporting calculations will receive zero for this question.

Prepare all the calculations required to prepare consolidated financial statements.

Prepare a consolidated income statement that includes a section below net income attributing income to shareholders of Prudence and NCI shareholders. Prepare a consolidated balance sheet for Year 7. Prepare statements in good form.

January 1, Year 7 CashAccountsreceivableInventoryCapitalassetsAccountspayableCommonsharesRetainedearningsBookvalue$140,000350,000345,0001,000,000$1,835,000$255,000300,0001,280,000Fairvalue$140,000350,000351,0001,070,000$1,911,000$255,000 Capital assets have a 10 year remaining life. AccountspayableDeferredincometaxesLong-termdebtCommonsharesRetainedearnings$55,00075,000900,000600,0001,347,0002,580,000$4,210,000$377,00060,000300,000$2,084,000$20 Statements of Income and Retained Earnings Year ended December 31 , Year 7 January 1, Year 7 CashAccountsreceivableInventoryCapitalassetsAccountspayableCommonsharesRetainedearningsBookvalue$140,000350,000345,0001,000,000$1,835,000$255,000300,0001,280,000Fairvalue$140,000350,000351,0001,070,000$1,911,000$255,000 Capital assets have a 10 year remaining life. AccountspayableDeferredincometaxesLong-termdebtCommonsharesRetainedearnings$55,00075,000900,000600,0001,347,0002,580,000$4,210,000$377,00060,000300,000$2,084,000$20 Statements of Income and Retained Earnings Year ended December 31 , Year 7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started