Question

On January 10, 2019, the first day of the spring semester, the cafeteria of The Defiance College purchased for cash enough paper napkins to last

On January 10, 2019, the first day of the spring semester, the cafeteria of The Defiance College purchased for cash enough paper napkins to last the entire 16-week semester. The total cost was $4,800. Required: Prepare the Horizontal model and Journal entry for each of the following transactions. The purchase of the paper napkins, assuming that the purchase was initially recorded as an expense. At January 31, it was estimated that the cost of the paper napkins used during the first three weeks of the semester totaled $960. The purchase of the paper napkins, assuming that the purchase was initially recorded as an asset. At January 31 if the initial purchase had been recorded as in c. Indicate the financial statement effect. Consider the effects that entries a and b would have on the following: Income statement for the month of January? Balance sheet at January 31?

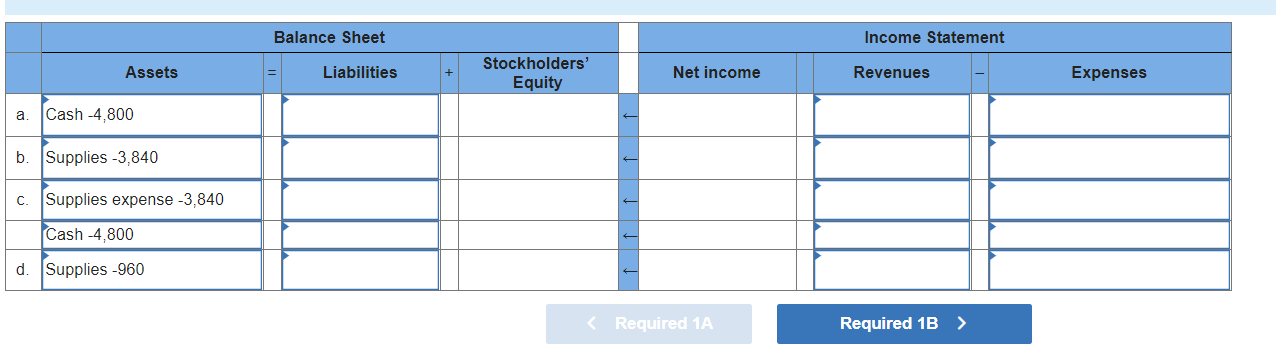

1-a. Prepare the Horizontal model for each of the following transactions. a. The purchase of the paper napkins, assuming that the purchase was initially recorded as an expense. b. At January 31, it was estimated that the cost of the paper napkins used during the first three weeks of the semester totaled $960. c. The purchase of the paper napkins, assuming that the purchase was initially recorded as an asset. d. At January 31 if the initial purchase had been recorded as in c. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.)

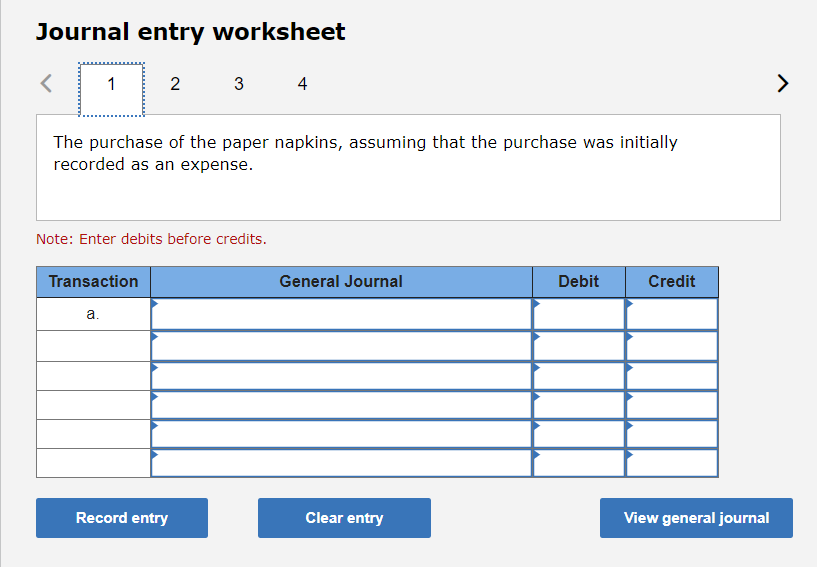

1-b. Prepare the journal entry for each of the following transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. The purchase of the paper napkins, assuming that the purchase was initially recorded as an expense. b. At January 31, it was estimated that the cost of the paper napkins used during the first three weeks of the semester totaled $960. c. The purchase of the paper napkins, assuming that the purchase was initially recorded as an asset. d. At January 31 if the initial purchase had been recorded as in c.

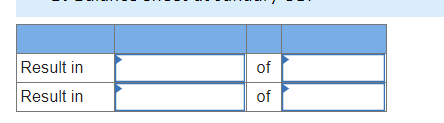

Consider the effects that entries a and b would have on the following: a. Income statement for the month of January? b. Balance sheet at January 31?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started