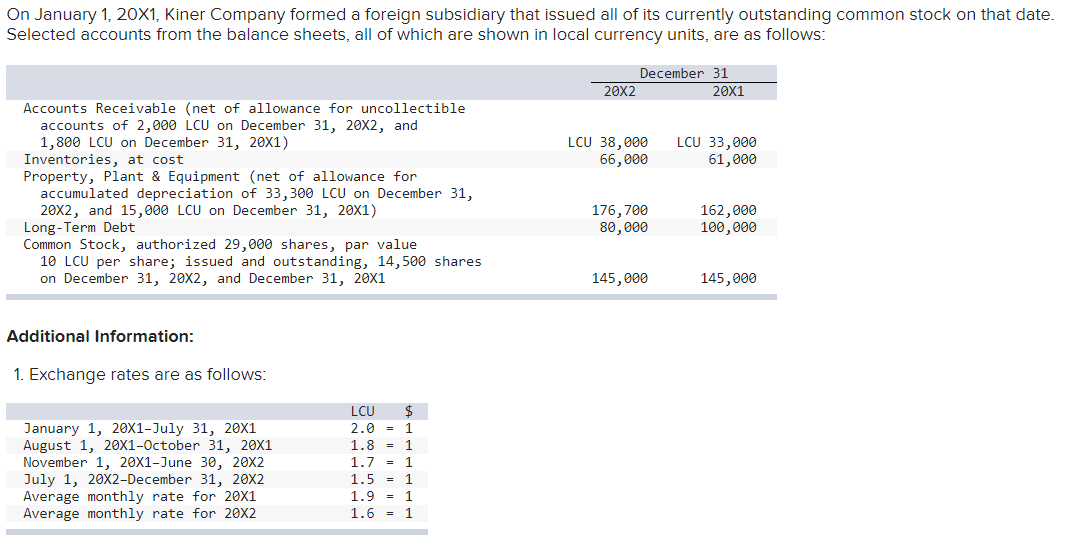

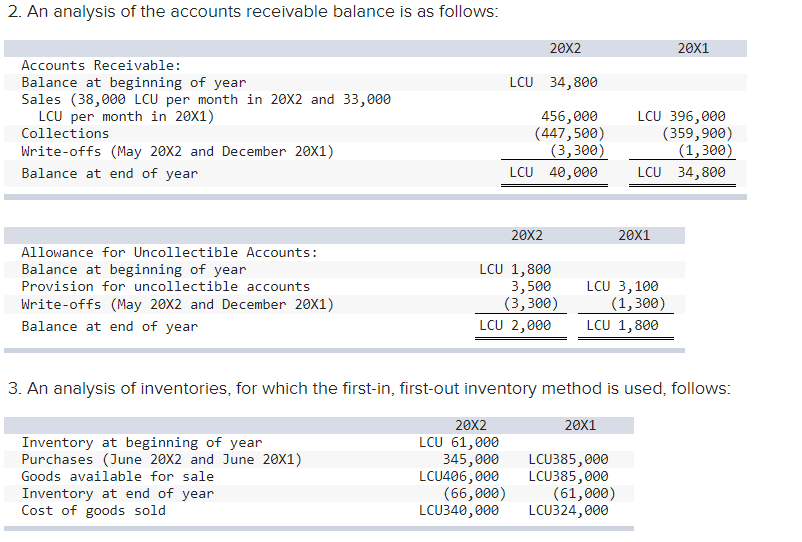

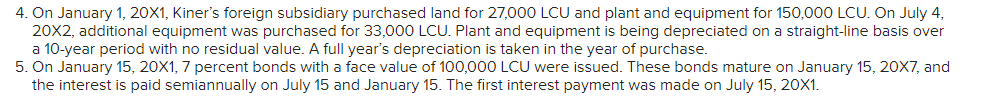

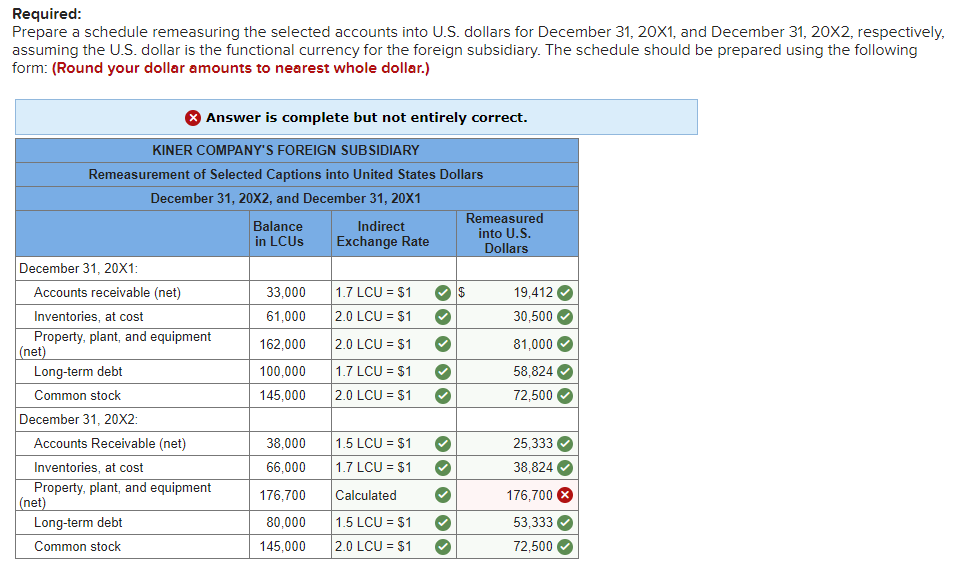

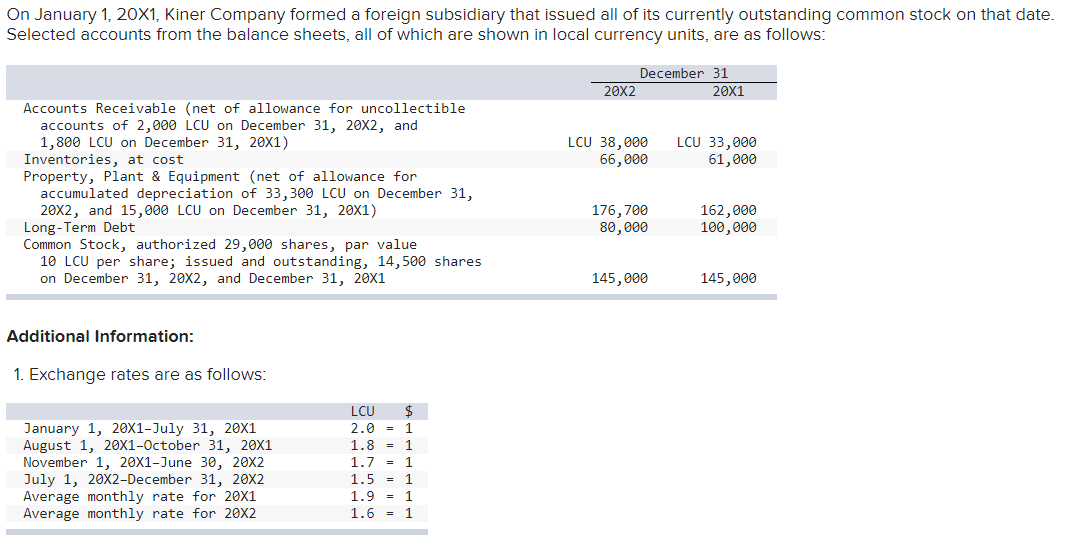

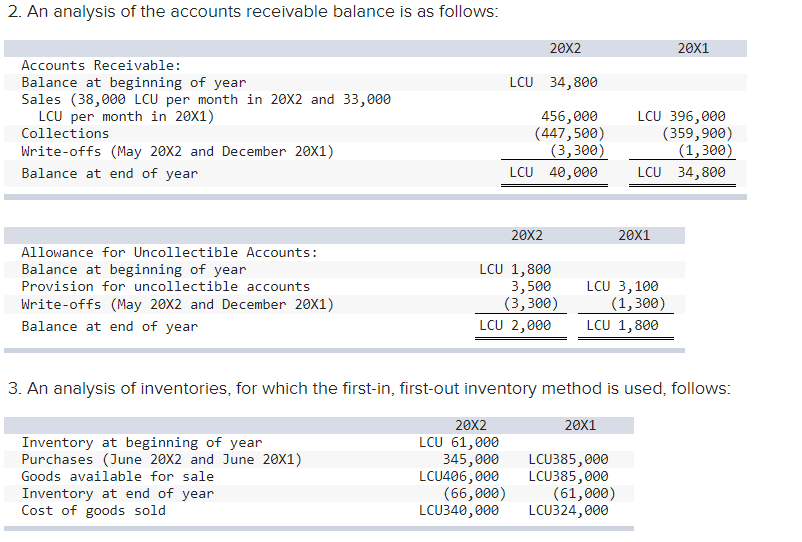

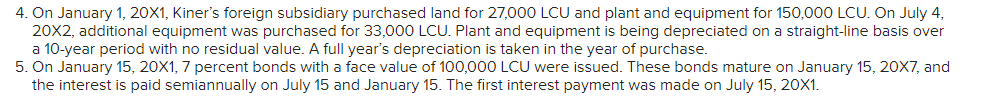

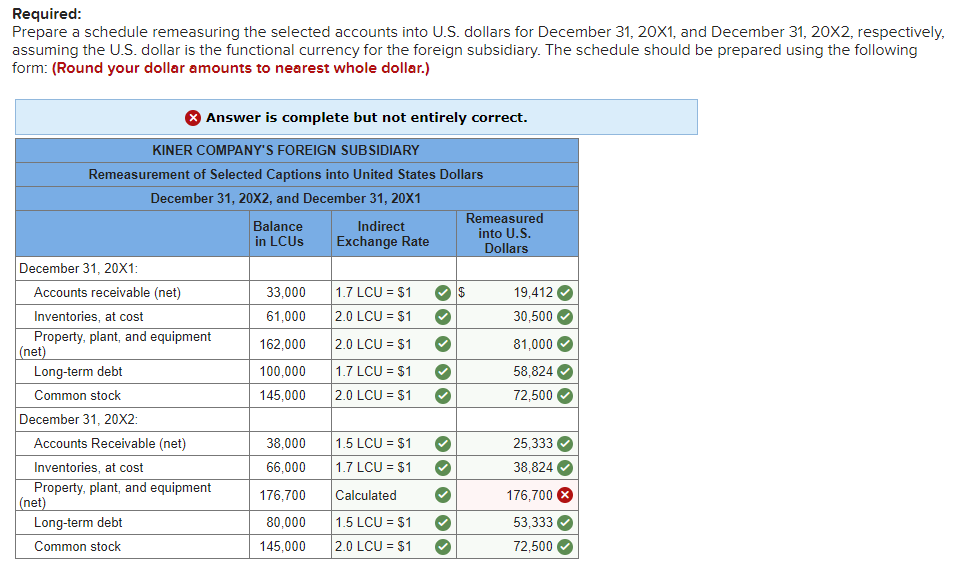

On January 1,201, Kiner Company formed a foreign subsidiary that issued all of its currently outstanding common stock on that date. Selected accounts from the balance sheets, all of which are shown in local currency units, are as follows: Additional Information: 1. Exchange rates are as follows: 2. An analysis of the accounts receivable balance is as follows: 3. An analysis of inventories, for which the first-in, first-out inventory method is use 4. On January 1,201, Kiner's foreign subsidiary purchased land for 27,000LCU and plant and equipment for 150,000LCU. On July 4 , 202, additional equipment was purchased for 33,000LCU. Plant and equipment is being depreciated on a straight-line basis over a 10-year period with no residual value. A full year's depreciation is taken in the year of purchase. 5. On January 15,201,7 percent bonds with a face value of 100,000LCU were issued. These bonds mature on January 15 , 207, and the interest is paid semiannually on July 15 and January 15. The first interest payment was made on July 15,201. Required: Prepare a schedule remeasuring the selected accounts into U.S. dollars for December 31,201, and December 31,202, respectively, assuming the U.S. dollar is the functional currency for the foreign subsidiary. The schedule should be prepared using the following form: (Round your dollar amounts to nearest whole dollar.) On January 1,201, Kiner Company formed a foreign subsidiary that issued all of its currently outstanding common stock on that date. Selected accounts from the balance sheets, all of which are shown in local currency units, are as follows: Additional Information: 1. Exchange rates are as follows: 2. An analysis of the accounts receivable balance is as follows: 3. An analysis of inventories, for which the first-in, first-out inventory method is use 4. On January 1,201, Kiner's foreign subsidiary purchased land for 27,000LCU and plant and equipment for 150,000LCU. On July 4 , 202, additional equipment was purchased for 33,000LCU. Plant and equipment is being depreciated on a straight-line basis over a 10-year period with no residual value. A full year's depreciation is taken in the year of purchase. 5. On January 15,201,7 percent bonds with a face value of 100,000LCU were issued. These bonds mature on January 15 , 207, and the interest is paid semiannually on July 15 and January 15. The first interest payment was made on July 15,201. Required: Prepare a schedule remeasuring the selected accounts into U.S. dollars for December 31,201, and December 31,202, respectively, assuming the U.S. dollar is the functional currency for the foreign subsidiary. The schedule should be prepared using the following form: (Round your dollar amounts to nearest whole dollar.)