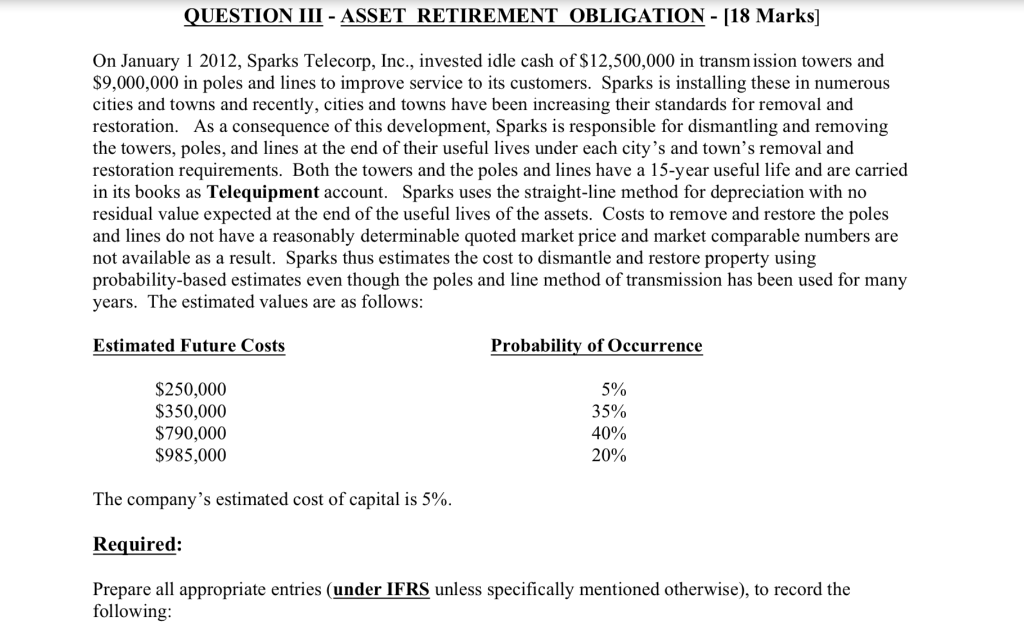

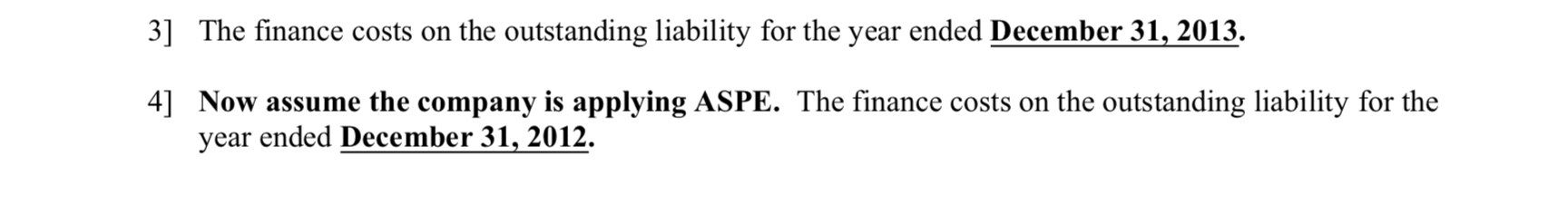

On January 12012 , Sparks Telecorp, Inc., invested idle cash of $12,500,000 in transm ission towers and $9,000,000 in poles and lines to improve service to its customers. Sparks is installing these in numerous cities and towns and recently, cities and towns have been increasing their standards for removal and restoration. As a consequence of this development, Sparks is responsible for dismantling and removing the towers, poles, and lines at the end of their useful lives under each city's and town's removal and restoration requirements. Both the towers and the poles and lines have a 15 -year useful life and are carried in its books as Telequipment account. Sparks uses the straight-line method for depreciation with no residual value expected at the end of the useful lives of the assets. Costs to remove and restore the poles and lines do not have a reasonably determinable quoted market price and market comparable numbers are not available as a result. Sparks thus estimates the cost to dismantle and restore property using probability-based estimates even though the poles and line method of transmission has been used for many years. The estimated values are as follows: The company's estimated cost of capital is 5%. Required: Prepare all appropriate entries (under IFRS unless specifically mentioned otherwise), to record the following: 3] The finance costs on the outstanding liability for the year ended December 31, 2013. 4] Now assume the company is applying ASPE. The finance costs on the outstanding liability for the year ended December 31, 2012. On January 12012 , Sparks Telecorp, Inc., invested idle cash of $12,500,000 in transm ission towers and $9,000,000 in poles and lines to improve service to its customers. Sparks is installing these in numerous cities and towns and recently, cities and towns have been increasing their standards for removal and restoration. As a consequence of this development, Sparks is responsible for dismantling and removing the towers, poles, and lines at the end of their useful lives under each city's and town's removal and restoration requirements. Both the towers and the poles and lines have a 15 -year useful life and are carried in its books as Telequipment account. Sparks uses the straight-line method for depreciation with no residual value expected at the end of the useful lives of the assets. Costs to remove and restore the poles and lines do not have a reasonably determinable quoted market price and market comparable numbers are not available as a result. Sparks thus estimates the cost to dismantle and restore property using probability-based estimates even though the poles and line method of transmission has been used for many years. The estimated values are as follows: The company's estimated cost of capital is 5%. Required: Prepare all appropriate entries (under IFRS unless specifically mentioned otherwise), to record the following: 3] The finance costs on the outstanding liability for the year ended December 31, 2013. 4] Now assume the company is applying ASPE. The finance costs on the outstanding liability for the year ended December 31, 2012