Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1,2018 Suzanne purchased, for $30,000, a three hectare parcel of land in rural Nova Scotia. On December 31,2020 she sold one hectare for

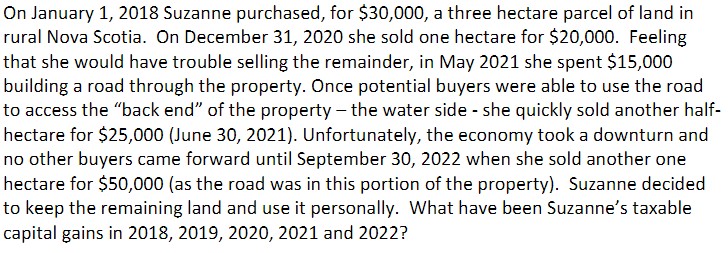

On January 1,2018 Suzanne purchased, for $30,000, a three hectare parcel of land in rural Nova Scotia. On December 31,2020 she sold one hectare for $20,000. Feeling that she would have trouble selling the remainder, in May 2021 she spent $15,000 building a road through the property. Once potential buyers were able to use the road to access the "back end" of the property - the water side - she quickly sold another halfhectare for $25,000 (June 30, 2021). Unfortunately, the economy took a downturn and no other buyers came forward until September 30, 2022 when she sold another one hectare for $50,000 (as the road was in this portion of the property). Suzanne decided to keep the remaining land and use it personally. What have been Suzanne's taxable capital gains in 2018, 2019, 2020, 2021 and 2022

On January 1,2018 Suzanne purchased, for $30,000, a three hectare parcel of land in rural Nova Scotia. On December 31,2020 she sold one hectare for $20,000. Feeling that she would have trouble selling the remainder, in May 2021 she spent $15,000 building a road through the property. Once potential buyers were able to use the road to access the "back end" of the property - the water side - she quickly sold another halfhectare for $25,000 (June 30, 2021). Unfortunately, the economy took a downturn and no other buyers came forward until September 30, 2022 when she sold another one hectare for $50,000 (as the road was in this portion of the property). Suzanne decided to keep the remaining land and use it personally. What have been Suzanne's taxable capital gains in 2018, 2019, 2020, 2021 and 2022 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started