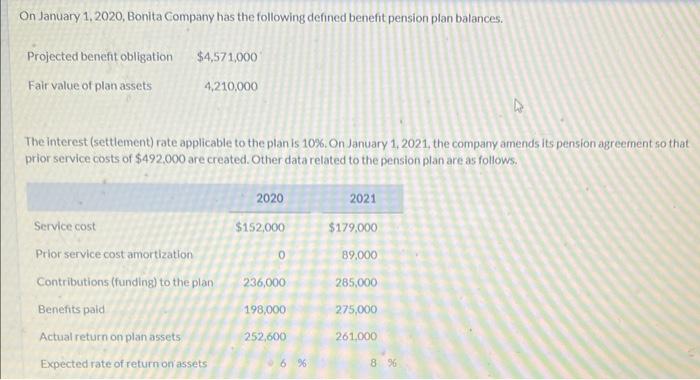

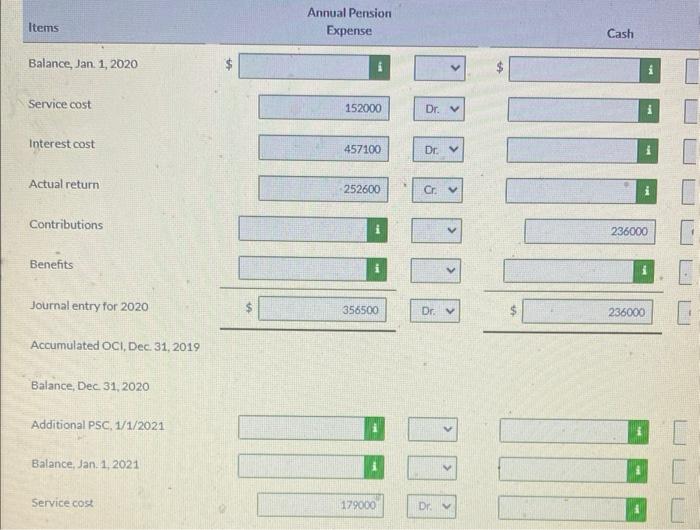

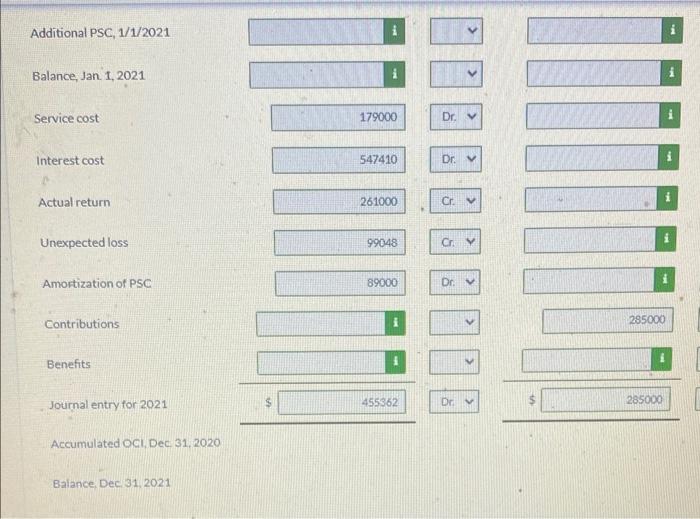

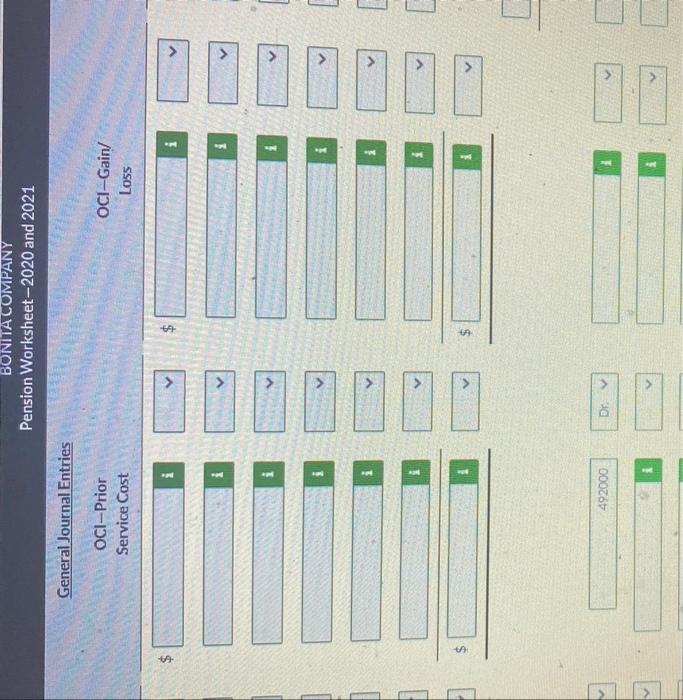

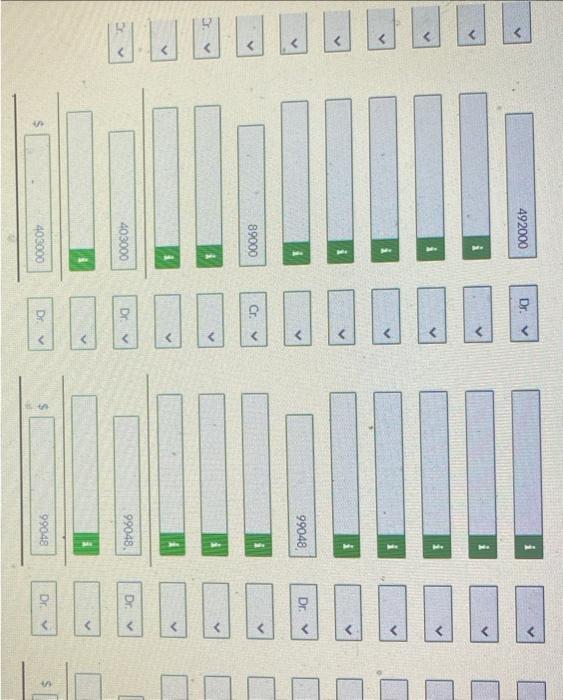

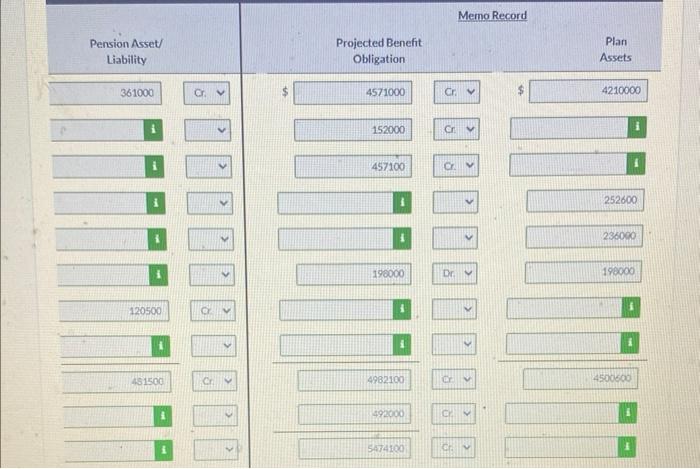

On January 1,2020, Bonita Company has the following defined benefit pension plan balances. The interest (settiement) rate applicable to the plan is 10%. On January 1,2021, the company amends its pension agreement so that prior service costs of $492,000 are created. Other data related to the pension plan are as follows. Annual Pension Items Balance, Jan. 1, 2020 Expense Cash i Service cost Interest cost Actual return Contributions Benefits Journal entry for 2020 Accumulated OCl, Dec. 31, 2019 Balance, Dec 31,2020 Additional PSC, 1/1/2021 Balance, Jan.1,2021 Service cost Additional PSC, 1/1/2021 Balance, Jan. I, 2021 Service cost Interest cost Actual return Unexpected loss Amortization of PSC Contributions Benefits Journal entry for 2021 Accumulated OCI, Dec 31,2020 Balance, Dec: 31,2021 1. 15 00068 ia 87066 F. 1 I 10 000z6t For 2021, prepare the journal entry to record pension-related amounts. (Credit occount titles are outomatically indented when amount is entered. Do not indent manually. If no entry is requined, select "No Entry" for the occount titles and enter O for the amounts.) On January 1,2020, Bonita Company has the following defined benefit pension plan balances. The interest (settiement) rate applicable to the plan is 10%. On January 1,2021, the company amends its pension agreement so that prior service costs of $492,000 are created. Other data related to the pension plan are as follows. Annual Pension Items Balance, Jan. 1, 2020 Expense Cash i Service cost Interest cost Actual return Contributions Benefits Journal entry for 2020 Accumulated OCl, Dec. 31, 2019 Balance, Dec 31,2020 Additional PSC, 1/1/2021 Balance, Jan.1,2021 Service cost Additional PSC, 1/1/2021 Balance, Jan. I, 2021 Service cost Interest cost Actual return Unexpected loss Amortization of PSC Contributions Benefits Journal entry for 2021 Accumulated OCI, Dec 31,2020 Balance, Dec: 31,2021 1. 15 00068 ia 87066 F. 1 I 10 000z6t For 2021, prepare the journal entry to record pension-related amounts. (Credit occount titles are outomatically indented when amount is entered. Do not indent manually. If no entry is requined, select "No Entry" for the occount titles and enter O for the amounts.)