Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1,2024 , Chas Inc purchases another piece of equipment for $25,000 cash. They expect to use the equipment in operations to generate revenue

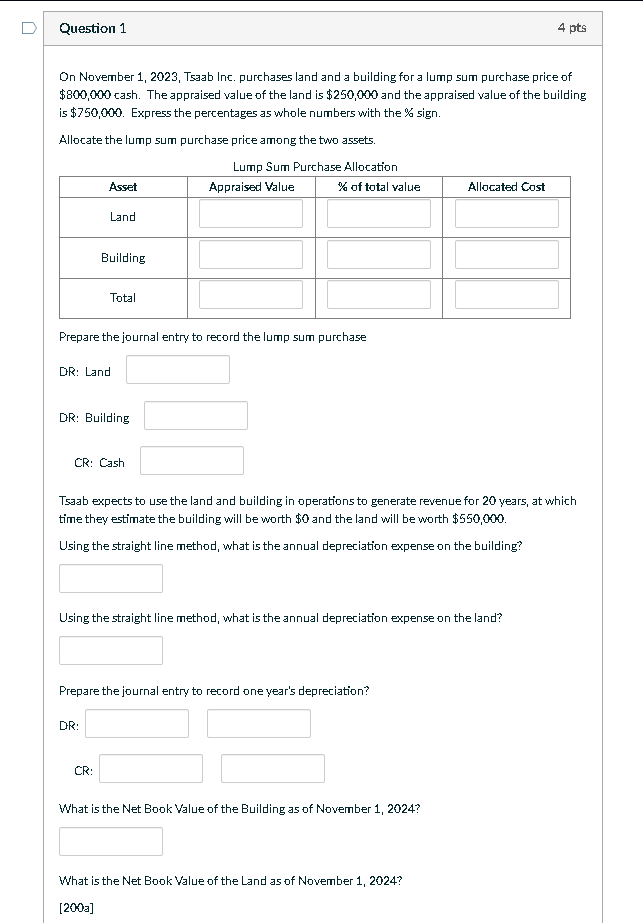

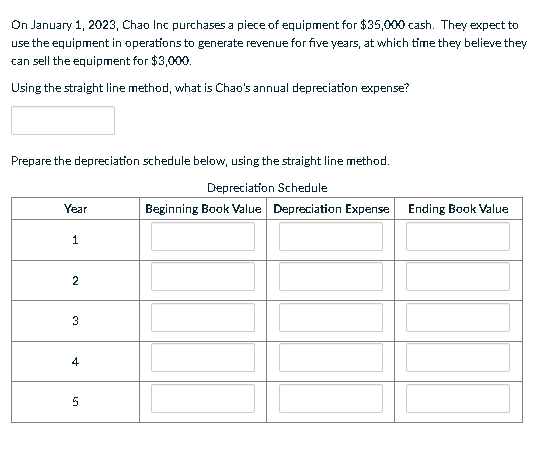

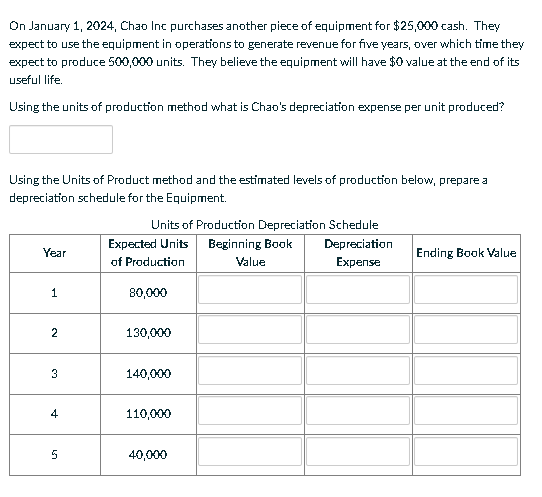

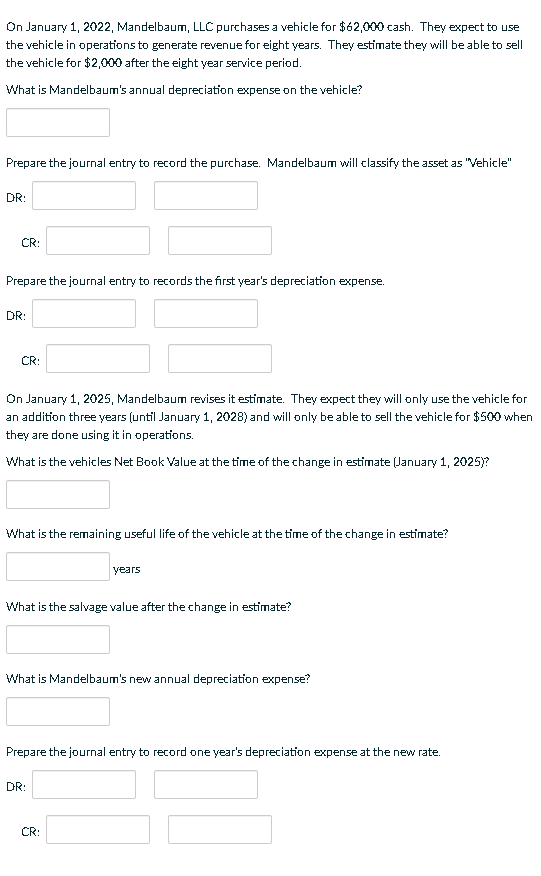

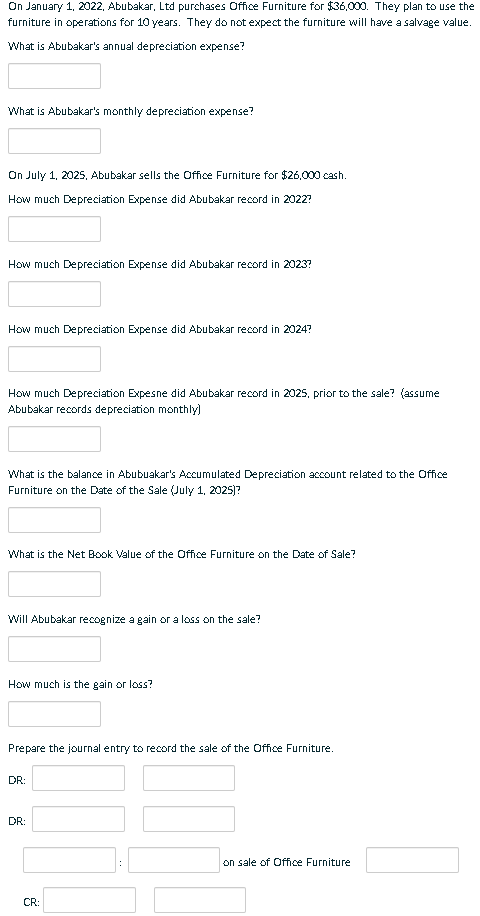

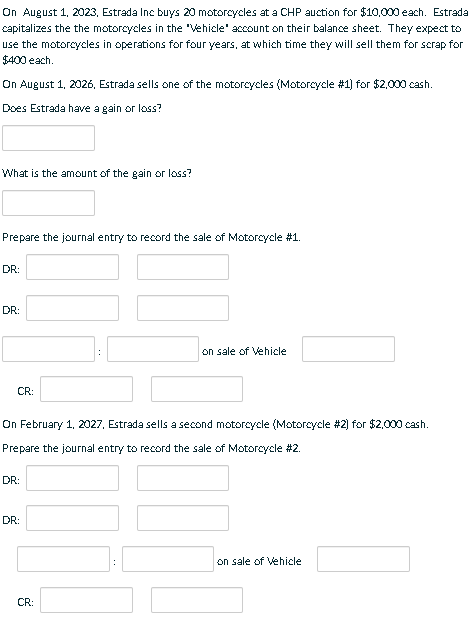

On January 1,2024 , Chas Inc purchases another piece of equipment for $25,000 cash. They expect to use the equipment in operations to generate revenue for five years, over which time they expect to produce 500,000 units. They believe the equipment will have $0 value at the end of its useful life. Using the units of production method what is Chao's depreciation expense per unit produced? Using the Units of Product method and the etimated levels of production below, prepare a depreciation schedule for the Equipment. IJnits of Prndurtinn Denreriatinn Srherlule On November 1, 2023, Tsaab Inc. purchases land and a building for a lump sum purchase price of $800,000 cash. The appraised value of the land is $250,000 and the appraised value of the building is $750,000. Express the percentages as whole numbers with the \% sign. Allocate the lump sum purchase price among the two assets. Prepare the journal entry to record the lump sum purchase [DR: Land [RR: Building CR: Cush Tsasb expects to use the land and building in operations to generate revenue for 20 years, at which time they etimate the building will be worth $0 and the land will be worth $550,000. Using the straight line method, what is the annual depreciation expense on the building? Using the straight line method, what is the annual depreciation expense on the land? Prepare the journal entry to record one year's depreciation? DR: CR: What is the Net Book Value of the Building as of November 1, 2024? What is the Net Book Value of the Land as of November 1, 2024? [200]] What is Abubakar's annual depreciation expense? What is Abubakar's monthly depreciation expense? On July 1, 2025, Abubakar sells the Office Furniture for $26,000 cash. How much Depreciation Expense did Abubakar record in 2022 ? How much Depreciation Expense did Abubakar record in 2023 ? How much Depreciation Expense did Abubakar record in 2024 ? How much Depreciation Expesne did Abubakar record in 2025, prior to the sale? (assume Abubakar records depreciation monthly] What is the balance in Abubuakar's Accumulated Depreciation account related to the Office Furniture on the Date of the Sale (July 1, 2025)? What is the Net Eook Value of the Office Furniture on the Date of Sale? Will Abubakar recognize again or a loss on the sale? How much is the gain or loss? Prepare the journal entry to record the sale of the Dffice Furniture. DR: DR: on sale of Dffice Furniture On January 1,2022 , Mandelbaum, LLC purchases a vehicle for $62,000 cash. They expect to use the vehicle in operations to generate revenue for eight years. They estimate they will be able to sell the vehicle for $2,000 after the eight year service period. What is Mandelbaum's annual depreciation expense on the vehicle? Prepare the journal entry to record the purchase. Mandelbaum will classify the asset as "Vehicle" LR: CR: Prepare the journal entry to records the first year's depreciation expense. [PR: CR: On January 1, 2025, Mandelbaum revises it etimate. They expect they will only use the vehicle for an addition three years (until January 1,2028 ) and will only be able to sell the vehicle for $500 when they are done using it in operations. What is the vehicles Net Book Value at the time of the change in etimate (January 1, 2025)? What is the remaining useful life of the vehicle at the time of the change in etimate? years What is the salvage value after the change in ettimate? What is Mandelbaum's new annual depreciation expense? Prepare the journal entry to record one year's depreciation expense at the new rate. DR: CR: On January 1,2023 , Chao Inc purchases a piece of equipment for $35,000 cash. They expect to use the equipment in operations to generate revenue for five years, at which time they believe they can sell the equipment for $3,000. Using the straight line method, what is Chao's annual depreciation expense? Prepare the depreciation schedule below, using the straight line method. On August 1, 2023, Estrada Inc buys 20 motorycles at a CHP auction for $10,000 each. Estrada capitalizes the the motorcycles in the "Vehicle' account on their balance sheet. They expect to use the motorcycles in operations for four years, at which time they will sell them for scrap for $400 each. On August 1, 2026, Etrada sells one of the motorcycles (Motorcycle \#1) for $2,000 cash. Does Estrada have a gain or loss? What is the amount of the gain or loss? Prepare the journal entry to record the sale of Motorcycle \#1. DR: DR: on sale of vehicle CR: On February 1, 2027, Estrada sells a second motorcycle (Motorcycle \#2) for \$2,000 cash. Prepare the journal entry to record the sale of Motorcycle \#2. DR: DR: on sale of Vehicle CR

On January 1,2024 , Chas Inc purchases another piece of equipment for $25,000 cash. They expect to use the equipment in operations to generate revenue for five years, over which time they expect to produce 500,000 units. They believe the equipment will have $0 value at the end of its useful life. Using the units of production method what is Chao's depreciation expense per unit produced? Using the Units of Product method and the etimated levels of production below, prepare a depreciation schedule for the Equipment. IJnits of Prndurtinn Denreriatinn Srherlule On November 1, 2023, Tsaab Inc. purchases land and a building for a lump sum purchase price of $800,000 cash. The appraised value of the land is $250,000 and the appraised value of the building is $750,000. Express the percentages as whole numbers with the \% sign. Allocate the lump sum purchase price among the two assets. Prepare the journal entry to record the lump sum purchase [DR: Land [RR: Building CR: Cush Tsasb expects to use the land and building in operations to generate revenue for 20 years, at which time they etimate the building will be worth $0 and the land will be worth $550,000. Using the straight line method, what is the annual depreciation expense on the building? Using the straight line method, what is the annual depreciation expense on the land? Prepare the journal entry to record one year's depreciation? DR: CR: What is the Net Book Value of the Building as of November 1, 2024? What is the Net Book Value of the Land as of November 1, 2024? [200]] What is Abubakar's annual depreciation expense? What is Abubakar's monthly depreciation expense? On July 1, 2025, Abubakar sells the Office Furniture for $26,000 cash. How much Depreciation Expense did Abubakar record in 2022 ? How much Depreciation Expense did Abubakar record in 2023 ? How much Depreciation Expense did Abubakar record in 2024 ? How much Depreciation Expesne did Abubakar record in 2025, prior to the sale? (assume Abubakar records depreciation monthly] What is the balance in Abubuakar's Accumulated Depreciation account related to the Office Furniture on the Date of the Sale (July 1, 2025)? What is the Net Eook Value of the Office Furniture on the Date of Sale? Will Abubakar recognize again or a loss on the sale? How much is the gain or loss? Prepare the journal entry to record the sale of the Dffice Furniture. DR: DR: on sale of Dffice Furniture On January 1,2022 , Mandelbaum, LLC purchases a vehicle for $62,000 cash. They expect to use the vehicle in operations to generate revenue for eight years. They estimate they will be able to sell the vehicle for $2,000 after the eight year service period. What is Mandelbaum's annual depreciation expense on the vehicle? Prepare the journal entry to record the purchase. Mandelbaum will classify the asset as "Vehicle" LR: CR: Prepare the journal entry to records the first year's depreciation expense. [PR: CR: On January 1, 2025, Mandelbaum revises it etimate. They expect they will only use the vehicle for an addition three years (until January 1,2028 ) and will only be able to sell the vehicle for $500 when they are done using it in operations. What is the vehicles Net Book Value at the time of the change in etimate (January 1, 2025)? What is the remaining useful life of the vehicle at the time of the change in etimate? years What is the salvage value after the change in ettimate? What is Mandelbaum's new annual depreciation expense? Prepare the journal entry to record one year's depreciation expense at the new rate. DR: CR: On January 1,2023 , Chao Inc purchases a piece of equipment for $35,000 cash. They expect to use the equipment in operations to generate revenue for five years, at which time they believe they can sell the equipment for $3,000. Using the straight line method, what is Chao's annual depreciation expense? Prepare the depreciation schedule below, using the straight line method. On August 1, 2023, Estrada Inc buys 20 motorycles at a CHP auction for $10,000 each. Estrada capitalizes the the motorcycles in the "Vehicle' account on their balance sheet. They expect to use the motorcycles in operations for four years, at which time they will sell them for scrap for $400 each. On August 1, 2026, Etrada sells one of the motorcycles (Motorcycle \#1) for $2,000 cash. Does Estrada have a gain or loss? What is the amount of the gain or loss? Prepare the journal entry to record the sale of Motorcycle \#1. DR: DR: on sale of vehicle CR: On February 1, 2027, Estrada sells a second motorcycle (Motorcycle \#2) for \$2,000 cash. Prepare the journal entry to record the sale of Motorcycle \#2. DR: DR: on sale of Vehicle CR Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started