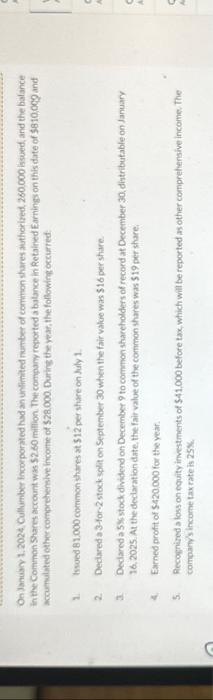

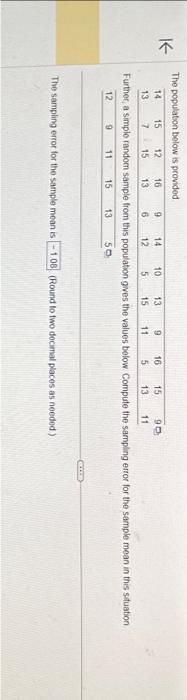

On January 1.2024 Cullumber incorporated had an unhimited number of common shares authorized, 260.000 assued and the balance in the Common Shares account was $2.60 million. The company reported a batance in Retained Earnings on this date of $810,009 and accumalated other comprehensive income of 528.000 . Durine the year, the following occurred: 1. Iswed 81,000 common thares at $12 per share on July 1. 2. Declared a 3 for-2 stock split on September 30 when the fair value was $16 per share. 1. Declared a 5% stockdwidend on December 9 to common shareholders of record at December 30, dintributable on January 16.2025. At the declaratian date, the fair value of the common shares was 519 per share 4. Earned profit of $420,000 for the year. 5. Recognired a loss on equity investments of 541.000 before tax, which will be reported as other comprehensive income. The company's income taxrate is 25% The populatoon below is provided Further, a simple random sample from this population gives the values bolow. Compute the sampling error for the sample mean in this situation The sampling error for the sample mean is (Round to two docmal places as needed) On January 1.2024 Cullumber incorporated had an unhimited number of common shares authorized, 260.000 assued and the balance in the Common Shares account was $2.60 million. The company reported a batance in Retained Earnings on this date of $810,009 and accumalated other comprehensive income of 528.000 . Durine the year, the following occurred: 1. Iswed 81,000 common thares at $12 per share on July 1. 2. Declared a 3 for-2 stock split on September 30 when the fair value was $16 per share. 1. Declared a 5% stockdwidend on December 9 to common shareholders of record at December 30, dintributable on January 16.2025. At the declaratian date, the fair value of the common shares was 519 per share 4. Earned profit of $420,000 for the year. 5. Recognired a loss on equity investments of 541.000 before tax, which will be reported as other comprehensive income. The company's income taxrate is 25% The populatoon below is provided Further, a simple random sample from this population gives the values bolow. Compute the sampling error for the sample mean in this situation The sampling error for the sample mean is (Round to two docmal places as needed)