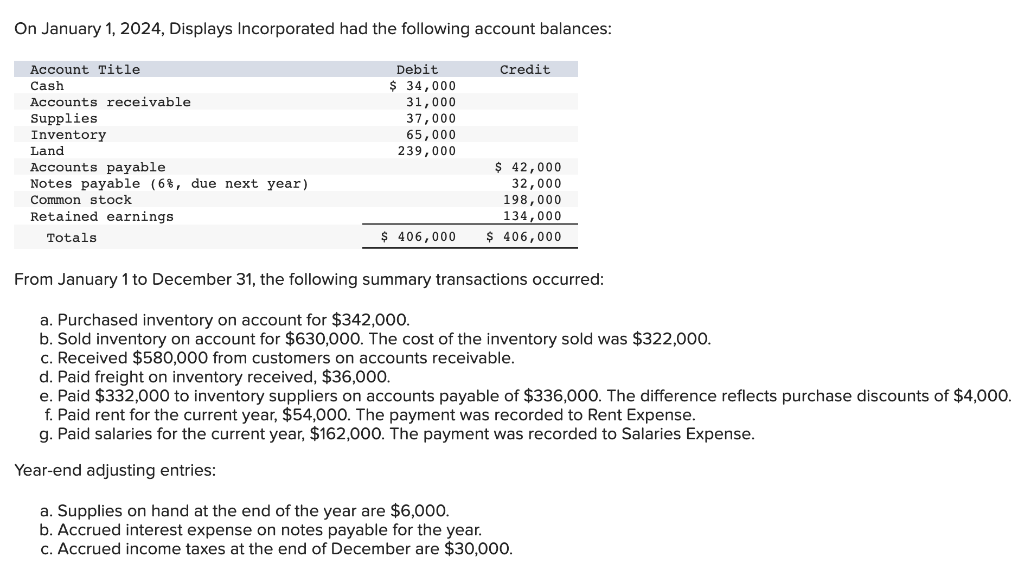

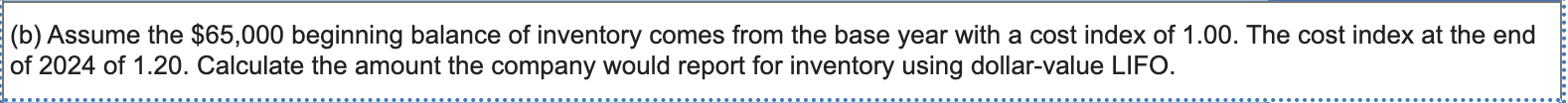

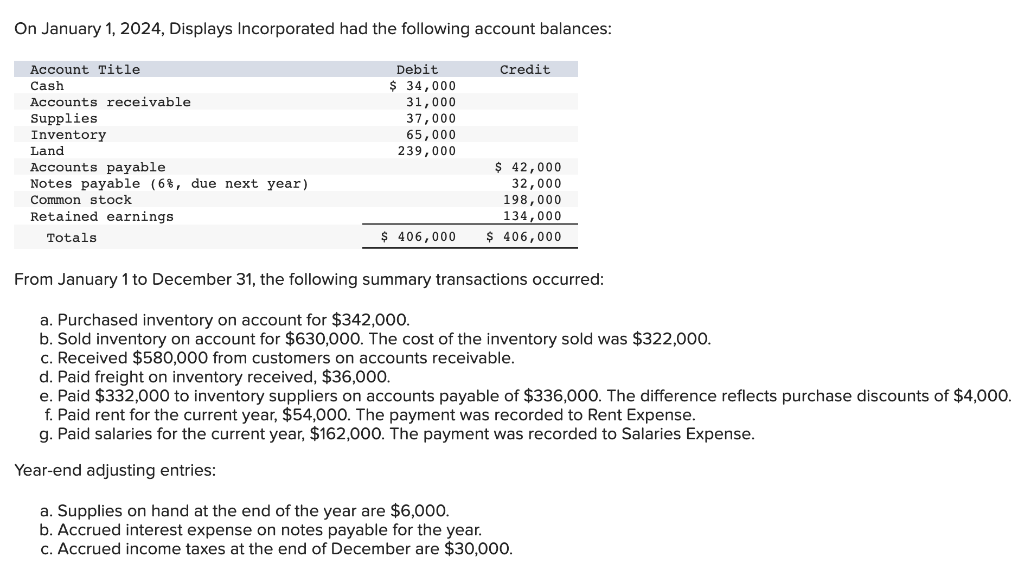

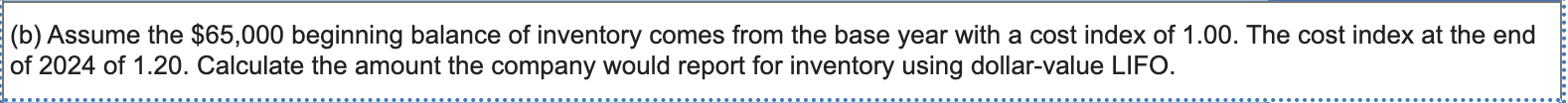

On January 1,2024 , Displays Incorporated had the following account balances: From January 1 to December 31 , the following summary transactions occurred: a. Purchased inventory on account for $342,000. b. Sold inventory on account for $630,000. The cost of the inventory sold was $322,000. c. Received $580,000 from customers on accounts receivable. d. Paid freight on inventory received, $36,000. e. Paid $332,000 to inventory suppliers on accounts payable of $336,000. The difference reflects purchase discounts of $4,000. f. Paid rent for the current year, $54,000. The payment was recorded to Rent Expense. g. Paid salaries for the current year, $162,000. The payment was recorded to Salaries Expense. Year-end adjusting entries: a. Supplies on hand at the end of the year are $6,000. b. Accrued interest expense on notes payable for the year. c. Accrued income taxes at the end of December are $30,000. (b) Assume the $65,000 beginning balance of inventory comes from the base year with a cost index of 1.00. The cost index at the end of 2024 of 1.20. Calculate the amount the company would report for inventory using dollar-value LIFO. On January 1,2024 , Displays Incorporated had the following account balances: From January 1 to December 31 , the following summary transactions occurred: a. Purchased inventory on account for $342,000. b. Sold inventory on account for $630,000. The cost of the inventory sold was $322,000. c. Received $580,000 from customers on accounts receivable. d. Paid freight on inventory received, $36,000. e. Paid $332,000 to inventory suppliers on accounts payable of $336,000. The difference reflects purchase discounts of $4,000. f. Paid rent for the current year, $54,000. The payment was recorded to Rent Expense. g. Paid salaries for the current year, $162,000. The payment was recorded to Salaries Expense. Year-end adjusting entries: a. Supplies on hand at the end of the year are $6,000. b. Accrued interest expense on notes payable for the year. c. Accrued income taxes at the end of December are $30,000. (b) Assume the $65,000 beginning balance of inventory comes from the base year with a cost index of 1.00. The cost index at the end of 2024 of 1.20. Calculate the amount the company would report for inventory using dollar-value LIFO