Answered step by step

Verified Expert Solution

Question

1 Approved Answer

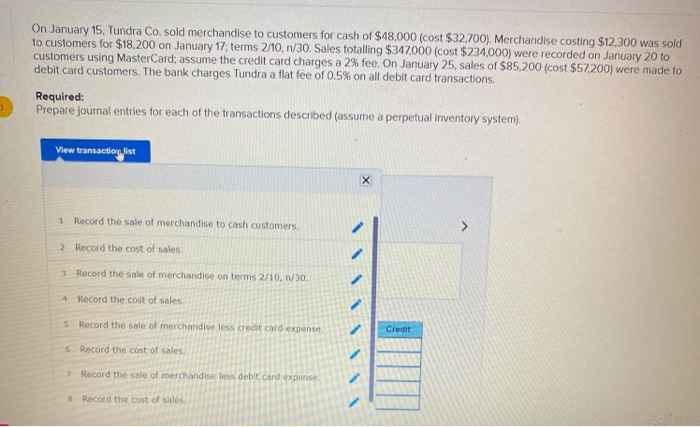

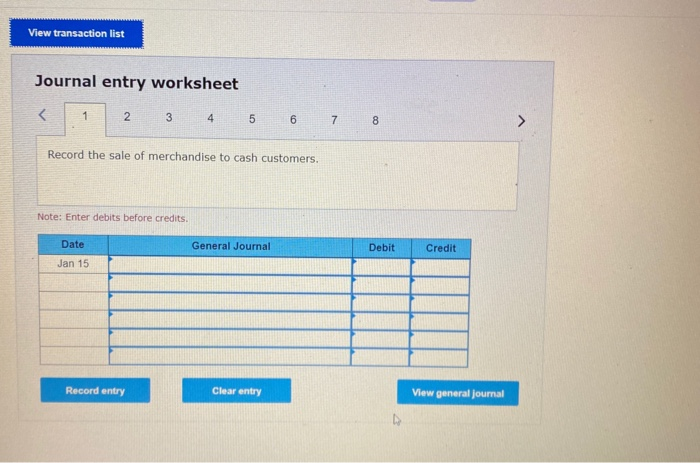

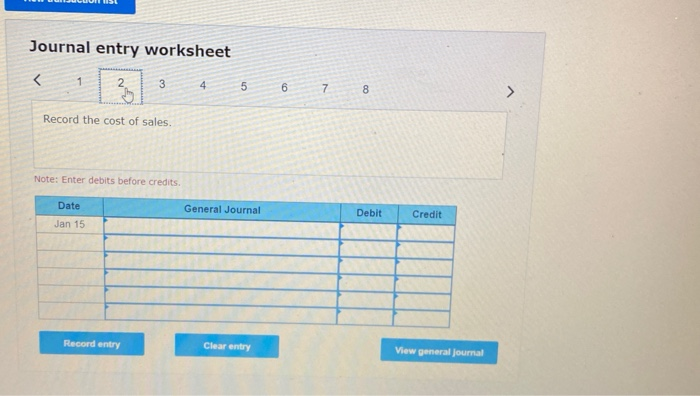

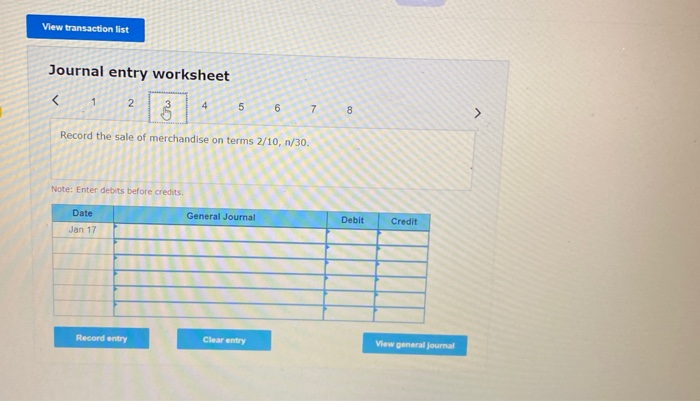

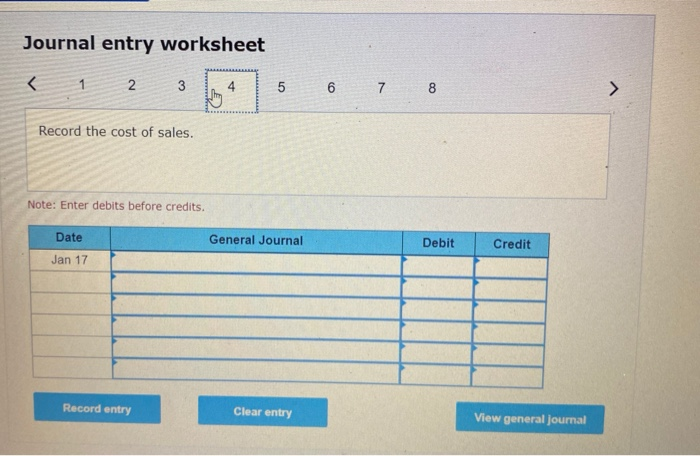

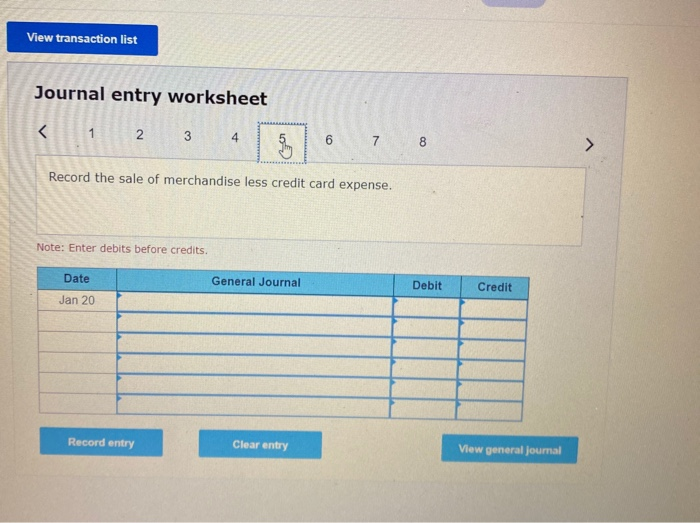

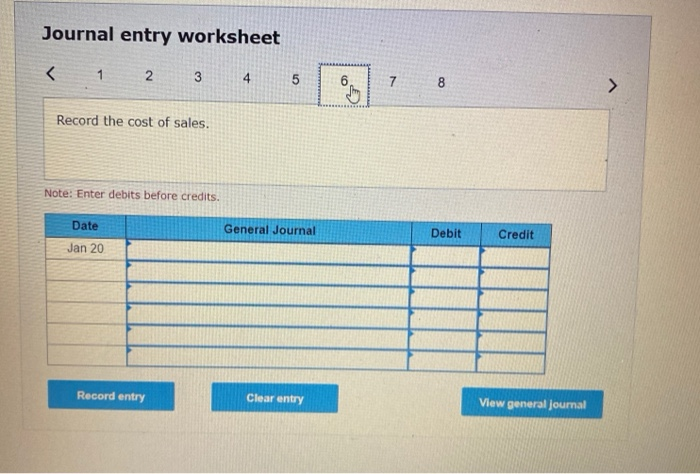

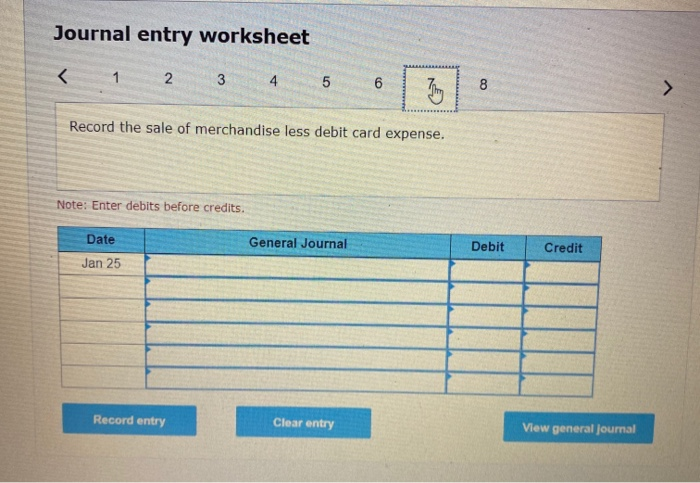

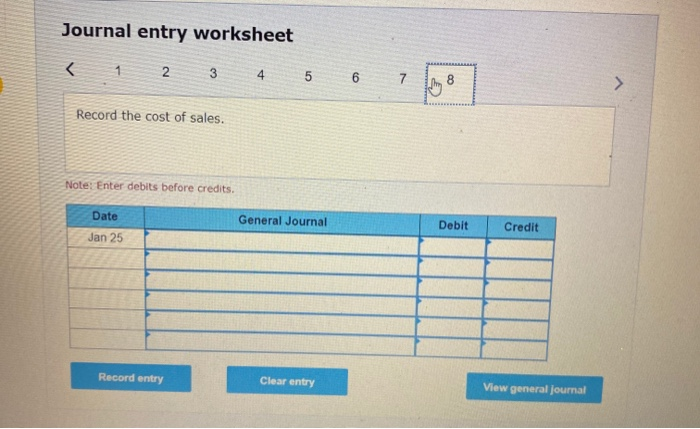

On January 15, Tundra Co. sold merchandise to customers for cash of $48,000 (cost $32,700). Merchandise costing $12,300 was sold to customers for $18,200 on

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started