Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 15, your firm has 8 months left on a 100 million dollars variable-rate bank loan that it took to finance an expansion.

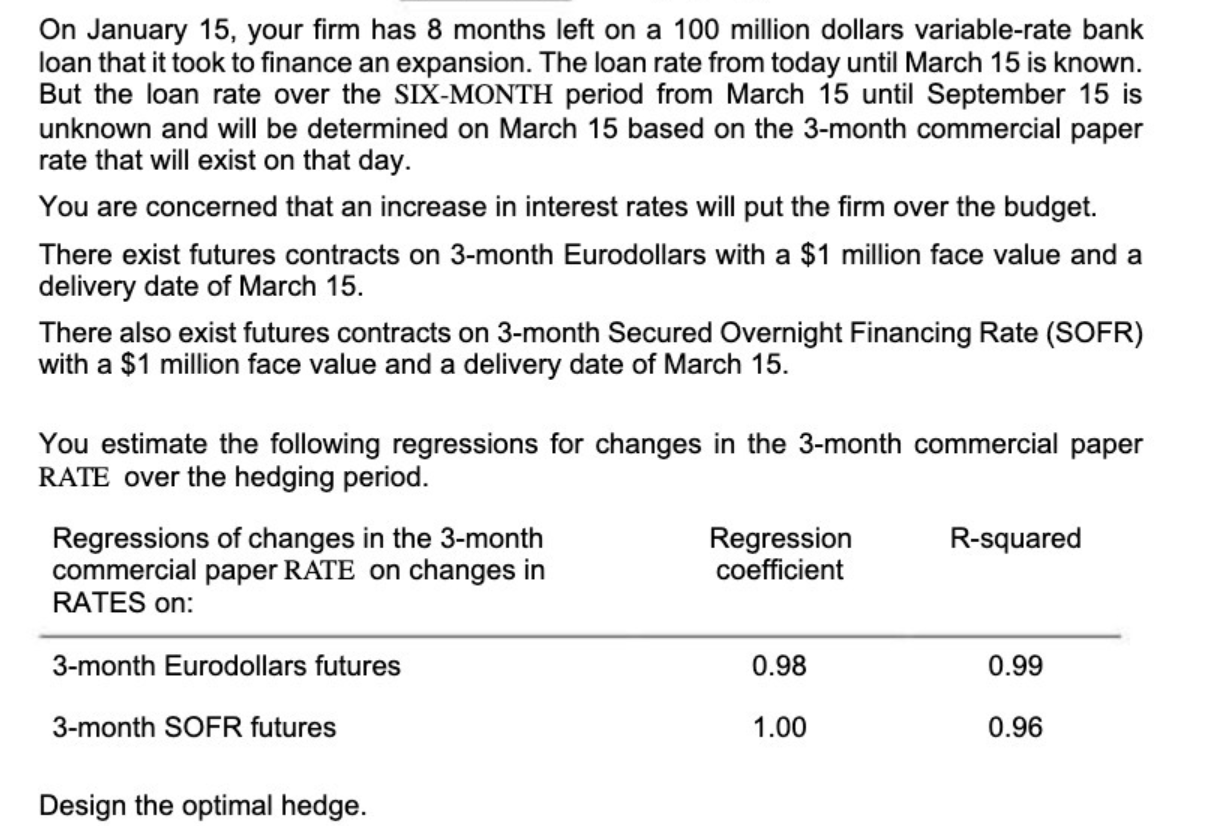

On January 15, your firm has 8 months left on a 100 million dollars variable-rate bank loan that it took to finance an expansion. The loan rate from today until March 15 is known. But the loan rate over the SIX-MONTH period from March 15 until September 15 is unknown and will be determined on March 15 based on the 3-month commercial paper rate that will exist on that day. You are concerned that an increase in interest rates will put the firm over the budget. There exist futures contracts on 3-month Eurodollars with a $1 million face value and a delivery date of March 15. There also exist futures contracts on 3-month Secured Overnight Financing Rate (SOFR) with a $1 million face value and a delivery date of March 15. You estimate the following regressions for changes in the 3-month commercial paper RATE over the hedging period. Regressions of changes in the 3-month Regression R-squared commercial paper RATE on changes in coefficient RATES on: 3-month Eurodollars futures 3-month SOFR futures 0.98 0.99 1.00 0.96 Design the optimal hedge.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started