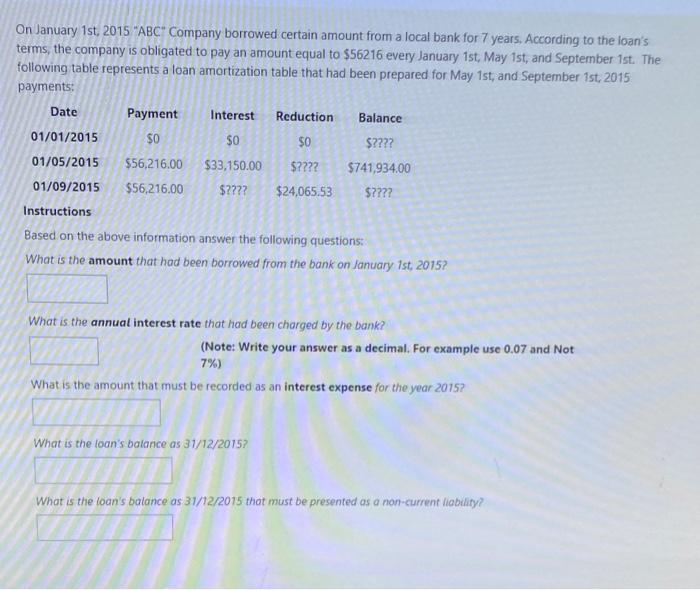

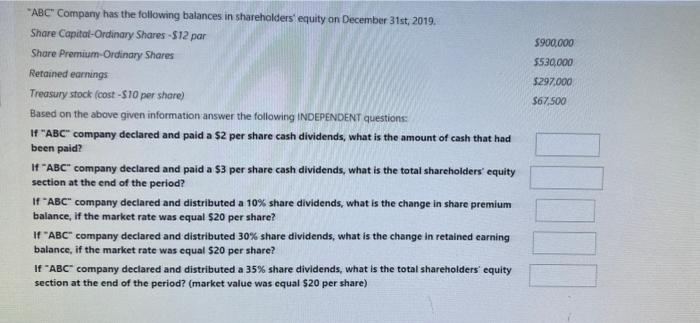

On January 1st, 2015 "ABC" Company borrowed certain amount from a local bank for 7 years. According to the loan's terms, the company is obligated to pay an amount equal to $56216 every January 1st, May 1st, and September 1st. The following table represents a loan amortization table that had been prepared for May 1st, and September 1st, 2015 payments: Date Payment Interest Reduction Balance 01/01/2015 $0 $0 $0 $???? 01/05/2015 $56,216.00 $33,150.00 $???? $741,934.00 01/09/2015 $56,216.00 $???? $24,065.53 $7777 Instructions Based on the above information answer the following questions: What is the amount that had been borrowed from the bank on January 1st, 2015? What is the annual interest rate that had been charged by the bank? (Note: Write your answer as a decimal. For example use 0.07 and Not 7%) What is the amount that must be recorded as an interest expense for the year 2015? What is the loan's balance as 31/12/2015? What is the loan's balance as 31/12/2015 that must be presented as a non-current liability? "ABC" Company has the following balances in shareholders' equity on December 31st, 2019. Share Capitat-Ordinary Shares - $12 par 5900,000 Share Premium-Ordinary Shares $530,000 Retained earnings $297.000 $67,500 Treasury stock (cost-$10 per share) Based on the above given information answer the following INDEPENDENT questions If "ABC" company declared and paid a $2 per share cash dividends, what is the amount of cash that had been paid? It-ABC company declared and paid a $3 per share cash dividends, what is the total shareholders' equity section at the end of the period? If-ABC company declared and distributed a 10% share dividends, what is the change in share premium balance, if the market rate was equal $20 per share? If "ABC" company declared and distributed 30% share dividends, what is the change in retained earning balance, if the market rate was equal $20 per share? If ABC company declared and distributed a 35% share dividends, what is the total shareholders' equity section at the end of the period? (market value was equal $20 per share)