Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1st, Bob took a long position on one contract of January 3rd oil futures at a futures price of $100 per barrel.

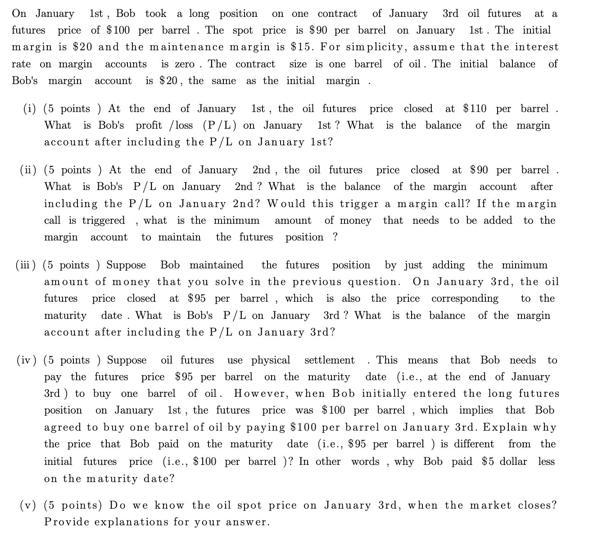

On January 1st, Bob took a long position on one contract of January 3rd oil futures at a futures price of $100 per barrel. The spot price is $90 per barrel on January 1st. The initial margin is $20 and the maintenance margin is $15. For simplicity, assume that the interest rate on margin accounts is zero. The contract size is one barrel of oil. The initial balance of Bob's margin account is $20, the same as the initial margin. 1st, (i) (5 points) At the end of January the oil futures price closed at $110 per barrel What is Bob's profit /loss (P/L) on January 1st? What is the balance of the margin account after including the P/L on January 1st? (ii) (5 points) At the end of January 2nd, the oil futures price closed at $90 per barrel. What is Bob's P/L on January 2nd? What is the balance of the margin account after including the P/L on January 2nd? Would this trigger a margin call? If the margin call is triggered, what is the minimum amount of money that needs to be added to the margin account to maintain the futures position ? (iii) (5 points) Suppose Bob maintained the futures position by just adding the minimum amount of money that you solve in the previous question. On January 3rd, the oil futures price closed at $95 per barrel, which is also the price corresponding to the maturity date. What is Bob's P/L on January 3rd? What is the balance of the margin account after including the P/L on January 3rd? (iv) (5 points) Suppose oil futures use physical settlement. This means that Bob needs to pay the futures price $95 per barrel on the maturity date (i.e., at the end of January 3rd) to buy one barrel of oil. However, when Bob initially entered the long futures position on January 1st, the futures price was $100 per barrel, which implies that Bob agreed to buy one barrel of oil by paying $100 per barrel on January 3rd. Explain why the price that Bob paid on the maturity date (i.e., $95 per barrel) is different from the initial futures price (i.e., $100 per barrel)? In other words, why Bob paid $5 dollar less on the maturity date? (v) (5 points) Do we know the oil spot price on January 3rd, when the market closes? Provide explanations for your answer.

Step by Step Solution

★★★★★

3.33 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Answer i On January 1st Bobs profitloss PL can be calculated as follows PL Futures price Initial futures price x Contract size 110 100 x 1 10 So Bobs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started