Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The financial year for companies below ends on 31 December. (a) COMPANY 1 purchased a computer for $13,000 on 1 July 2020. The company

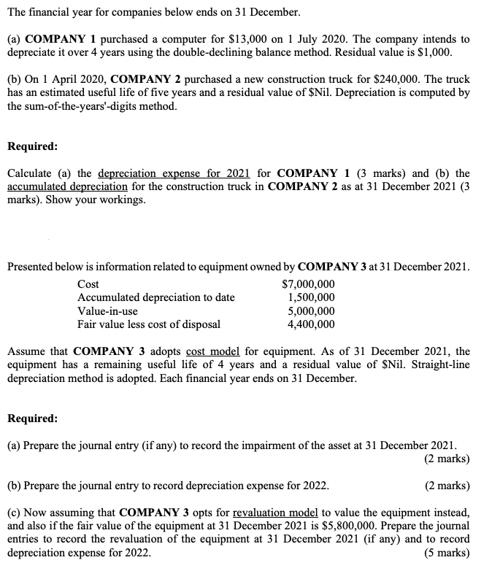

The financial year for companies below ends on 31 December. (a) COMPANY 1 purchased a computer for $13,000 on 1 July 2020. The company intends to depreciate it over 4 years using the double-declining balance method. Residual value is $1,000. (b) On 1 April 2020, COMPANY 2 purchased a new construction truck for $240,000. The truck has an estimated useful life of five years and a residual value of $Nil. Depreciation is computed by the sum-of-the-years'-digits method. Required: Calculate (a) the depreciation expense for 2021 for COMPANY 1 (3 marks) and (b) the accumulated depreciation for the construction truck in COMPANY 2 as at 31 December 2021 (3 marks). Show your workings. Presented below is information related to equipment owned by COMPANY 3 at 31 December 2021. Cost Accumulated depreciation to date Value-in-use Fair value less cost of disposal $7,000,000 1,500,000 5,000,000 4,400,000 Assume that COMPANY 3 adopts cost model for equipment. As of 31 December 2021, the equipment has a remaining useful life of 4 years and a residual value of SNil. Straight-line depreciation method is adopted. Each financial year ends on 31 December. Required: (a) Prepare the journal entry (if any) to record the impairment of the asset at 31 December 2021. (2 marks) (b) Prepare the journal entry to record depreciation expense for 2022. (2 marks) (c) Now assuming that COMPANY 3 opts for revaluation model to value the equipment instead, and also if the fair value of the equipment at 31 December 2021 is $5,800,000. Prepare the journal entries to record the revaluation of the equipment at 31 December 2021 (if any) and to record depreciation expense for 2022. (5 marks)

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a COMPANY 1 Purchased computer for 13000 on 1 July 2020 Residual value is 1000 Depreciation is over ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started